Water As A CFO Issue

By Will Sarni and Alexis Morgan

Creating greater business value

In general, water is not viewed as a strategic issue for businesses in the same manner as other core business issues such as intellectual property, innovation, information technology, and workforce recruiting and retention. These other issues are viewed as critical to business continuity and growth yet, without water, most businesses are out of business.

For context, companies need water for manufacturing (e.g., auto and apparel), product ingredients (e.g., food and beverage), energy (e.g., from hydropower electricity to cooling data centers), and logistics (e.g., transportation of goods via rivers and lakes). Without water, there is business disruption and, in some cases, even stranded assets which are of paramount concern to a Chief Financial Officer (CFO) and investors alike.

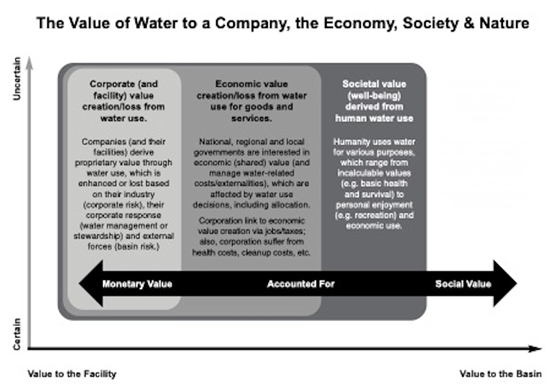

Water as a critical resource is managed primarily as a regulatory compliance matter, a corporate social responsibility, or an environmental, social, and governance (ESG) reporting and disclosure issue. At best, it may form a limited part of a sustainability strategy, which in turn may feed into part of a broader corporate strategy. This narrow view of the role of water as a business issue significantly limits the creation of business value that benefits the business itself and its stakeholders (communities, supply chain, workforce, etc.). Water has significant value for businesses, society, and ecosystems across several dimensions as illustrated below (WWF).

We believe that it is long overdue to revisit prioritizing water as a financially material business issue (be it risks, fiduciary liabilities or opportunities: assets and sales growth) and the role of the CFO.

Rethinking Water As A CFO Responsibility

With water being at the center of climate impacts, we propose that water, as a critical resource, should be the purview of a CFO and not sequestered within a marketing or public relations function. It is simply too important to the financial profitability of the company to be cast aside. Our rationale is as follows: the financial performance of the company is the responsibility of the CFO and given how deeply financial performance is being influenced by factors such as climate-related water risks (from water scarcity to extreme weather events), there is a fiduciary responsibility for water to fall within the CFO’s purview. Perhaps more importantly, just as an income statement contains both expenses and revenue, water needs to be seen not simply as a risk. Climate instability is creating a large array of opportunities — many (if not most) of which are manifesting as growing water challenges (ranging from consumer demand for sustainable products to direct solutions that build offerings or create suppliers that can outcompete the competition). Strategically developing new water-related forms of income further strengthens the case to raise water to the CFO level. Financial decisions related to new business opportunities — be it through innovation in products and services or mergers and acquisitions — require CFOs to understand the strategic value of water to the bottom line and long-term success of the company (e.g., brand value). Elevating water to the CFO level provides a business the opportunity to improve risk management issues attributed to water and identify opportunities for a business to participate in investment in developing solutions to water scarcity, poor quality, and increasing access to water.

The CFO is uniquely positioned in a business to create greater business value by ensuring that the company delivers environmental and social performance, and that value creation is more than managing risks. There is an opportunity for a business to increase brand value and develop new products and services to address water scarcity, poor quality, and lack of access to safe drinking water.

A Path Forward

If our argument holds, then how is a CFO to proceed? Many thoughts come to mind, but here are three to get you started:

- Deeply integrate water and other non-financial issues into your annual reports. While integrated reporting has been around for a long while, robust consideration for how non-financial issues translate into financial issues continues to be thinner than desired. Given the enormous short- and long-term implications of climate instability and biodiversity loss (and water as a medium for both), CFOs need to up their game when it comes to engaging investors. The Task Force on Climate-related Financial Disclosures (TCFD), the Taskforce on Nature-related Financial Disclosures (TNFD), and other efforts from regulators are helping to push, but whenever regulation is pushing the private sector, it means that business is lagging (regulation should always lag since businesses can move faster than the government).

- Consider your sustainability reporting structures. These days leading large multinationals tend to have a Chief Sustainability Officer. At the same time, we continue to support such a notion to ensure line management of such issues, so having the CSO report to the CFO may be worth considering. Such a structure forces sustainability to be rationalized financially — which it invariably can be. Tying sustainability into the finance team forces cross-functional literacy and accountability between sustainability teams and finance/accounting teams. As the issuance of green bonds and sustainability lines of credit continue to grow amongst large multinationals, linking sustainability to finance will become increasingly important.

- Innovate methods to value water. For some time, notions of carbon pricing have shaped how net present values can be adjusted for carbon-energy-related investments. While water is not quite as simple, and there are challenges with adopting shadow pricing for water, the concept of innovation for valuing water is sound. From ecosystem service valuation to valuing water-related assets, to approaches that consider value-at-risk, to water-related hedging and catastrophe bonds, there are many creative ways in which water can be valued by companies. These need to be embraced as we go forward.

The pathway of our planet and its economy will continue to be shaped by large planetary forces increasingly affected by our changing planet. As ecosystems reach tipping points and as weather patterns grow increasingly unstable, financial performance will be heavily dictated by those who best adapt. With water being the means through which most impacts are felt, those companies that place water at the heart of their financial risk and growth strategies are likely to be the ones that generate disproportionate returns for investors. With a water-savvy CFO in the mix, companies are ensuring they have qualified captains as we make our way into uncharted waters.

Will Sarni is Foundry and General Partner, Water Foundry Ventures, and the CEO of Water Foundry, a strategy consulting firm focused on the water sector. Please feel free to contact him at will@waterfoundry.ventures or will@waterfoundry.com. For more information on Water Foundry, please visit https://www.waterfoundry.com/.

Alexis Morgan is the Global Water Stewardship Lead for WWF. Please feel free to contact him at Alexis.Morgan@wwf.de.

Originally published in the Raymond James Water Quarterly Newsletter, Winter 2022/2023