Rehabilitation And Wastewater To Fuel Decade Of Growth In Pipe Infrastructure, Exceeding US$117B By 2035

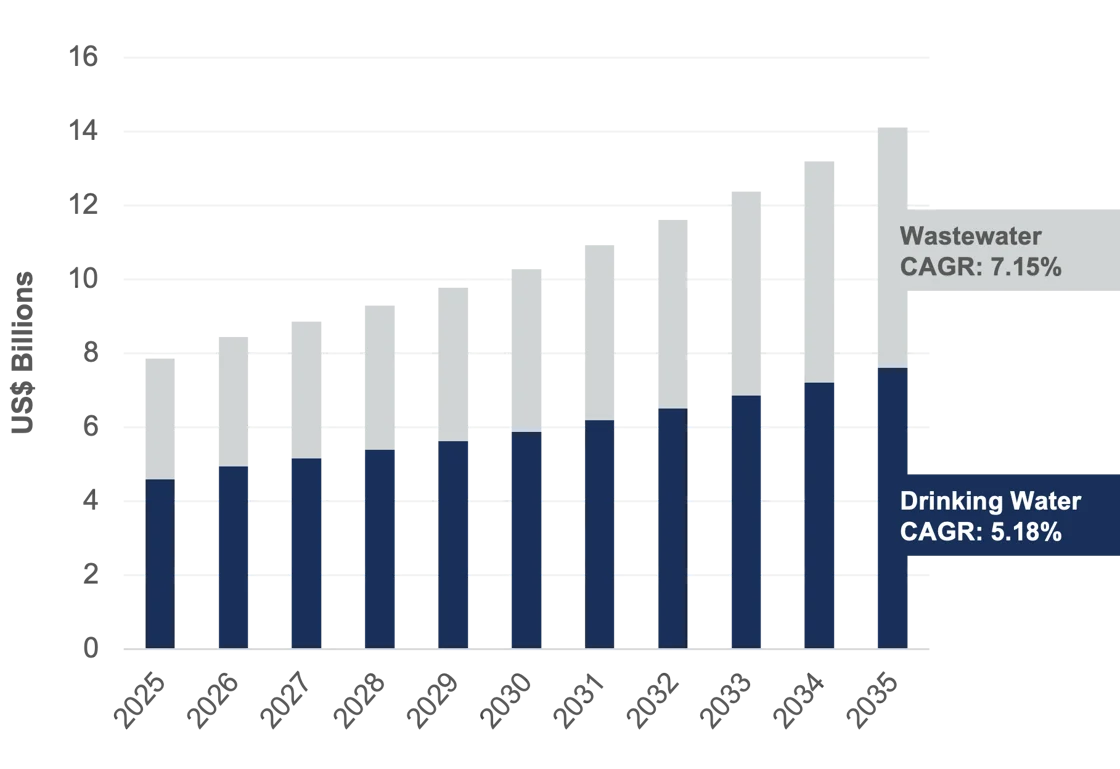

Capital expenditures (CAPEX) on pipe infrastructure for municipal water and wastewater utilities in the U.S. and Canada are projected to reach a total of US$117.0B between 2025 and 2035, according to a new report from Bluefield Research, a leading provider of global water market data and insights. This 10-year surge in annual spending is nearly double the current expenditure, increasing from US$7.9B in 2025 to US$14.1B by 2035. It prioritizes water distribution and wastewater (i.e., sewer) collection networks for utilities facing challenges such as water losses, escalating material costs, and funding uncertainty.

Over the next decade, rehabilitation of existing pipe networks is forecasted to grow at a robust 15.10% compound annual growth rate (CAGR), significantly outpacing both pipe replacement (4.93%) and new installations (4.35%). The emphasis on rehabilitation indicates that utilities are focused on extending the life span of existing assets to limit near-term impacts on capital budgets and maximize the value of their installed asset base. Even so, new installations will still command the largest share of total expenditures, estimated at US$68.3B throughout the forecast period.

“Utilities are being forced to rethink how they invest in their underground systems,” says Charlie Suse, a senior analyst at Bluefield Research. “Amid rising material costs and national water loss rates exceeding 17%, there’s a growing emphasis on smarter rehabilitation—approaches that extend asset life while minimizing operational downtime.”

Historically underfunded relative to drinking water networks, wastewater collection systems now represent a new frontier, drawing increased financial focus. Investment in wastewater pipe is projected to grow at a 7.15% CAGR, outpacing the 5.18% growth rate forecast for drinking water pipes. This shift reflects utilities’ response to aging sewer assets, the growth of urban and suburban populations, and a broader transition from private septic tanks to centralized municipal systems.

Exhibit: U.S. and Canada Pipe Infrastructure CAPEX Forecast, 2025–2035

Regional Growth Fueled by Housing Starts and Population Surge in U.S. and Canada

Investment patterns across North America reveal significant geographic differences, with new housing developments and population shifts driving some of the most compelling opportunities for pipe infrastructure. The fastest-growing markets across the U.S. and Canada are led by Arizona (7.78% growth), followed by Ohio and Nova Scotia.

High population growth and new housing starts in the U.S. Sunbelt are key factors supporting the overall outlook for pipe CAPEX. States such as Texas, California, and Florida—home to the largest populations and extensive linear asset bases—are expected to account for roughly 30% of total projected pipe spending. Beyond these larger states, North Carolina ranks among the top 10 markets for CAPEX and is projected to capture a significant share of pipe investments over the next decade.

From 2022 to 2023, Canada experienced its highest population growth rate since 1957. In this context, more miles of drinking water, wastewater, and stormwater pipes were installed from 2020 to 2022 than during any other period on record—bolstering the forecast of US$8.12B in pipe infrastructure CAPEX through 2035.

Material Selection Reflects Cost and Performance Trade-Offs

Building on a base of 4.5 million miles of distribution and collection networks in the U.S. and Canada, polyvinyl chloride (PVC) continues to gain market share in new pipe installations. It is favored for its lower up-front costs, ease of transport, and widespread use in growing residential and suburban areas. In the South and West, where population growth and new housing developments are strongest, property developers often choose lower-cost materials such as PVC, high density polyethylene (HDPE), and polyethylene (PE) to reduce up-front capital costs.

However, the selection of pipe material varies significantly by region. While PVC dominates greenfield installations in rapidly growing states, ductile iron remains entrenched in older urban systems due to its durability and reduced risk of breakage in congested underground environments. “Material selection is more than just price,” Suse points out. “These decisions are shaped by the local environment (urban or rural), the utility’s experience with its existing pipe network, and the long-term objectives of the final buyer, whether a utility or a property developer.”

Price Uncertainty Shapes Planning and Procurement

The U.S. market is entering what Bluefield identifies as a fourth phase of price volatility. Between 2014 and 2024, material prices underwent three distinct phases: market stability (2014–2020), high inflation (2020–2022), and a brief period of deflation (2022–2024). Looking ahead, ongoing supply chain disruptions are creating a new and more complex planning environment—driven by on-again, off-again tariffs and the challenges suppliers face in meeting bipartisan policies, such as the Build America, Buy America Act.

The potential impacts of the fourth phase could include renewed price hikes, project delays, and, in some cases, cancellations as buyers ride out market turbulence. These risks are further compounded by potential cuts to federal programs, such as State Revolving Funds, which provide low-interest loans and grants to the approximately 73,000 community water and wastewater systems in the U.S.

“Pipe infrastructure may be buried, but it’s rising to the top of mind for many stakeholders,” notes Suse. “Utility decisions are not made in a vacuum—most are being asked to do more with less—and the choices they make over the next decade will define water infrastructure resilience and service reliability for utility customers moving forward.”

About Bluefield Research

Bluefield Research supports strategic decision-makers with actionable water market intelligence and data in global industrial and municipal sectors. With expertise across infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report, U.S. & Canada Water and Wastewater Pipe CAPEX Forecasts, 2025–2035, presents a data-driven perspective on how market trends, policy disruptions, and strategic pivots are reshaping the investment landscape for pipe infrastructure. The full report is available for purchase and immediate download from Bluefield’s website.

Source: Bluefield Research