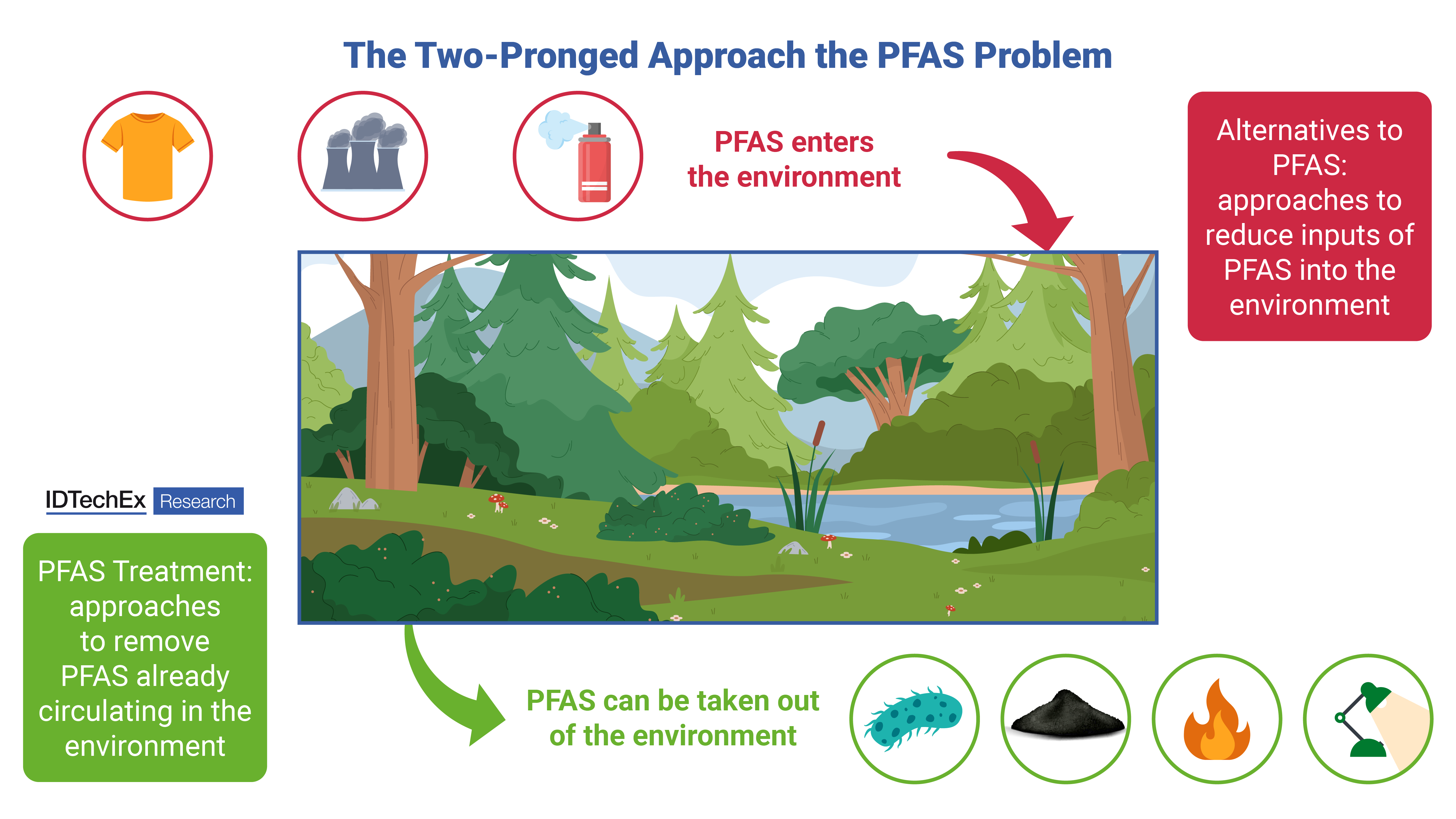

Reduce And Remove: The Two-Pronged Approach To The PFAS Problem

By Sona Dadhania, Principal Technology Analyst at IDTechEx

The discussion surrounding per- and polyfluoroalkyl substances (PFAS), driven by the persistence and bioaccumulation of these "forever chemicals" in ecosystems and human bodies, has reached a critical juncture. With some 5,000 PFAS compounds being utilized in industries from food packaging to semiconductors, concerns over their environmental and health risks—linked to cancer, hormonal disruption, and developmental delays—have created demands for action. However, solving this crisis requires more than a single strategy. A dual approach is emerging: regulating PFAS usage to stem the flow of new chemicals into the environment and advancing treatment technologies to destroy or remove existing contamination. Together, these approaches form a comprehensive framework to mitigate the PFAS problem. IDTechEx explores this framework through its PFAS research portfolio, including recently released reports on "Per- and Polyfluoroalkyl Substances (PFAS) 2025: Emerging Applications, Alternatives, Regulations", and "PFAS Treatment 2025-2035: Technologies, Regulations, Players, Applications".

Regulating PFAS usage: Closing the tap on PFAS pollution

Global Regulatory Momentum

Regulatory bodies worldwide are considering shifting from reactive measures to proactive PFAS production and use bans. The European Union's proposed universal PFAS restriction is the most aggressive regulatory effort to date. Introduced in 2023 and still under revision by the European Chemicals Agency (ECHA) as of 2025, this sweeping regulation aims to ban nearly all PFAS except for "essential uses" in critical sectors like semiconductors and renewable energy. While industries such as fuel cells (reliant on PFAS-based proton exchange membranes) and batteries (using PFAS-containing binders) may secure exemptions, most applications—including food packaging and textiles—may face strict phase-out timelines.

In the U.S., federal action lags, but state-level initiatives are filling the gap. Maine and Minnesota have adopted EU-style universal PFAS bans, while California targets PFAS in consumer goods like cosmetics and food containers. Even the U.S. Environmental Protection Agency (EPA) had set unprecedented drinking water limits (4 ppt for PFOA/PFOS), signaling a tightening regulatory landscape. Even the new EPA administrator under the Trump administration has indicated a willingness to keep pursuing action to address PFAS contamination.

Industry Shifts and Alternatives

Regulations may force industries to pivot toward PFAS-free alternatives. For example:

- Sustainable Food Packaging: With the EU's Packaging and Packaging Waste Regulation (PPWR) banning PFAS-coated materials, companies are adopting biowax, nanocellulose, or non-PFAS-containing polymer-based coatings for grease resistance.

- Hydrogen Economy: Fluoropolymer membranes in fuel cells could face substitution by hydrocarbon alternatives, though cost, performance, and scalability remain major hurdles.

- Data Centers: Non-PFAS coolants and dielectric fluids are emerging for immersion cooling systems as key fluorochemical manufacturers like 3M exit the market.

IDTechEx's report "Per- and Polyfluoroalkyl Substances (PFAS) 2025: Emerging Applications, Alternatives, Regulations", highlights that while alternatives exist, their commercial viability hinges on overcoming technical limitations and cost barriers. For businesses, preparing for both "best-case" (targeted bans) and "worst-case" (universal bans) scenarios are critical to navigating this uncertain terrain.

Treating PFAS contamination: Cleaning up the past

The Scale of the Challenge

PFAS contamination is ubiquitous, with an estimated 57,000 contamination sites in the U.S. alone. The chemical diversity of PFAS complicates treatment:

- Long-chain PFAS (e.g., PFOA/PFOS): Legacy contaminants are regulated globally but are persistent in soil and water.

- Short-chain PFAS (e.g., PFBA/PFBS): Mobile replacements for long-chain PFAS, are now under scrutiny for similar risks.

- Ultra-short-chain PFAS (e.g., TFA): Byproducts of degradation, highly mobile and largely unregulated.

Traditional treatment methods like granular activated carbon (GAC) and ion exchange resins (IER) effectively capture long-chain PFAS but struggle with shorter variants. Moreover, these methods risk recontamination if transferred to landfills.

Emerging Destruction Technologies

A spotlight is being shined on permanent destruction technologies that break carbon-fluorine bonds—the strongest in organic chemistry. Key innovations emerging include (but are not limited to):

- Electrochemical Oxidation (EO): Uses reactive species to degrade PFAS in water.

- Supercritical Water Oxidation (SCWO): Heats contaminated water beyond 374°C to mineralize PFAS into harmless byproducts.

- Plasma Treatment: Leverages thermal or non-thermal plasma to cleave PFAS molecules.

- Hydrothermal Alkaline Treatment (HALT): Combines heat and catalysts like sodium hydroxide for efficient breakdown.

However, challenges persist. Incineration, the incumbent method for PFAS destruction, faces skepticism due to incomplete combustion risks. This presents an opportunity for emerging destruction technologies, but while they are promising, they also lack data from commercial deployments that would be important to reassure potential adopters.

Market Growth and Regulatory Synergy

IDTechEx forecasts that the global PFAS treatment market for municipal drinking water will reach US$2.3B by 2035, driven by stringent regulations like the EPA's 4 ppt limit. Regulations mandate cleanup and incentivize innovation on a PFAS cleanup problem that may cost US$2T in Europe alone.

Conclusion: A synergistic path forward

PFAS contamination issues cannot be solved by regulation or treatment alone. Prevention through bans and alternatives reduces future contamination, while treatment technologies address legacy pollution. This two-pronged approach is already reshaping industries:

- High-tech companies invest in R&D to replace PFAS without compromising performance.

- Water utilities and environmental firms are piloting advanced destruction systems to meet regulatory standards.

Yet, gaps remain. Ultra-short-chain PFAS lack regulatory oversight, and alternatives for critical applications like fuel cells are nascent. Collaboration between policymakers, industries, and researchers will be essential to balance environmental health with technological progress.

As IDTechEx underscores in its reports "Per- and Polyfluoroalkyl Substances (PFAS) 2025: Emerging Applications, Alternatives, Regulations" and "PFAS Treatment 2025-2035: Technologies, Regulations, Players, Applications", the roadmap to a cleaner future is complex but achievable—provided both prongs of the strategy advance in lockstep.

For more information on these reports, including downloadable sample pages, please visit www.IDTechEx.com/PFAS and www.IDTechEx.com/PFASTreat.

For the full portfolio of market research into PFAS regulations, alternatives, and treatment technologies, please visit here www.IDTechEx.com/Research/AM.

About IDTechEx

IDTechEx provides trusted independent research on emerging technologies and their markets. Since 1999, we have been helping our clients to understand new technologies, their supply chains, market requirements, opportunities and forecasts. For more information, visit www.IDTechEx.com.

Source: IDTechEx