Water Losses Cost U.S. Utilities US$6.4B Annually

Nearly one in five gallons—19.5%—of treated drinking water in the U.S. is lost before it reaches customers or is improperly billed. This growing challenge, commonly known as non-revenue water (NRW), results in more than US$6.4B in uncaptured revenues annually for utilities, according to a new report from Bluefield Research, a leading global water market data and insights provider.

A major contributor to these losses is a vast and aging distribution network that spans more than 2.2 million miles across the country. Water main breaks are estimated to occur every two minutes, placing significant financial, operational, and infrastructure burdens on utilities and their stakeholders (residential, commercial, and industrial).

“Non-revenue water is a significant and often overlooked challenge in municipal water management, and in many respects, core infrastructure delivering drinking water is approaching the end of its useful life,” asserts Megan Bondar, an Analyst at Bluefield Research. “Our analysis shows that the vast majority—about 87%—of total water loss stems from real losses, such as leaks and pipe bursts. Apparent losses, such as metering inaccuracies, data errors, and unbilled authorized consumption like firefighting, make up a much smaller share.”

On average, small and very small utilities report water losses above 20.0% of total supply, according to Bluefield. “With limited financial resources, technical expertise, and staffing, smaller utility systems face steep challenges in leak detection, asset management, and system upgrades,” says Bondar. In contrast, larger utilities report average losses of 16.7%, underscoring the advantages of scale and access to more advanced monitoring technologies. This disparity highlights the need for targeted investment and tailored solutions for under-resourced communities facing aging infrastructure and capital limitations.

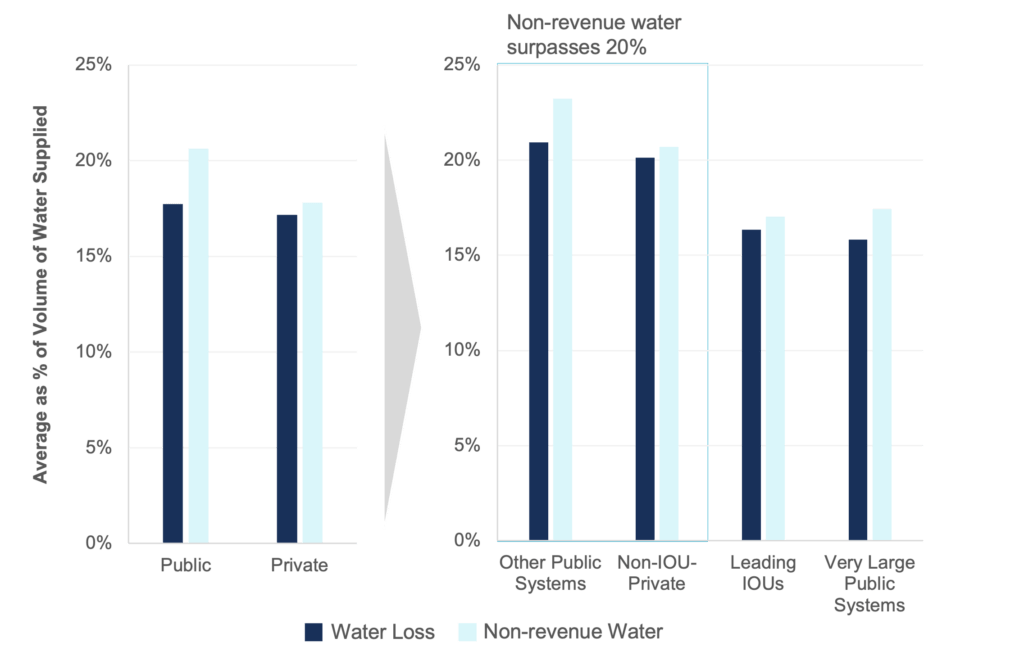

Exhibit: Water Loss and NRW by Utility Type

U.S. water systems collectively lose approximately 6.75 billion gallons of treated drinking water daily. Just five states—California, Texas, Florida, New York, and Illinois—account for over one-third of national losses, collectively exceeding 2.44 billion gallons daily, or roughly US$6.3M in uncaptured revenue. Loss rates vary widely across the country, influenced by pipe age, material type, weather exposure, and system density. The South accounts for 37.2% of total national losses, driven by the scale of water networks in states like Texas and Florida.

“Despite rising operational and financial risks, the U.S. still lacks a cohesive national policy framework to address NRW across nearly 48,000 community drinking water systems,” explains Bondar. “While states such as California, Georgia, Indiana, and Texas are taking steps to standardize reporting and validation requirements, many utilities still lack accurate, validated data—hindering transparency, performance benchmarking, and corrective action.”

A perfect storm of supply disruptions, aging infrastructure, and digital innovation is pushing utilities to rethink how they manage water loss. Technologies—advanced metering infrastructure, satellite leak detection, acoustic sensors, and smart customer engagement platforms—are moving from pilot initiatives to core strategies for identifying and mitigating real losses. Yet, technology alone isn’t enough. Traditional, field-based methods, such as pipe replacements, routine inspections, and boots-on-the-ground monitoring, remain essential to keeping systems operational and resilient.

In many cases, utilities are turning to highly localized solutions. “Some communities even rely on trained dogs to detect leaks,” Bondar adds. “This underscores how local and varied the solutions to water loss can be. Tailored approaches are needed to reflect each utility’s specific financial and operational constraints.”

About Bluefield Research

Bluefield Research supports strategic decision makers with actionable water market intelligence and data across the global industrial and municipal sectors. With expertise across water infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This insight report analyzes over 2,400 utility water loss audits across 11 U.S. states to quantify the scale and cost of non-revenue water. The full report is available for purchase and immediate download from the Bluefield Research website (or included with a U.S. & Canada Municipal Water Market Corporate Subscription).

Source: Bluefield Research