Water Management For Fracking Evolves

By Reese Tisdale, president of Bluefield Research

To date, the bulk of analysis on the U.S. fracking industry has largely centered on well counts and oil and gas production. The market for water management and wastewater solutions — while crucial to fracking operations — has received less attention and remains opaque to many in the industry. However, increasing water stress and regulatory pushback is driving well operators and energy companies to consider alternative water management strategies as a way to defray potential water supply risks and the impacts of rising water costs.

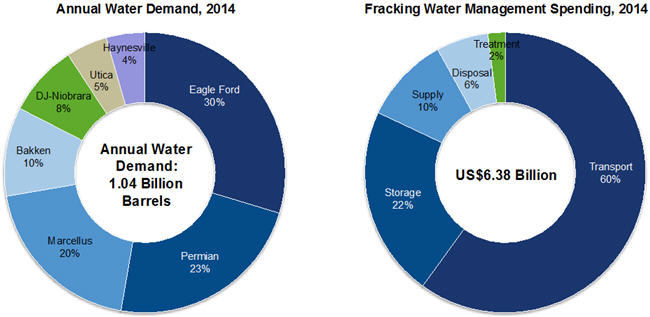

Currently, the U.S. fracking industry consumes over 1 billion barrels of water annually, producing 450-500 million barrels of wastewater for disposal. Overall, the industry will spend $6.38 billion in 2014 on water management — supply, transport, storage, treatment, and disposal. Water transport and disposal costs will account for 66 percent of the total water management spend this year.

With water supplies increasingly at risk, tighter regulations emerging in key states, and costs of trucking and disposal on the rise, alternative strategies such as water treatment and reuse are expected to increase substantially. A new report from Bluefield Research forecasts water treatment and reuse to increase from 14 percent of total produced and flowback water in 2014 to 27 percent by 2020. Over the same period, wastewater treatment spending for fracking is expected to grow almost three-fold, from $138 million to $357 million.

Water for Fracking: Demand and Management Market in U.S.

Source: Bluefield Research

State Regulators At Center Of Water-For-Fracking Policy

State-level policies remain the key driver for water treatment and reuse, providing limits on wastewater disposal and clarity into how wastewater can be transported and transferred. For example, in Pennsylvania — where state policymakers in 2010 placed discharge limits on wastewater from unconventional oil and gas operations — statewide treatment and reuse rates for the Marcellus Basin soared from 23 percent in 2010 to 90 percent in 2014.

More recently, policies have been proposed in Texas, where the state’s Railroad Commission has mandated increased monitoring and testing for seismic activity and well integrity. Arkansas regulators already banned wastewater disposal at injection wells 1,200 square miles around a fault line due to concerns that wastewater disposal was causing earthquakes.

Treatment/Reuse Solutions Becoming Cost-Competitive With Trucking/Disposal

Water treatment and service providers are bridging the cost gap in some shale plays with water reuse costs as much as 15 percent lower than those of trucking and disposal. According to Bluefield’s new report, well operators that employ treatment and reuse solutions spend on average $8.80 per barrel of water used compared to $10.20 per barrel of water trucked and injected into wells, although cost comparisons are site specific.

While treatment and reuse present compelling cost gains on average, there is still not a one-size-fits-all treatment solution for fracking. This has been a major obstacle to widespread adoption. Solutions providers are still ascending a steep learning curve to consistently treat the variable wastewaters that a single fracking well is capable of producing. However, recent demonstration deployments from an emerging group of pure-play technology providers will provide a vote of confidence as operators look for reliable solutions that can cost-effectively treat wastewater of variable qualities over the life of a well.

New Companies And Business Models Emerge

In response to new challenges in water management for fracking, a number of companies have entered the market and made significant investments to expand their water service portfolios. This has created a highly fragmented competitive landscape with nearly 60 key companies active in the U.S. fracking industry’s water management segment. Bluefield categorizes these companies in three market segments — pure-play water service providers, energy service providers, and key technology providers.

Pure-play water service providers possess the greatest share of treatment and reuse deployment across key shale plays. These companies are building water pipelines to supply, transport, and treat wastewater for fracking operations, and in many cases centralizing treatment to build economies of scale. Others are contracting with local municipalities to purchase municipal wastewater that is then treated and reused at fracking sites in order to sure up supply.

At the same time, established energy service providers are scaling their water related activities. Their strategies are more focused on complementing existing energy service portfolios and creating a vertically-integrated oil and gas solution that includes water management. In some cases, energy service providers are developing proprietary treatment and reuse applications.

Meanwhile, technology providers focused on treating produced water are using strategic partnerships as a foothold for market entry. These partnerships are critical at this early stage in the market’s growth to demonstrate the bankability of new technology solutions. Further, they enable technology suppliers to penetrate new shale plays and customer bases. To date, there has been a heavy reliance on more traditional water technologies, but a host of innovative solutions including improved fracking fluids and gases are being deployed to reduce treatment requirements for produced water before reuse.

Bluefield is working with these service providers and technology firms, providing analysis of water strategies and market trends, enabling clients to make more informed business decisions. Click here to learn more about Bluefield Research’s new report on water management for hydraulic fracturing.