Is It Time To Reinforce Confidence In Your Tap Water Quality?

For years, backlash over perceived quality, consumer confidence, and drinking preferences between bottled water vs. tap water has set community water systems back on their heels a bit when it came to water-consumption patterns. Now, new research shows that although consumer preferences are still split, changes in behavior resulting from the COVID pandemic have created new chances for water suppliers to regain some ground. Here’s how.

New Survey Reveals Strengths, Opportunities

Recent research performed by OnePoll on behalf of American Water indicates that opportunities to change the tap water vs. bottled water habits of U.S. water consumers might be changing, due in part to evolving buying behaviors impacted by COVID-19. The survey included responses from more than 2,000 participants among a nationally representative audience of water consumers. While 66 percent of respondents said that they have strong opinions on their water preferences, there are still some positive signs and opportunities for tap-water providers.

- The Good News. Despite the longstanding debate over bottled-water preferences, there are some positive indicators for tap-water suppliers coming out of the survey:

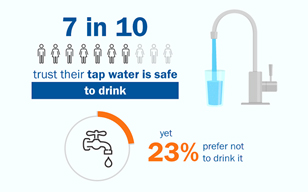

- Nearly 7 in 10 respondents indicated that they considered their tap water safe to drink, even though nearly one in four of all respondents prefer not to drink it (Figure 1).

- Even though 42 percent of respondents usually drink bottled water and 54 percent of respondents indicated that they would not drink tap water outside their homes, only 23 percent said that they would not drink tap water from their homes.

Graphic courtesy of American Water

Figure 1. The good news for community water systems is that most customers still trust their tap water is safe to drink. While 23 percent exhibit a strong preference not to drink tap water, the remaining consumers have a variety of habits and preferences about drinking a mix of tap water and bottled water.

- The Better News. While there are still some strong anti-tap-water feelings, there are also favorable indications that demonstrate opportunities for water suppliers to improve their share of market.

- Of the 69 percent of respondents who said that they preferred the taste of bottled water, nearly one-third of them said that buying bottled water was simply a shopping habit (Figure 2).

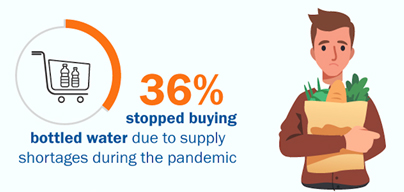

- 36 percent of the audience said that they stopped buying bottled water due to supply issues during the pandemic and 37 percent could not remember why they preferred bottled water in the first place, which shows that consumer behaviors can change despite previously claimed preferences (Figure 3).

- Even among those who buy bottled water, 36 percent of respondents report that they refill their plastic bottles with tap water — another encouraging sign of receptiveness to water utilities.

- A separate positive outcome of the survey was that 45 percent of respondents claimed they were wasting less water because of the pandemic.

Graphic courtesy of American Water

Figure 2. Just because some people prefer bottled water, does not mean that is their only choice. Nearly a third of them admitted that buying bottled water is simply a shopping habit, and some changed that habit during the COVID pandemic.

Graphic courtesy of American Water

Figure 3. The 36 percent of respondents who changed their bottled-water shopping habits during the pandemic proved that water-consumption habits can change. That can create an opening for community water systems to regain customer loyalty under the right circumstances.

- The Remaining Challenges. While the survey showed that there are possibilities to win over at least a segment of habitual bottled-water buyers, challenges still remain for tap-water suppliers to convince the public at large.

- Overall water consumption is lower than recommended. The average daily consumption per respondent was only 4.5 cups, although more than half of respondents reported drinking five or more glasses per day and a third drink six or more glasses per day.

- Of the respondents who felt that their tap water was not safe to drink, the top concerns were about taste (55 percent), possible contamination with lead or heavy metals (54 percent), and the fear that it is not clean (50 percent).

What Does All This Mean For Water Providers?

Although the survey was conducted to assess consumer preferences, it also provides insights that water utilities might leverage to make progress toward elevating customer loyalty. That includes using periodic customer-communications efforts to show progress on key areas of concern to water consumers. It can also include emphasizing positive changes in utility practices and encouraging desirable behaviors with respect to consumer health and environmental responsibility.

- Emphasize Good Water Quality Reports. For the 65 percent of respondents who feel confident that they can understand the findings in U.S. EPA-mandated water quality reports from their water utility, be sure to emphasize high-quality performance and progress being made since prior reports. And for customers who are not confident in navigating their water quality report, be sure to include a cover note that explains in clear, simple language key factors highlighting the utility’s progress regarding concerns about water quality.

- Highlight Utility Investments. Using regular consumer-outreach communications pieces to report on utility progress in replacing old tuberculated water mains, installing new water-treatment equipment, and elevating water-quality test results can chip away at negative and/or subjective opinions (e.g., that tap water tastes bad, is contaminated with lead or other heavy metals, or looks dirty out of the tap). Utilities who use water-polishing treatments for taste-and-odor problems might consider entering water-tasting competitions held by industry organizations such as AWWA, then touting their results.

- Finally, Give Customers Reasons To Switch. Water utilities looking to capitalize on changes in bottled-water buying habits might make a point of offering logo-imprinted reusable water bottles as part of promotional efforts — via billing inserts, their websites, periodic emails, community-day events, etc. (Figure 4). Such efforts can improve visibility and favorability among their customers regarding recent improvements and can give customers reasons to make their new habits more permanent. For example:

- Promote Healthy Lifestyles. Justifying greater water consumption for health reasons can naturally increase the consumption of tap water thanks to the ready supply of affordably priced water right at the customer’s kitchen sink.

- Appeal to Environmentally Responsible Consumers. Educating consumers about the extended impacts of bottled water — such as the volume of plastic bottles relegated to landfills — could have an impact on the 59 percent of survey respondents who prefer to make environmentally friendly choices.

Figure 4. Proactive water utilities might encourage bottled-water users to switch to tap water by offering reusable water bottles as part of a water-utility promotional giveaway.