A Smarter Future For Water Distribution And Non-Revenue Water Management

By Joel Hagan

The landscape is changing for water consumers and suppliers and the delivery systems that connect them, with data and analytics forging the path ahead.

Managing valuable water resources and ensuring that supplies are distributed reliably has never been more difficult. The world’s population is growing rapidly, with the United Nations expecting 2.1 billion more people on the planet by 2050.

Even by 2030, demand for water is expected to be 40 percent higher than the levels we can currently access reliably today. This water will, for the most part, be delivered through networks installed over 100 years earlier.

Our growing population is concentrating in urban areas. Globally, the number of people living in towns and cities is growing at 1.5 million a week. The number of cities in the U.S. with populations exceeding a million people is expected to grow from 41 in 2010 to 53 by 2030.

Meanwhile, extreme weather events threaten supply with greater frequency. The U.S. has experienced 30 major weather disasters in the past two years alone, according to the National Centers for Environmental Information. Floods, droughts, severe snowstorms, and other weather events that have the potential to seriously affect supply now happen at a rate that is more than double the long-term average.

Deluge Of Big Data And Analytics

Innovation in water distribution and non-revenue water (NRW) reduction forms a large part of the solution to these challenges. Much of the innovation we see is in the use of data and analytics to smooth supply, minimize the strain on creaking infrastructure, and reduce losses from leakage and bursts.

South West Water in the UK, for instance, recently began installing smart data loggers on its network to record, communicate, and analyze data relating to water demand, flow, pressure, asset condition, and pressure transients.

The insight these loggers provide underpins South West Water’s pressure optimization and customer interruption reduction initiatives, helping it to ensure that supply keeps pace with demand and reduce the excess pressure that damages the network and contributes to leakage and bursts.

Similarly, Israeli water utility Mei Carmel has just deployed loggers and visualization software as part of efforts to cut nonrevenue water levels to less than 5 percent of supply. Data and analytics allow Mei Carmel to match supply pressure to demand and eliminate excess pressure.

Other innovations in water distribution gaining traction include acoustic loggers. Utilities are making significant investments in this area to identify and locate leaks in their networks. This isn’t new technology, but it is more practical to use now as unit prices decrease, and it becomes easier to efficiently communicate larger amounts of data from the network.

The stream of data from these sources will become a raging torrent with smart meters. Once installed, these devices will allow real-time monitoring and management of water consumption at every end point of the network and improve responses to events.

Smart meters take water utilities further into the realms of Big Data and add to their ability to use sophisticated analytics to produce actionable insight. Analytics can already show the location of a leak and identify (with a startling degree of accuracy) the underlying causes of faults with network assets.

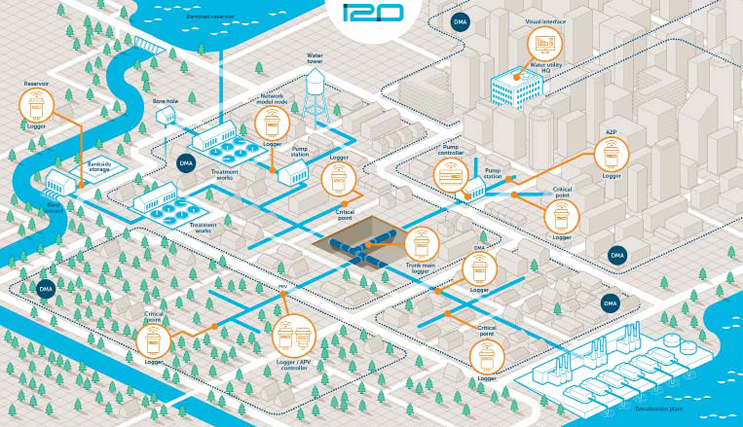

Anatomy of a smart water network

Business Model Innovation

One of the challenges associated with improving water distribution and reducing NRW levels further lies in justifying the investment. Water companies have a fiduciary duty to their shareholders, so if it costs less to access new sources of supply than it does to reduce leakage, there is little incentive to go above and beyond the regulators’ targets.

As a result, technology providers are adapting their models to the fiscal preferences of publicly traded companies. New licensing models and the availability of data handling and analytics packages on a Software as a service (SaaS) model change these technologies from capital expenditures, into operating expenditures, making such investments much more appealing, as it is now possible to achieve a return on investment in under a year.

Another big change we expect to see in the next five to 10 years is a reduction in spending on bespoke consultancy projects, as water utilities turn to off-the-shelf solutions developed by technology providers working in partnership with the industry.

i2O is just one water industry technology provider moving in this direction, as it has developed lower-cost hardware and has made its data logging, analysis, and advanced pressure management software available as a SaaS offering. Utilities can now access them without having to expand their IT footprints, build additional data center capacity, or embark on a costly in-house software installation.

Innovation In The Innovation Process Itself

The third area of innovation we see happening, which applies, but is not exclusive, to water distribution and NRW reduction, is innovation in the innovation process itself.

Water utilities are becoming more open to working in partnership with trusted technology partners on new products and services that can help them address these challenges, improve supply to customers, cut leakage, and reduce bursts.

Increasingly, we see water companies from different parts of the world come together to share knowledge and cocreate new solutions in partnership with technology providers. This approach reduces the cost and risk for all parties and helps to ensure that what is produced will benefit everyone.

Looking To The Future

Innovation in water conservation and leakage management tends to be iterative, with improvements made in many small but decisive steps.

While the introduction of i2O’s advanced pressure management solutions was among the latest big breakthroughs in this field, it is data and analytics — the bedrock of smart water networks — that should provide the biggest opportunity for further improvement over the next decade, supported by new business models and ways of working.

What the next big breakthrough in innovation looks like remains to be seen. There is huge potential for artificial intelligence, which is a natural progression for a lot of the work that is already happening in data and analytics, and there are a number of organizations doing fascinating things with robots that can find, measure, and fix leaks in water supply networks.

These are areas of innovation that smart water utilities are watching with great interest.

About The Author

Joel Hagan joined i2O as CEO in 2015, bringing more than 20 years of business leadership and technology expertise to his role. Founder and former chief executive of ONZO, a venture-backed startup providing energy data analytics, he has a deep understanding of the utilities sector and significant experience in building early-stage companies and developing data analytics and control technologies.

Joel Hagan joined i2O as CEO in 2015, bringing more than 20 years of business leadership and technology expertise to his role. Founder and former chief executive of ONZO, a venture-backed startup providing energy data analytics, he has a deep understanding of the utilities sector and significant experience in building early-stage companies and developing data analytics and control technologies.