Ultrapure Water Treatment: A Market With Energy

By Shilpa Tiku

A look at the market dynamics and drivers for ultrapure water treatment reveals multiple industries with growing demand, including one that stands above the rest.

The U.S. ultrapure water (UPW) treatment systems market for the power generation, pharmaceutical, and microelectronics industry was valued at over $1.1 billion in 2019. The market is expected to witness a compound annual growth rate (CAGR) of over 4 percent over the next seven years.

The market is dominated by a few players holding a significant market share. The top four companies make up more than 65 percent of the market share by revenue in 2019. The market has witnessed numerous acquisitions over the last few years, which has strengthened the ability of companies to offer multiple technologies and comprehensive solutions.

Market Dynamics

- The power generation industry is the largest end-user group requiring ultrapure water treatment systems.

- The pharmaceutical industry will likely see the fastest growth at an estimated CAGR of over 6 percent during the forecast period. An increased focus on expanding pharmaceutical infrastructure to meet a surge in demand for pharmaceutical products during the COVID-19 pandemic is expected to drive its growth in the short term.

- The COVID-19 pandemic will likely accelerate adoption of digitalization. Connectivity and remote access features are expected to become the norm. Introduction of the 5G mobile network is expected to spur demand for semiconductor components, which will have a positive impact on demand for ultrapure water in the microelectronics industry.

- Mergers and acquisitions are becoming increasingly popular in this market. Established companies are broadening their product/technology offerings by investing in technological expertise offered by smaller water treatment system companies.

- Companies are increasingly offering systems designed to reduce overall operational spending and provide increased flexibility and scalability without sacrificing efficiency and product quality.

Market Drivers

The market drivers for UPW treatment systems include diverse value-added services, market consolidation and alliances, marketing efforts by companies, growth of end-user industries, and technological advances made to increase system reliability uptime and cost effectiveness.

- Diverse value-added services – Companies are increasingly offering diverse pre-sales and after-sales value added services to address various customer needs. Equipment maintenance could be bound by a custom contract or could be served for repairs on an as-needed basis. Having field service that can respond 24/7 is critical for customers to do business with a supplier in that area. So, the after-sales market is probably just as important as the capital expense for customers. Companies have to ensure that all the components get replaced regularly before they break down because breakdown during the middle of a production process is unacceptable.

- Customers are looking for partnerships – Vendors that can be more integrated and provide both solutions and ongoing support to help their customers succeed. There is an increased emphasis toward overall productivity as a trend in making big relationships even bigger.

Some of the key challenges in the market include high entry barriers, shortage of skilled labor, and industry-specific challenges associated with process complexities.

- High entry barriers – The UPW treatment systems market is characterized by high vendor loyalty, particularly in the pharmaceutical and microelectronics industries. Customers cannot risk any system failure impacting product quality since the production cost is enormous. Additionally, they are inclined to stick with familiar vendors who can be trusted, even though they might not be the best in the market or best-priced.

Evoqua and SUEZ dominate the UPW treatment systems market with over 45 percent combined market share. The increasing presence and role of large companies will continue to be a challenge to smaller companies. These companies have strong financial advantage over smaller competitors in major business areas such as research and development and marketing. Larger companies have developed capabilities to offer complete solutions under one umbrella.

Competitive Factors

- Complete solutions – Companies are striving to broaden their product offerings and strengthen their market position through acquisitions and partnerships. Customers are increasingly seeking system suppliers who can offer complete solutions for diverse water needs for instance engineering contracts that include both process water and wastewater systems.

- Diverse value-added services – Customers look for vendors who provide value-added services. This has driven companies in the market to focus their efforts on constantly working toward offering a diverse range of product and service offerings. Companies are increasingly providing integrated solutions and ongoing support to help their customer’s business succeed.

- Prompt service – Having field service that can respond 24/7 is critical for customers to do business with suppliers in a particular area. The after-sales market is just as important as the capital expense. Customers are generally concerned about consistent and prompt service in their surrounding area and not as concerned about great service nationwide. As long as the service is prompt and consistent in that region, customers are not concerned about validating the level of service in the next state or nationwide.

COVID-19 Impact

The COVID-19 pandemic will likely accelerate digitalization, which will positively impact the microelectronics industry. Adoption of Internet of Things (IoT) technologies like data analytics, cloud computing, augmented intelligence, and blockchain will be accelerated.

Customers will increasingly seek solutions equipped with remote monitoring and control features to analyze, automate, correct in real time, predict, and minimize risks.

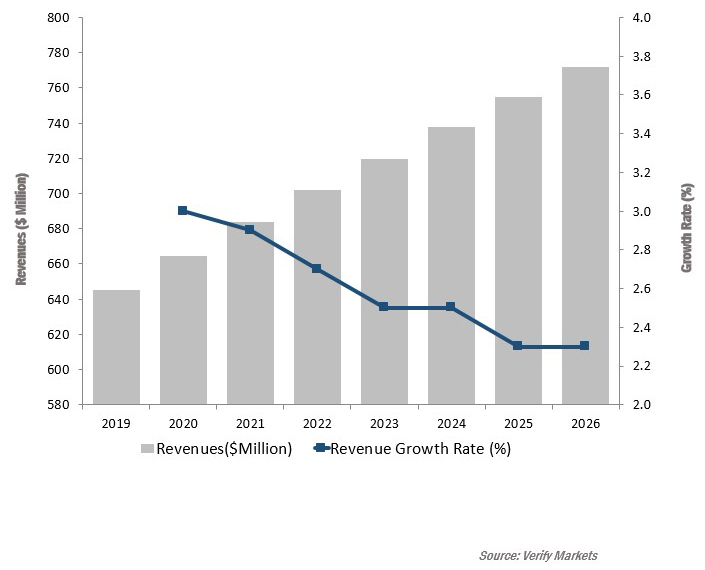

The power generation industry is the largest consumer of ultrapure water in the United States. The chart shows the market forecasts for UPW treatment systems in the power generation industry from 2019 until 2026. The UPW treatment systems market in the power generation industry was valued at $645.6 million in 2019 and is expected to reach revenues of $772 million in 2026.

Ultrapure Water Treatment Systems Market: Revenue Forecast, Power Generation, 2019-2026

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies, and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies, and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com