New Report Ranks Largest Global Food Companies On Water Risk Management As Climate Change Impacts Accelerate

Climate change is making water one of the biggest risks to the $5T food industry, whether from epic flooding or prolonged drought. A new report released recently by the sustainability nonprofit organization, Ceres, calls on major food companies to reduce the impacts of a warming climate—on both the global water supply and on their bottom lines—by adopting far stronger practices to use limited fresh water resources more efficiently.

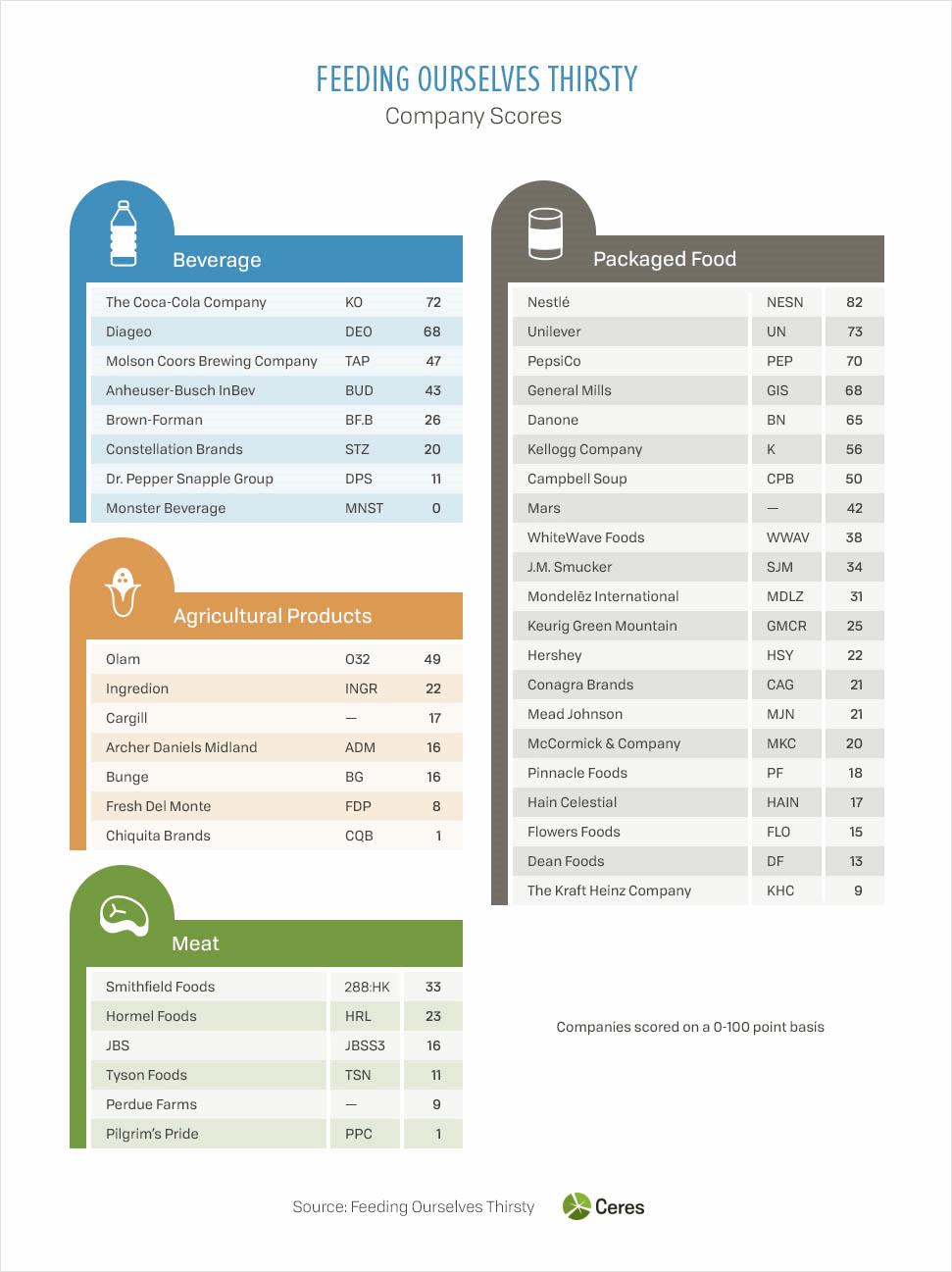

Feeding Ourselves Thirsty: Tracking Food Company Progress Toward a Water-Smart Future,ranks the 42 largest global food and beverage companies—mostly U.S. based—on how effectively they are responding to corporate water risks like water dependence, water security and operational water use efficiency (e.g., how they manage precious freshwater supplies), compared to 2015, when the first edition of Feeding Ourselves Thirsty was released.

“Smart water management is a business imperative for food companies, as the impacts of climate change and water scarcity and pollution accelerate around the world,” said Brooke Barton, senior director of water and food at Ceres, who co-authored the report. “Some corporate leaders are making strong progress, but the majority must do more to water-proof their businesses to protect and sustain our water supplies.”

Companies were divided into four industry categories: packaged food, beverage, agricultural products and meat, and analyzed against actions in four categories of water risk management. The top scoring companies, out of a possible score of 100, by industry were: Nestlé (Packaged Food) (NESN) 82 up from 64 in 2015, Coca-Cola (Beverage) (KO) 72 up from 67 in 2015, Smithfield Foods (Meat) (SFD), 33 no change from 2015 and Olam(Agricultural Products) (SGX: O32) 49; Olam was not part of the 2015 analysis. (See all company scores)

Top scorers in Beverage and Meat were unchanged from 2015; however, the top scorers in Packaged Foods and Agricultural Products in 2015 were, respectively, Unilever (UN) with 70 and Bunge (BG) with 29.

The report found a 10 percent improvement in the average score of the food sector’s management of water risk since 2015. The packaged food and meat industries made the biggest gains in improvement at 16 and 20 percent, respectively. However, the average score for the 42 companies benchmarked was still only 31 points and despite big gains, the meat and agricultural products industries continue to lag far behind the packaged food and beverage industries.

“As a long-term investor, CalSTRS engages companies on ESG issues, including the need to analyze risks to their value from exposure to a depleting water supply and either a lack of or an ineffective water use management plan and policy,” said Anne Sheehan, director of corporate governance at CalSTRS. “This updated analysis can be used by large institutional investors to reassess their environmental risk engagements, especially with the low-scoring companies held in their portfolios. It also provides investors a clearer perspective on how well—or not—food companies are responding to water risk in order to sustain a competitive advantage in their market sector.”

The analysis notes that the food sector is highly vulnerable to climate change impacts; yet, surprisingly, more than one-third of the publicly held companies analyzed made no mention of climate-related water risks in their most recent 10-K filings, even though increasing variability in precipitation patterns due to climbing temperatures pose enormous risks to the food sector, such as agricultural supply chain disruptions and lost growth opportunities in water-stressed markets.

"Over 70 percent of the world’s irrigated land faces water shortage either chronically, seasonally, or during dry periods, and that means our food supplies are at risk. Food companies need to step up sustainable management of water resources, including by working collaboratively with their agricultural suppliers,” Kate A Brauman, lead scientist at the University of Minnesota Global Water Initiative.

The analysis found that, overall, companies need to improve most on governance and board oversight, wastewater management, integrating water risk into procurement processes and collaboration to protect watersheds.

In contrast, areas showing most improvement since 2015 include integration of water risks into business strategy, setting water targets, water accounting, risk assessment and sustainable sourcing programs. Companies making strongest progress in these areas include General Mills (GIS) and Unilever (UN) (risk assessment), Kellogg’s (K) (sustainable sourcing).

“More than 85 percent of our water footprint is from growing and transporting crops, and turning those crops in to food ingredients,” said Jerry Lynch, vice president and chief sustainability officer at General Mills. “This underscores the role we must play to address water stewardship issues in our agricultural supply chain. We continue to identify opportunities to increase efficiency and conservation upstream of our operations, which is where we can have the most impact.”

Using publicly available data from sources like 10-K filings, sustainability reports and the CDP Global Water Report, Feeding Ourselves Thirsty scored companies based how they manage water through governance and strategy and in their direct operations, manufacturing and agricultural supply chains.

To access the analysis, visit https://feedingourselvesthirsty.ceres.org/

About Ceres

Ceres is a sustainability nonprofit organization working with the most influential investors and companies to build leadership and drive solutions throughout the economy. For more information, visit www.ceres.org.

Source: Ceres