A Decade Of Progress And Shifting Concerns In The U.S. Water Industry

By the Black & Veatch Insights Group

Although the water industry has a reputation for being slow to change, the past 10 years provide evidence to the contrary.

When Black & Veatch released its first water report in 2012, fading infrastructure, an aging workforce, and financial obstacles were top-of-mind concerns for the leaders in the nation’s water industry. Ten years later — though the drivers of these forces largely have changed — the sector still grapples with them. The biggest difference? They’re now complicated — and in some ways eased — by the increasing influences of digitalization and resilience.

As the tangled threats of an aging workforce, budget constraints, extreme weather events, and deteriorating assets push against the newer influences of the increasing reliance on and protection of digital systems and a front-and-center focus on sustainability and resilience, burgeoning opportunities flood the water industry.

Amid this changing landscape, water utilities find themselves perfectly poised to take on major transitions in how and even why they operate. As they mitigate both long-standing and newly developed challenges, U.S. water utilities are opening up to new tools, practices, and motivations. Overall, the sector finds itself using data and technology to do more with less as it navigates changing workforce and environmental, social, and governmental (ESG) considerations and funding opportunities.

Converging Concerns And Financial Inputs

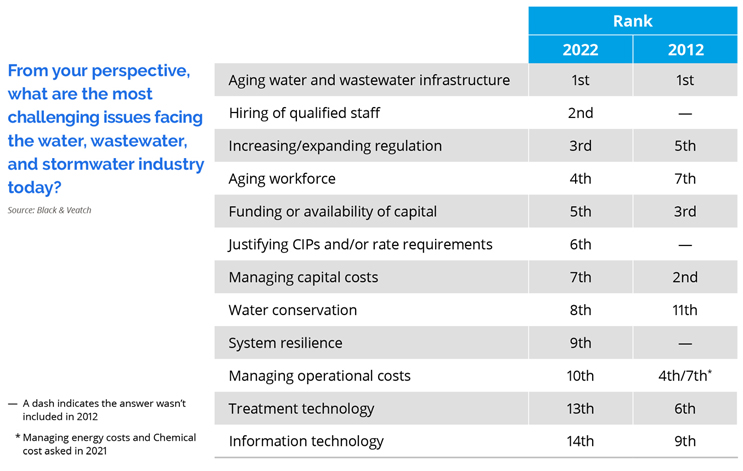

Comparing results of Black & Veatch’s survey of more than 300 U.S. water industry stakeholders for the 2022 water report to the company’s similar polling from 2012 demonstrates an industry at once evolving rapidly yet unable to outrun some enduring challenges.

As with each year the survey has been conducted, the 2022 outreach began with a call to identify the industry’s pressing issues. To little surprise, aging infrastructure topped the list, as it did in 2012. The second largest challenge in 2022 — hiring of qualified staff — wasn’t an option in the 2012 survey. This, along with issues around the industry’s aging workforce (also rising in the survey from seventh to fourth), underscores the significant strain to develop and retain human capital resources.

Despite its drop in concern over time, funding remains a major headwind for industry leaders. Though the federal government is coordinating support for the water industry, especially for contaminant removal and infrastructure upgrades, industry need will continue to outweigh current investment, at least in the near term. The Biden administration has offered a lifeline in the Infrastructure Investment and Jobs Act (IIJA) that earmarks $82.5 billion for critical water investments, with the largest portions allocated to improving safe drinking water and sanitation. These commitments will help revitalize aging infrastructure but will only get the ball rolling on the numbingly large number of necessary improvements.

Because of the availability of new funding, managing capital and operational costs dropped in concern over the past decade, yet they remain within the top 10 of the ranked issues affecting the industry. Another element of costs — justifying capital costs — comes in prominently in the sixth spot. This points to a difficult conclusion regarding the decade’s progress: Issues may not necessarily be changing, but they’re multiplying. Long-standing concerns remain at the forefront, while new and developing obstacles emerge to grab mindshare.

Though federal funding will aid the industry, continuing investment and concentrated effort will be required to revitalize the water sector and stimulate its long-term success. But finances are only a portion of the issue. As the water industry progresses, it also grapples with finding solutions that cannot simply be bought.

Staffing Instability

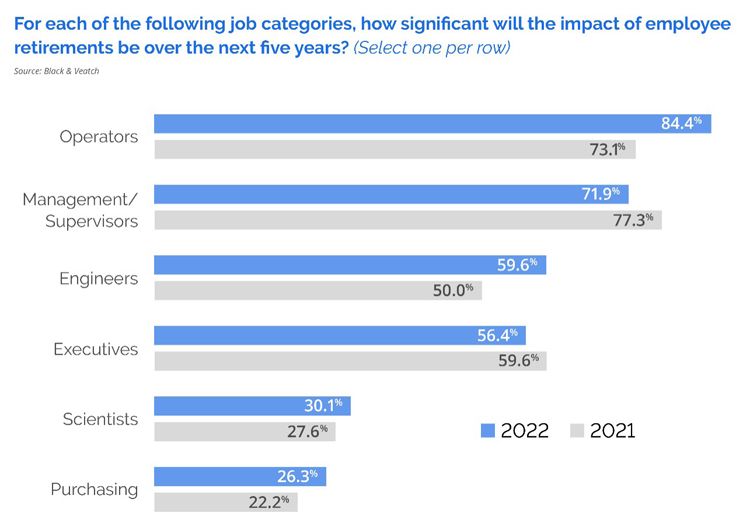

The modern water industry is definitely a worker’s market. As the “Great Resignation” era and an aging water industry workforce intertwine to place demand for workers at an all-time high, hiring qualified staff has become such a worry that it’s taken the second highest spot on the list in 2022. By comparison, it ranked 14th in Black & Veatch’s 2017 survey results.

As workers age out, retire, and pivot careers, the workforce to replace them is dwindling rapidly. While digitalization stands to remove some of the burden on those who remain, much of the stress falls upon field roles that cannot yet be automated. When survey respondents were asked which roles are impacted most by the changing workforce, operators and managers stood out as the top two.

The Water Industry In The Information Age

As the water industry’s top challenges heavily influence the plans, projects, and projections the industry is creating, the information age offers significant tools in the realms of digitalization and data collection, many of which were underutilized or undeveloped a decade ago.

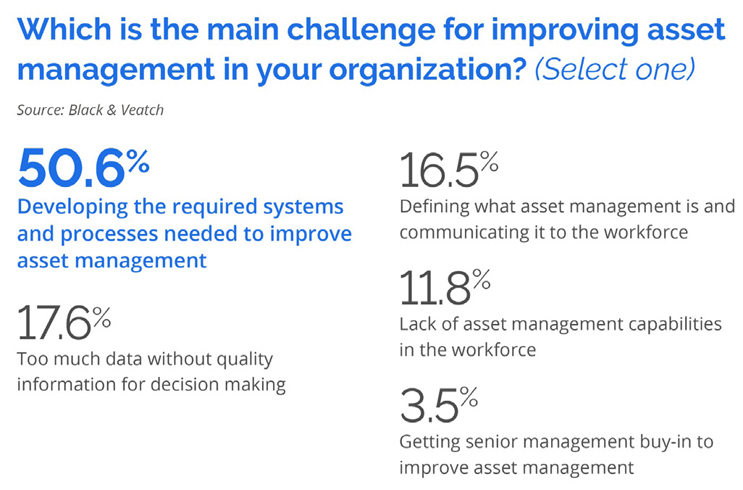

In 2022, data collection for any business is widely accepted and often prioritized, though barriers to effective interpretation and use remain, especially in utility industries. Nearly seven in 10 respondents to Black & Veatch’s latest survey reported they collect “lots” of data, although 41% admit they are not leveraging it effectively — many companies are data rich but information poor.

When asked what they found to be the main challenge for improving asset management, nearly one-fifth — 18% — of respondents selected “too much data without quality information for decision-making,” while “developing the required systems and processes” — which nowadays often includes data collection and management — was the highest concern.

Where data collection once was underappreciated, we now collect so much information that we overwhelm ourselves. With heaps of unorganized but plentiful data at our disposal, we falter in the task of making it useful. To ensure the data collected are deployed as an advantageous asset, utilities must create master plans for data analysis, extrapolate long-term trends, and glean actionable items from the revelations it offered.

The tools to do so are plentiful and are making it easier than ever for even the most tech-averse individuals to capitalize on data. With data dashboards and business intelligence, utilities can now organize and display meaningful statistics in an interactive format that can easily be manipulated for various metrics and results, giving simple, data-driven insights. Digital twins — virtual models of assets that can run simulations of various possible scenarios to determine outcomes and mitigation strategies — also offer interactive, meaningful interpretation of collected data.

New Tools For New Tasks

Though the past 10 years have seen the water industry challenged by new obstacles, the decade has also yielded new and exciting tools to combat them. Though respondents to Black & Veatch’s survey find workforce availability and resilience concerns to be higher priority than before, digitalization and data collection offer a myriad of methods to lessen the impacts.

Digitalizing systems opens a wealth of potential for data collection and analysis, which can be used to deepen understanding of almost anything, to predict or anticipate potential failings in assets, and to drive enhanced decision-making processes. For many utilities, the ability to track long-term trends with data has unlocked significant benefits for boosting efficiency, mitigating water loss, and strengthening system resilience. Data collection and digital systems can even mitigate workforce availability issues by automating processes and boosting efficiency, thereby decreasing overall workload.

Though the enduring and arising challenges the water industry faces can seem monumental at times, a long-term view of the past decade gives hope by illustrating an industry that is actively adopting new practices and technologies to evolve. Though time has brought new challenges, it has also brought many ways for utilities to rise to them, should they so choose.

About The Author

Black & Veatch is a 100% employee-owned global engineering, procurement, consulting, and construction company with a more than 100-year record of innovation in sustainable infrastructure.