Demand For Mobile Water Treatment Systems Is Expected To Grow

By Shilpa Tiku

The North American mobile water treatment market was valued at $725 million in 2022. The market is expected to witness a single-digit growth rate during the forecast period, driven by the provisional need for a treatment system in case of plant downtime, facility maintenance, emergencies, or to meet regulatory requirements for effluent discharge. The key challenges in this market include intense competition, the COVID-19 pandemic, and economic volatility.

Mobile water treatment units are pre-engineered, containerized water treatment units that are deployed at locations as temporary solutions or to meet long-term water treatment requirements. They are quick to set up and easy to relocate. These units usually find their applications during equipment breakdown, plant commissioning, plant failures, maintenance outages, additional capacity requirements, pilot testing, environmental cleanup & remediation, and emergencies. Mobile water treatment systems are deployed via stand-alone units or modular units in combination to form complete systems.

Intense competition – The mobile water treatment market has several companies competing to gain market share. The market leader in 2022 was Evoqua Water Technologies. Evoqua’s success can be attributed to its diverse product offering, innovation, and quick response time to meet customer expectations. Some of Evoqua’s largest customers are power plants, refineries, and chemical plants.

While larger companies dominate the market, several smaller companies are competing to sustain market share. Larger companies have a strong financial advantage over smaller competitors in major business areas such as research and development and marketing. They compete by offering complete turnkey solutions through one offering. Small players struggle to thrive in a highly competitive market coupled with economic volatility, evolving regulations, threats from emerging contaminants, extreme weather events, and skilled labor shortages, among other challenges.

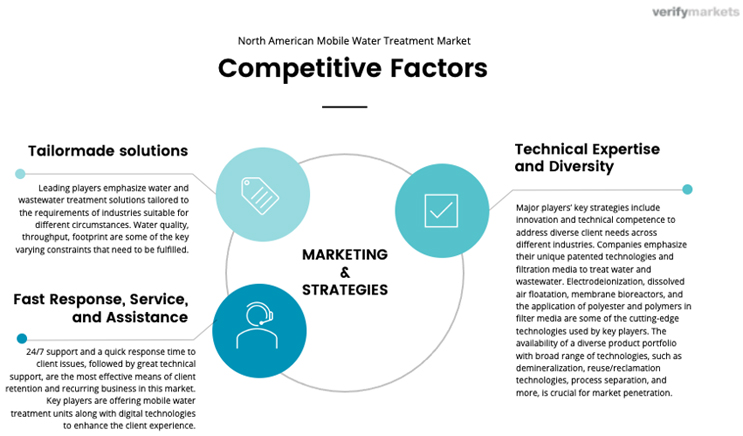

Competitive factors – Some of the competitive factors within this market include tailor-made/custom solutions, technical expertise and diversity, regional sites, and fast response time. Large companies typically have regional coverage to dispatch units quickly. Timing is the key competitive factor in this market. Companies must have the equipment ready when end users need them. Pricing is not as large of an issue in this market, and companies often charge a premium if the system needs to be at a site within 24 hours. This gives companies with regional site coverage a substantial competitive advantage.

The chart below highlights the key competitive factors within this market.

End user groups – Key end user groups for mobile water treatment units include power & cogeneration, oil & gas refineries, water utilities, food & beverage, pharma, chemical & petrochemical, and mining & mineral processing. Industrial end users make up and estimated 88% of the market by revenue and municipal end users make up an estimated 12% of the market share by revenues. The power industry makes up more than 45% of the market by revenue, mainly due to the vast amounts of water required to generate power for use in virtually every step of the process.

Technology trends – Resin technology is predominantly used in North America. In industrial plants, resin is commonly used due to its ability to reduce a range of contaminants like arsenic, nitrates, uranium, perchlorate, and more. An estimated 55% of the technology used was resin, an estimated 38% was membranes, and the remaining 7% of the market by revenue in 2022 included other technologies.

There has been a rising consolidation in the mobile water treatment industry through mergers, partnerships, and acquisitions. One of the most recent acquisitions was Veolia and Suez. Veolia North America (VNA), a wholly owned subsidiary of Veolia Group, announced the integration of its businesses with Suez’s assets in the U.S. and Canada in 2022.

Shilpa Tiku is the chief research officer and partner at Verify Markets. Tiku has experience in research and consulting for more than 17 years. She focuses on monitoring and analyzing emerging trends, technologies, and market dynamics in several global markets, including water, wastewater treatment, waste management, air treatment and consumer products. Ms. Tiku can be reached at shilpa.tiku@verifymarkets.com

Shilpa Tiku is the chief research officer and partner at Verify Markets. Tiku has experience in research and consulting for more than 17 years. She focuses on monitoring and analyzing emerging trends, technologies, and market dynamics in several global markets, including water, wastewater treatment, waste management, air treatment and consumer products. Ms. Tiku can be reached at shilpa.tiku@verifymarkets.com

Verify Markets is a global B2B market research and consulting firm specializing in industrial, environmental, energy, consumer products, and water markets. Our research & consulting practice provides global industry analysis, customized research engagements, end-user research and analysis, strategy consulting, market intelligence and forecasts that are designed to aid company strategic planning and diligence efforts. Our project teams are comprised of industry market experts, creative thinkers, business analysts, and independent consultants located around the world. We work with our clients to bring solutions to every project and deliver reliable data and trends based on primary research. Contact us to see how we can help deliver valuable data and insights to your organization at info@verifymarkets.com or +1.210.595.9687.