Are Wastewater Treatment Prices On The Rise Following The Election?

By Deonta Smith, Procurement Analyst, IBISWorld Inc.

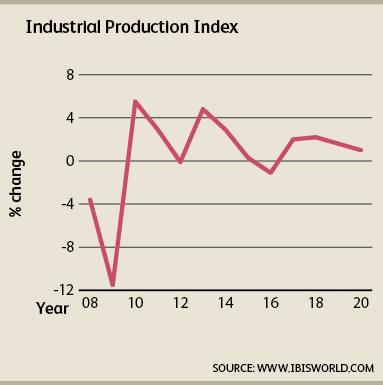

Over the course of the 2016 presidential election, President-elect Donald Trump has presented to the American public his energy and economic plans, which are geared toward establishing energy sovereignty and increasing the pace of job creation in the nation. In his push for energy independence, Trump has suggested lifting restrictions placed on shale, oil, natural gas, and coal production. To spur faster economic growth domestically, he has suggested imposing crippling tariffs on offshore companies, incentivizing onshoring. These measures are expected to prompt energy producers and manufacturers to open more facilities and subsequently increase total output, which would boost industrial activity and the amount of wastewater being created. While these new policies are expected to boost demand for wastewater treatment and disposal services, IBISWorld forecasts that businesses in need of wastewater-related services, namely industrial production and manufacturing firms, will be negatively impacted by the higher wastewater treatment prices that are to come.

The Unexpected Cost of Energy Independence

In recent years, the Obama Administration made a strong push to curb U.S. greenhouse gas pollution by placing restrictions on domestic fossil fuel production; this policy, in turn, has placed upward pressure on energy prices. In the coming years, a central part of the president-elect’s energy plan is to ease federal restrictions on onshore drilling and fossil fuel production, which would prompt energy producers to open more facilities and increase total output as a result, create more industrial jobs, and reduce energy costs for downstream buyers. Operators in the wastewater treatment and disposal services market stand to benefit from this plan, as it would prompt a boost in demand.

The EPA works with federal, state, and tribal governments to ensure that homes, municipalities, and businesses comply with wastewater discharge regulations. The entity establishes the specific treatment and disposal requirements that are carried out by certified wastewater treatment and disposal service firms. Because crude oil and natural gas mining companies are among the top producers of wastewater, any increase in fossil fuel output will lead to a higher volume of wastewater created, thus necessitating wastewater services. In meeting demand growth, suppliers will use greater amounts of treatment chemicals, which will increase their operating costs. As a result of strengthened demand and higher costs, wastewater treatment firms will have greater leverage to raise prices at an annualized rate of 2 percent in the three years to 2019, according to IBISWorld estimates. The higher cost to treat and dispose of wastewater will thereby pressure energy producers’ bottom lines.

A Boost in Manufacturing Activity

Onshoring practices are also expected to contribute to the rise in wastewater treatment and disposal prices. Outlined in his “First 100 Days” agenda, President-elect Trump has pledged to bring manufacturing jobs back onshore by establishing tariffs to discourage companies from producing goods abroad. This plan seeks to fuel growth in domestic manufacturing activity in the three years to 2019. While manufacturers, which are among the largest producers of wastewater, can successfully avoid these tariffs by producing goods domestically, they will see an uptick in wastewater treatment and disposal compliance costs due to demand growth. Common byproducts of the manufacturing process include alkali and other corrosive materials, thus establishing the need for wastewater treatment to comply with the Clean Water Act. Therefore, as manufacturing activity ramps up over the next three years, the amount of wastewater produced will rise. Consequently, demand for wastewater treatment and disposal will expand, allowing service firms to raise prices.

Hedging Against Rising Prices

While new policies and the resultant price increases will be harmful for industrial firms, an opportunity exists in the form of rising competition among wastewater treatment and disposal providers. Despite there being only 300 firms in the wastewater treatment and disposal services market, the market is highly fragmented, with the top four providers generating less than 30 percent of market revenue, according to IBISWorld. Concentration is low, primarily because the average supplier is limited to operating in the region directly surrounding their facilities. Furthermore, competition is higher in areas where multiple suppliers operate. As such, buyers should consider locating their facilities strategically in areas with a high number of wastewater treatment firms. This can also help pressure wastewater treatment and disposal service providers to offer competitive pricing to avoid being undercut by their competitors.