A Shift In Strategy: Improving Global Water Management

By Deonta Smith

What effect will the push to improve inadequate water infrastructure have on the cost for supplies and services? A procurement research analyst predicts the near future.

The White House considers the existing global water challenge one of the greatest threats to national security. In fact, the U.S. Department of State asserts that the growing global water crisis could increase disease, undermine domestic economic growth, and foster insecurity and state failure abroad. In response to these concerns, a number of federal government agencies have collaborated on creating more sustainable supplies of high-quality water, both in the U.S. and abroad. To this end, Congress has boosted its allocation of the federal budget for investment in sustainable global water supply infrastructure.

As federal government spending on water quality initiatives increases, so will demand and, subsequently, prices of related supplies and services. ProcurementIQ expects this trend to have a major impact on water infrastructure operating costs for downstream buyers, including state, local, and private government agencies.

Rising Costs Lead To New Initiatives

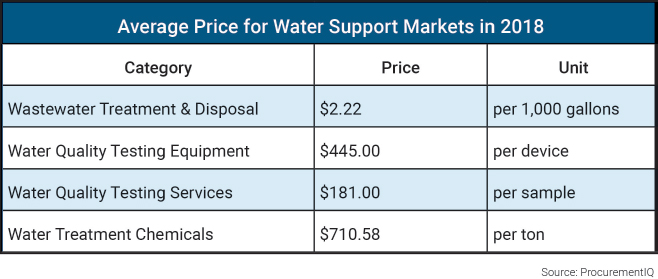

According to the U.S. Agency for International Development (USAID), the global water and wastewater market exceeds $700 billion annually. While investments in water conservation and sustainability have spurred significant advancements in water sanitation technologies and service initiatives, implementation costs have risen with demand, a consequence that has largely benefited water management support companies. Rising costs are attributed to strengthening demand for water management support products and services ranging from water treatment products and services to water quality testing equipment and services; this trend has given water management support companies the upper hand in key price negotiations.

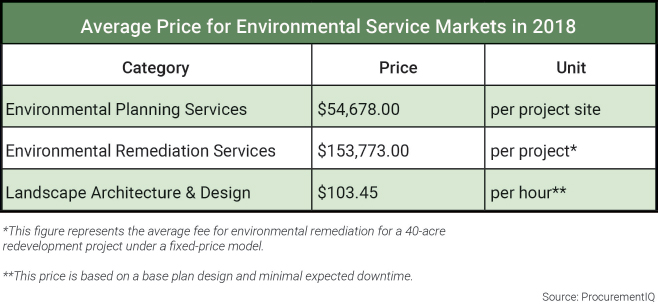

In an effort to stretch their dollars further, federal government agencies have been pushed to adjust their approach to achieving greater quantities of high-quality water. One such approach made by federal government agencies (e.g., the U.S. EPA and U.S. Department of Agriculture) domestically has been curbing expenditure on infrastructure-related projects (i.e., passing more of these costs on to states) and increasing funding in greenspace restoration and protection efforts. For example, a Joint Chiefs’ project was established to improve water quality through restoring forests and grasslands. This initiative’s goal is to protect water sources as they travel through greenspace to reach municipal water systems, which would enhance water quality. While investments will still be made to expand the number of aqueducts, reservoirs, and treatment plants, the Joint Chiefs’ project will be centered around working with agricultural producers and forest landowners to make grassland and forestation improvements to restore water flows and improve local ecosystems. In fact, this year the Joint Chiefs’ partner USDA agencies are providing $2.9 million to fund seven new projects and $29 million to support 21 ongoing partnership projects. In effect, a greater portion of the federal government’s budget that was originally used to fund water treatment projects will be reallocated to source environmental services (e.g., environmental remediation and planning services) — a more sustainable solution that will help them achieve the initiatives mentioned above.

Internationally, U.S. federal agencies are addressing water issues in countries deemed high priority under the Water for the World Act, including Afghanistan, Jordan, Haiti, and Kenya. Water problems in these countries stem from a lack of infrastructure. According to the U.S. Department of State, countries lacking access to high-quality water have been suffering from increased poverty and disease, food and energy insecurity, economic dislocations, and cross-border and regional tensions. These problems have the potential to undermine economic development, exacerbate migration pressures, increase civil unrest, aid terrorist recruitment, reduce trade and export opportunities, and prevent countries from advancing policies and programs important to the U.S.

To address these problems, investments made by USAID will focus on improving water management efforts abroad. Specifically, USAID’s mission will be to assist in the adoption of key hygiene behaviors, encourage the sound management and protection of freshwater resources, promote cooperation on shared waters, and strengthen water-sector governance, financing, and institutions. In addition to these investments, other U.S. government agencies in the Interagency Water Working Group will use prevailing water supply management tools and services, such as water treatment chemicals, wastewater treatment services, and water transportation from nearby sources to address quality and quantity issues.

Impact On Key Domestic Procurement Departments

An unintended consequence of the federal government’s global water strategy is its effect on state, local, and private water infrastructure operators. State, local, and private procurement departments can expect hikes in the cost of operating and maintaining their water supply infrastructures. As the federal government increases its expenditure on enhancing water safety abroad, ProcurementIQ expects demand for water treatment chemicals, water quality testing services, environmental planning, and water treatment services to surge, resulting in exponentially higher prices. Consequently, the price increases of these water infrastructure-related services mean costlier operations for businesses across multiple industries.

In the coming years, demand for water infrastructurerelated products and services is expected to further soar as global water management investments are expanded. As water management products and services become more expensive, state governments and private entities are anticipated to seek long-term supply and service agreements, which are effective in controlling operating costs.

About The Author

Deonta Smith is a lead procurement research analyst for ProcurementIQ, specializing in construction and infrastructure. He holds a bachelor’s degree in economics from Pepperdine University. The research featured in this article can be found at procurementiq.com.

Deonta Smith is a lead procurement research analyst for ProcurementIQ, specializing in construction and infrastructure. He holds a bachelor’s degree in economics from Pepperdine University. The research featured in this article can be found at procurementiq.com.