8 Things You Need To Know About Innovations In Water Asset Management

By Will Maize

With resources constrained and needs abundant, water and wastewater utilities are obliged to understand and evolve with trends in asset management.

A typical water utility operates thousands of kilometers of buried water mains and wastewater pipes, hundreds of hydrants and valves, and multimillion-dollar treatment facilities, all to ensure sustainable and safe provision of water and wastewater services. The workflows associated with these assets — be it planning, design, construction, operation, or maintenance — can be defined more broadly as “asset management.”

Concerned with operating and replacing aging infrastructure, changing workforce dynamics, and increasing climate volatility, asset management practices and solutions have been evolving for years. From strategic asset management platforms (e.g., asset investment planning) to tactical asset management tools (e.g., maintenance systems and mobile workforce management) to core asset management (e.g., asset condition assessment, geospatial), commercial solutions providers have developed tools that have greatly helped municipal water utilities tackle a wide variety of pain points.

However, the proliferation of nascent, data-driven technology is leading municipal water utilities toward the adoption of advanced asset management strategies with the goals of maximizing asset service life, prioritizing capital investment for the most critical infrastructure, and shifting toward predictive, risk-based maintenance strategies.

Here are eight things you need to know about innovations surrounding the management of municipal water, wastewater, and stormwater assets, from around the world.

Figure 1. Timeline of asset management standards related to water and wastewater utilities

- What factors are shaping advances in asset management?

Innovations in asset management practices are largely indicative of much larger trends within the global municipal water sector as a whole, influenced by local conditions such as utility governance structure, market structure and regulation, water availability, and other environmental factors. For example, under the presence of Ofwat, the U.K. leads global markets in terms of asset management program maturity, incubating a thriving market for advanced commercial solutions.

- How have global standards evolved for asset management?

In 2014, the International Standards Organization (ISO) published a new framework to govern the management of assets in asset-centric industries, emphasizing whole lifecycle asset management planning and broadening the scope of asset management outside physical assets. The new standard largely displaced the British PAS55 standard for asset management, popular around the world. In the U.S. water sector, many utilities that have leaned on EPA best practices are now eyeing the ISO standard.

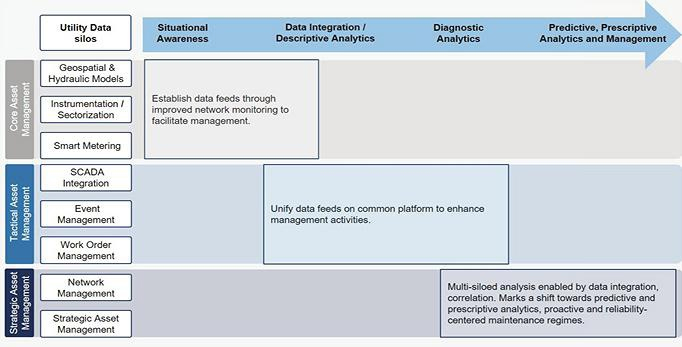

Figure 2. Utility journey toward advanced asset management

- What barriers must be overcome before large-scale adoption?

Municipal water utilities include dozens of departments managing disconnected data silos to make complex operational and strategic decisions. Additionally, fragmented procurement of data and analytics solutions has led to data-rich, information-poor, and software-solution-fatigued utility end users. Many water utilities remain unwilling to increase the importance of their data into critical decision-making processes. Asset management software tools enable utilities to connect these silos and optimize decision-making.

- What should a utility focus on first?

The utility journey most often starts with establishing a core asset management layer, marking the representation of linear assets within geospatial models and a first step toward situational awareness. Tactical solutions are often the next step, generating asset-centric operations and maintenance data that can be used to better understand performance in real time, informing reliability-centered maintenance practices. Advanced analytical insights can only be achieved once a utility has effectively integrated disparate datasets together, clearing the hurdle of utility mistrust of previously collected network data.

- Which regions are leading the world in terms of asset management?

Anglophone markets drive deployment of advanced asset management solutions, as strategies of early-adopting utilities set the example for global peers. Led by the U.K., progressive utilities in Australia, Canada, mainland Europe, and the U.S. are developing unique strategies to value, model, and manage assets. Utilities within these countries (representing 31 countries) currently manage $2.9 trillion (USD) in water, wastewater, and stormwater assets, which provide critical infrastructure services to more than 822 million people.

- What is the scale of this opportunity for municipal water utilities?

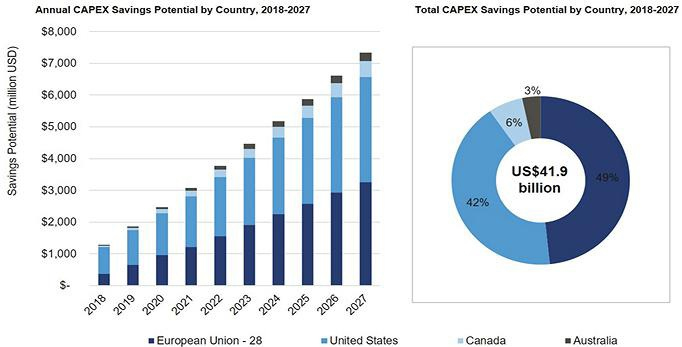

Turning to market-ready, advanced asset management solutions, which have shown capital expenditure (CAPEX) savings and avoidance of up to 20 percent in case studies, utilities in these 31 countries could potentially realize an estimated $41.9 billion (USD) in CAPEX savings from 2018 to 2027. This is made up of $1.2 billion annual CAPEX savings in 2018, scaling to $7.3 billion of annual savings in 2027.

Figure 3. CAPEX savings potential for EU, U.S., Canadian, and Australian utilities

- Which companies are positioning smart water strategies around asset management?

A diverse group of players are looking to capitalize on this opportunity, with companies across the municipal water value chain migrating toward strategic asset management decision-making from a wide variety of strategic positions. From equipment providers such as Xylem, modeling firms such as Bentley, and engineering consultancies such as Black & Veatch, strategic asset management solutions have made their way into core product and service offerings.

- Which technology segments are pertinent, and how can this shape business models?

Data-driven, smart water technologies are rapidly incorporating technology innovations — cloud computing and storage, neural networks, and machine-learning algorithms — to drive a new paradigm of municipal water, disrupting age-old asset planning processes. These solutions can enable utilities to more effectively determine asset failure risks and model long-term asset deterioration and to be more efficient in allocating long-term capital deployment. As the utility and municipal government sector is becoming more comfortable with software as a service (SaaS) and cloud-based service offerings, an increasing number of innovative, asset-centric business models are developing. This should open the market for small to midsize utilities that have previously been too resource-constrained — both budget- and personnel-wise — to adopt new technology.

This article draws from Bluefield’s latest report, Advanced Asset Management in Municipal Water: Global Trends & Strategies, 2018- 2027, which deconstructs the complex processes that municipal water utilities undertake to manage their assets. Bluefield analyzes key market drivers and inhibitors as well as successful strategies of early-adopting utilities and profiles over 40 innovative solutions providers.

About The Author

Will Maize is a research director for Bluefield Research, specialized in global municipal infrastructure and smart water technologies. He can be reached at wmaize@bl

Will Maize is a research director for Bluefield Research, specialized in global municipal infrastructure and smart water technologies. He can be reached at wmaize@bl