The U.S. Water And Wastewater Analytical Instrumentation Market Is Expected To See Growth

By Shilpa Tiku

The U.S. water and wastewater analytical instrumentation market is mature and competitive. The market is projected to experience a growth rate of 2.9 percent over the next seven years. The growth is expected to be driven by the need to meet regulatory compliance, outstanding after sales service support, increasing need for automating processes, and the availability of products equipped with smart features.

Market Size

The total U.S. water and wastewater analytical instrumentation market was valued at $432.3 million in 2019 and is expected to reach revenues of $527.6 million in 2026. The key segments making up the total market size include both portable and continuous/online instruments for measuring pH, conductivity, turbidity, dissolved oxygen (DO), total organic carbon (TOC), total nitrogen (TN), and total phosphorus (TP). Over the next seven years, the online segment is projected to grow faster than the portable segment due to increasing automation and optimization solutions. Solutions such as user-friendly software tools for easy interpretation of process data and errors are being developed to address concerns regarding declining in-house expertise as experienced workforce retires.

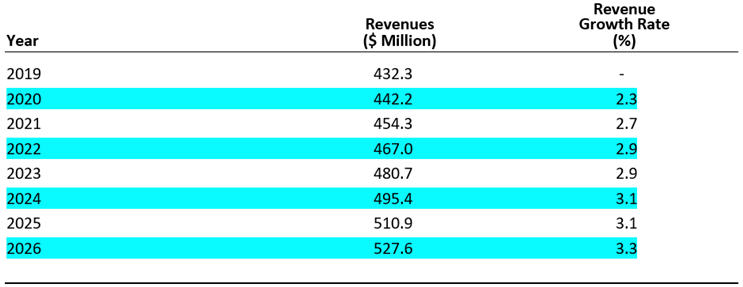

Total Water And Wastewater Analytical Instrumentation Market: Revenue Forecasts (U.S.), 2019-2026

(Source: Verify Markets)

Note: The total market size includes revenues for both portable and online instruments. The segments include pH, conductivity, turbidity, DO, TOC, TN, and TP instrumentation. Compound Annual Growth Rate (2019-2026) = 2.9%

Market Drivers

The COVID-19 pandemic will likely accelerate digitalization of the water and wastewater sector and drive growth for online analytical instrumentation. Connectivity and remote access features will become the norm, especially for newer operators.

- Growth in the online segment is fueled by increasing automation and optimization solutions.

- Other drivers include demand from new treatment facilities and refurbishment of existing facilities.

- Cost savings, convenience, and efficient products offered by companies: Companies are offering technologies that enable accurate real-time measurement of parameters such as TP, TOC, and TN in a shorter time as compared to longer waiting time required if the measurements are done in laboratories using bench-top instruments. Predictive diagnostic tools which include warning LEDs, and high-visibility notification screens have enabled end-users to detect potential issues before they result in unplanned downtime and maintenance events.

- Value-added services will drive the market, including providing calibration certificates, operator training/hands-on customer training, easy availability of spare parts, preventive maintenance packages for uninterrupted operations, ongoing customer support, and complete solution offerings.

Market Challenges

Regulation-related challenges hinder technological innovation and act as an entry barrier. The water and wastewater market is heavily regulated, so if companies innovate on the technology side, they may have to incur a long waiting period to gain acceptance by a regulatory body. New entrants aspiring to play in this space may consider differentiation in ways other than technology.

Other challenges faced by companies in this market include process complexity and gaining customer confidence. Sustaining growth is a challenge faced by small market participants. Smaller players have to compete with conglomerates that offer well-built after sales services.

The pH market is the largest segment in this space. It is a commoditized market. Additionally, the prices of sensors have been declining over the years, making it a highly price-competitive market segment. Customers on the utility side are conservative and manage with bare minimum technology in order to meet regulatory requirements. The market is dominated by a few large players with capabilities to offer complete solutions. All these factors pose significant challenges for smaller market participants and hinder their growth.

Market Trends

Companies are increasingly offering diverse products suitable for varied applications. They are designing instruments that can be easily calibrated and require less maintenance. This helps increase instrument uptime and reduce operating costs.

Additionally, companies are also working towards building rugged sensors which last longer and measure pH values without compromising product safety and quality. Smart sensors equipped with Bluetooth technology enable data transmission from remote locations, helping companies increase unmanned operations. pH instruments are designed to resist corrosion in hazardous areas and extreme temperature. Companies also offer instrumentation designed to meet hygienic and sterile demands for ultrapure water applications.

The TOC instrumentation market is predominantly dominated by European companies. Very few players from the U.S. play in this market space.

The U.S. water and wastewater analytical instrumentation has witnessed several mergers and acquisitions over the years. The market is dominated by a few large players who have capabilities to offer complete solutions. Some key companies in the market include Danaher Corporation, Thermo Fisher Scientific Inc., Xylem Inc., Hanna Instruments, Inc., Yokogawa Electric Corporation, Endress+Hauser AG, Emerson Electric Co., Mettler-Toledo International Inc., and more.

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com.

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com.