Trenchless Technology Poised To Advance Infrastructure Resiliency

As one of many ripple effects of COVID-19, capital investment in water and wastewater infrastructure is expected to see some setbacks due to reductions in revenue and cash flow during the pandemic. But a recent report highlights a brighter picture for the growth of trenchless technology in pipeline repair expenditures, thanks to its cost-effective approach for meeting pent-up demand.

That report, Trenchless Players Move To Redefine Pipe Market: Forecasts, Competitive Positioning, And Water Market Trends, was published by Bluefield Research. It benchmarks existing trenchless-technology options, identifies underlying factors favoring trenchless solutions, provides an overview of the competitive environment, and analyzes market forecasts by geography and technology.

Weathering A Perfect Storm

For aging U.S. water distribution and wastewater collection infrastructure that was already under duress entering 2020, the added financial pressures brought on by COVID-19-related revenue losses have the potential to add insult to injury. If infrastructure rehabilitation continues to lag at less than its 1-percent replacement rate — or dips even lower — water systems will face an even more difficult task of maintaining service in the face of ongoing leaks and breaks in aging underground pipelines.

With “renewal and replacement of aging water and wastewater infrastructure” and “financing for capital improvements” identified as the top two issues in AWWA’s State of the Water Industry 2020 Executive Summary, trenchless technology is well positioned to satisfy those concerns and provide a bit of financial relief.

“Due to its cost-effectiveness, reduced environmental impact, and quicker project timelines, trenchless offers a potential bright spot for growth in a municipal market that is bracing for looming financial impacts,” notes Bluefield analyst Mariel Marchand. “Given the economic downturn and resulting financial constraints on municipal stakeholders, a push to extend the life of assets with fewer capital costs will be an increasingly attractive option.”

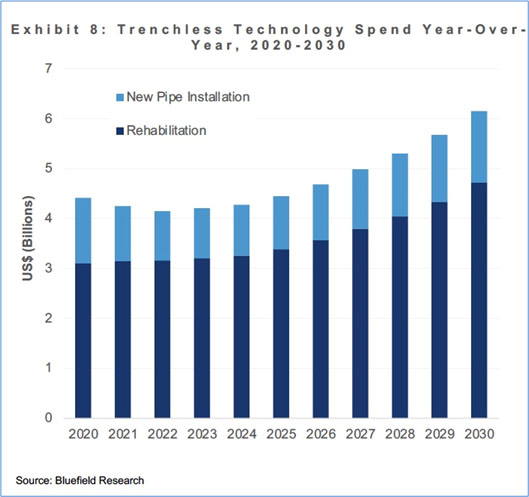

That position is reflected in the report’s forecast of 3.4-percent year-over-year growth for trenchless technology in the 2020-2030 timeframe — more favorable than the overall spending growth for municipal infrastructure investment in general. Even with that, the report does show some differences in how such spending will be allocated (Figure 1). Forecasts of CAPEX spending on trenchless technology for new pipe installations over the next decade show a slight decline in the first few years after the COVID-19 backlash before rebounding. Forecasts of trenchless-technology use for rehabilitation efforts hold steady in the early part of the decade and grow after that. Overall, trenchless-technology applications are expected to represent a $52.5-billion market by 2030. With that total, rehabilitation expenditures are expected to outpace new installation expenditures by a 3:1 ratio.

The majority of trenchless-technology spending over the timeframe covered by the report is expected to be for pipe diameters < 24 inches. While wastewater collection system rehabilitation applications are expected to continue their dominance over water distribution applications in the use of trenchless technology, increasing focus on non-revenue water losses holds promise for increased acceptance in the drinking water sector.

Figure 1

Identifying The Right Tool For The Job

Trenchless technology offers favorable characteristics in terms of saving time, money, and disruptive inconveniences for utilities and their ratepayers. By avoiding much of the expense and disruption of excavating large amounts of dirt and replacing above-ground infrastructure, trenchless technology offers significant savings potential. Marchand estimates that those savings can grow as high as 30 percent of total project costs in urban applications.

This U.S. EPA white paper provides an early look at trenchless technology for water/wastewater infrastructure rehabilitation, while this more recent report on pipeline renewal technologies enhances that with case-study and cost-comparison perspectives.

The trenchless technologies chosen typically depend on the circumstances of the application (pipe diameter, type, length, configuration, etc.) and the ground conditions (e.g., soil type, groundwater, rocks, debris, etc.). They include:

- Existing Pipe Refurbishment. Refurbishment or replacement of existing pipelines can take advantage of the structure or pathway for the existing pipeline.

- Cure-In-Place-Piping (CIPP). At 36 percent of total trenchless-technology spending, CIPP technology is the most widely used trenchless technique, bolstered in large part by its use in wastewater collection systems. This technique uses a continuous-feed resin-impregnated liner, which is both driven into the existing host pipe and expanded using air or water and then cured in position against the inner wall of the pipeline structure to form a new, unbroken surface.

- Pipe Bursting. This technique follows the original path of an existing pipeline, fracturing old brittle pipe and driving the fragments into the soil as a continuous length of new pipe is pulled behind the bursting head to fill the resulting void.

- Sliplining. Where there is not a concern for loss of cross-section capacity and where abrupt changes in pipe direction are not a concern, sliplining can take advantage of the original pipe cavity. New, but smaller diameter round pipe — often polyvinylchloride, polyethylene, polypropylene, etc. — is slid through the existing pipe. The new pipe can be continuous, made up of shorter segments that are fused together, or spiral wound. Once inside, grout is used to fill the void between the old and new pipe for structural support.

- Spray Coating. Where appropriate, spray-on epoxy coatings are another method that can be used to refurbish existing pipelines ranging from several inches to multiple feet in diameter. In those automated applications, cleaning tools are sent through the length of pipe to prepare the surface before a resin application spray head is pulled back through the pipe to coat the interior walls.

- New Pipe Installations. Drilling is forecast to be the predominant technology used for new pipe installations. It can be achieved through several approaches that can remove spoils either through mechanical means or via pumped slurry or drilling mud.

- Horizontal Directional Drilling (HDD). Because it can be accomplished from the surface, HDD can provide a more economical method of new underground pipe installation where extreme precision of installation is not an overriding concern. After a pilot hole is opened, a series of reaming heads is used to progressively widen the hole to the desired size before the final pipeline is pulled through.

- Microtunneling. Although it requires excavation at each end of a run to set installation equipment down to the desired pipe level, this technique provides good control over long distances for more precise installations — such as gravity sewers, which must maintain a specific pitch. Spoils removal is typically achieved as pumped slurry.

- Auger Boring. This technique is similar to microtunneling and pipe jacking in that the start and endpoints are typically located in an excavated pit at the installed pipe level. It excavates the soil while jacking segments of pipe casing through the created opening.

- Pipe Jacking. Where soil conditions permit, hydraulic jacks in an excavated pit can be used to force a string of pipe segments through the soil, with spoils being removed manually or mechanically.