The Highly Consolidated U.S. UV Water Treatment Equipment Market

By Shilpa Tiku

The U.S. ultraviolet water (UV) water treatment equipment market for industrial and drinking water applications is competitive, mature, and saturated. The market is dominated by a few leading players holding significant market shares.

The U.S. UV water treatment equipment market was valued at over $145.0 million in 2019. Verify Markets expects the market to grow at a compound annual growth rate of over 6 percent between 2020 and 2026.

Competitive factors:

Companies regularly work on developing comprehensive products and service packages to meet specific customer requirements in both drinking water and industrial water applications. Manufacturers are increasingly focusing on designing customized lamps and adjustable flow ranges suitable for various applications. Systems in the marketplace are equipped with the latest technologies such as dose-based algorithms, intuitive user interfaces, alarms, real-time analytics, remote monitoring, and others.

The market is highly consolidated:

More than 70 percent of the market by revenue is dominated by a handful of participants which mainly include: Trojan Technologies, Calgon Carbon Corporation, and Xylem Inc. Trojan Technologies, a part of Danaher’s environmental segment and water quality platform was the market leader in the U.S. UV treatment equipment market in 2019. Trojan has been actively pursuing the municipal drinking water market. With a strong established network of municipal clients, Trojan Technologies will continue to be a dominant player in the market.

Most companies in this market space maintain offices in several cities and primarily operate through sales reps. The network of local professionals enables companies to respond rapidly and efficiently to meet customer needs. These reps call on cities or the engineers directly on a regular basis by word of mouth or personal contacts.

Key drivers and restraints in the market:

The key drivers in this market include chemical-free technology, increasing demand for clean and high purity water, and legislation. The key restraints include a highly consolidated and saturated market, availability of alternative treatments, and high vendor loyalty.

UV technology has experienced an increased acceptance due to technology improvements and safety issues associated with the reliance on chlorination. A key driver for this technology is public health concerns. “UV technology is a simple, non-chemical means to make communities safer. There is also a better awareness of using the technology. UV technology can now directly compete with membranes and filtration and has proven to be a good form of sterilization.” – Notes Chief Research Officer Shilpa Tiku at Verify Markets.

Additionally, COVID-19 has definitely highlighted the ability of a non-chemical disinfectant to treat water and disinfect surfaces.

High vendor loyalty tends to be a challenge in this market, especially in the municipal segment. Municipalities tend to rely on a limited number of suppliers who they have confidence in and, as a consequence, commonly do not try products from other suppliers. Other than enormous incentives such as free solutions, municipalities will not likely take risk of unverified manufacturers in the market – especially putting the public health at risk”. - notes Tiku

Another challenge is the autonomous operation of municipalities that make their own procurement decisions.

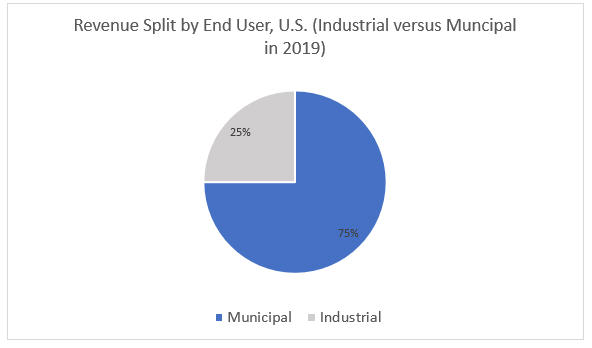

Market shares by end users in 2019:

The end users in this market include municipal and industrial water treatment plants. The industrial segment is further classified into key applications such as pharmaceuticals, food & beverage industries, power plants, aquaculture, and others.

UV technology is being used across a wide spectrum of the food & beverage industries, and also in industries where water of the highest purity is required, such as pharmaceutical manufacturing, cosmetic industries, power generation, and semiconductors.

In 2019, the municipal segment made up an estimated 75 percent of the market share by revenue. UV disinfection is popular in the municipal segment due to its ability to deactivate cryptosporidium and giardia. The industrial segment made up an estimated 25 percent of the total market by revenue in 2019. In 2019, the food & beverage industry was the largest end user industrial group for UV treatment equipment.

The selection of treatment equipment vendors in the drinking water segment is based on vendor familiarity, recognition, and equipment pricing. Cost is a determining factor in purchase decisions and manufacturers that provide cost-effective solutions to potential buyers are clear winners. Past experiences and case study examples are important factors as well.

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies, and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com.