Surveying The U.S. Water Sector's Embrace Of Technology And Sustainability

By Mike Orth

Black & Veatch’s latest annual survey of the water sector reveals a changing set of circumstances, challenges, and potential solutions.

Just a decade ago, Black & Veatch’s first annual assessment of the U.S. water industry showed a sector grappling with the lingering fallout of the financial crisis. Upgrades to infrastructure well past its prime fell victim to funding deemed grossly inadequate. “Sustainability” held the promise of significant benefits, even if a unified definition proved elusive. Data’s vast potential in managing and optimizing assets was on the industry’s radar, though actually seeing it in practice was another story.

Ten years since, Black & Veatch’s 2022 Water Report — based on expert analyses of a survey of more than 300 stakeholders in America’s water, wastewater, and stormwater sectors — magnifies how many of those takeaways remain — and how so many things have grown more complex.

Just as the industry’s infrastructure continues to age, so are its workers, increasingly exiting into retirement with their skills and institutional knowledge, posing formidable staffing challenges in a historically tight job market. The embrace of data in decisionmaking — vital in enabling utilities to do more with less in this age of “digital water” — is recognized for its potential but still lags in adoption. Cybersecurity, climate change, and decarbonization — unmentioned in the 2012 report — have emerged as pressures the industry can’t ignore. Concerns about evolving regulations are deepening.

Despite all of that, there’s opportunity and optimism. Funding through the American Rescue Plan Act of 2021 (ARPA) and the $1.2-trillion Infrastructure Investment and Jobs Act (IIJA) is a generational opportunity to invest in long-overdue water projects. The downside: Many utilities — insistent that they’ll pursue some of that infusion — aren’t quite sure how to go after it.

In this complicated world of water, old ways of thinking are giving way, albeit relatively slowly, to what’s new and possible in addressing chronic pain points in 2022 — the 50th anniversary of the Clean Water Act — and beyond.

The Vexing Complexities Of Aging

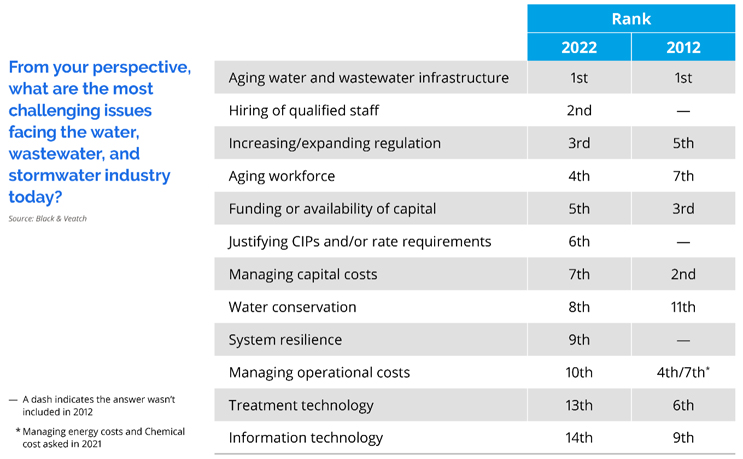

Ten years ago, survey respondents declared aging water and sewer infrastructure as the industry’s foremost concern. That hasn’t changed; nearly two-thirds — 63% — still put it atop the list, but it is down nearly 12 percentage points from a year ago.

Over time, workforce-related issues have ascended in the rankings, with the challenge of hiring qualified staff — not included as a survey option in 2012 and ranked No. 14 in 2017 — now spiking to No. 2. The industry’s aging workforce jumped three spots to No. 4 over the past decade, just behind increasing or expanding regulations — an issue that ranked fifth in 2012.

Given the exodus of older skilled workers, utilities more than ever are looking to fill the void through automation, outsourcing, and an ever-thinning pool of recruits who enjoy more career options and greater leverage for various reasons. Fewer people generally seek out water utility work, and the pursuit of their talents has devolved into a bidding war in which utilities — especially smaller ones — often can’t compete, given their tight finances.

Data: A Path To Resilience, Sustainability

With growing awareness of everything that data can do, going digital can help water utilities reap greater efficiency and resilience through actionable information to evaluate and optimize asset performance, along the way alerting them of potentially looming failures.

Yet only seven in 10 respondents say they’re collecting “lots of data,” though slightly more than one-quarter believe they are leveraging it effectively. Those who aren’t are missing out, given that harnessing data — and artificial intelligence technologies — offers rewards ranging from a holistic view of the water system to enhanced efforts to track consumption, drive efficiencies, save energy, and prioritize investment dollars, heightening resilience and sustainability.

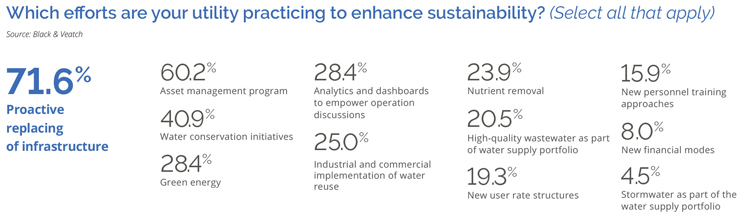

Since its absence in Black & Veatch’s 2012 water report, sustainability isn’t merely a buzzword. Some 72% of survey respondents now say their enterprise has sustainability goals and the means to measure them, up roughly 7 percentage points from last year. Slightly more than half say separately they’ve adopted sustainability goals, independent of community or regulatory pressures.

Nearly two-thirds cast sustainability as a critical strategic focus in the water sector, though one-third say sustainability “sounds good” but isn’t a priority. Seven in 10 from utilities that serve more than 500,000 customers deem sustainability a priority, compared with 58% of those who serve fewer than that population threshold.

Approaches to greater sustainability vary, with proactive replacement of infrastructure leading the way at 72%, ahead of asset management programs (60%) and water conservation initiatives (41%). As decarbonization gains momentum across all utilities, nearly 30% of water sector respondents say they’re adopting initiatives involving green energy, with an identical number using analytics and dashboards to empower operational discussion.

Welcomed Funding From Uncle Sam

Inadequate funding and the numbing price tag of languishing infrastructure upgrades have been years-long headwinds for the industry, where four in 10 respondents believe funding for capital projects will not be enough over the next five to 10 years. By a two-to-one margin over their bigger counterparts, utilities with fewer than 500,000 customers think that will be the case. Overall, one-third say funding will be sufficient, while 16% believe it will merely meet the requirement.

Feeding into state revolving funds (SRFs) as part of partnership between states and the U.S. government, tens of billions of dollars from the IIJA over the next five years will go to critical water investments, including projects involving drinking water and sewers. Billions more are bound for cities and counties under the ARPA.

Fifty-eight percent of respondents say they’re pursuing ARPA funds, with one-third intending to chase IIJA money earmarked for water infrastructure and resiliency efforts. Yet when pressed as to why their organizations haven’t taken advantage of funding mechanisms, the top cited reasons were that they were administratively too burdensome (37%), the programs were too restrictive (27%), and there was a lack of awareness about them (21%).

Asked separately whether they’re accelerating capital projects because of new state or federal funding sources, just one-third of respondents said they “might or might not” — the top reaction. One-quarter reported “probably yes,” with one in five “probably not.”

Clearly, the IIJA represents more of a lifeline to the water industry — not a panacea, given that more long-term investment will be essential to address decades of underinvestment. But in a sector rife with challenges — from eliminating contaminants from drinking water to thwarting cybercriminals, to mitigating climate change’s effects — it’s another positive step forward.

About The Author

About The Author

Mike Orth is president of Black & Veatch’s governments and environment business.