What To Expect In Smart Water For 2024

By Allie Parks

North American utilities are getting wise to smart technology, with over $530 million in new projects calling out a data-driven focus kicking off in 2024.

Water and wastewater operators have a tall order to fill, tasked with ensuring some of the most critical community services run safely and effectively. For the past several years, North American water and wastewater systems have been plagued by aging infrastructure and challenges meeting staffing needs, exacerbating the already demanding job of maintaining essential services. These challenges, combined with a once-in-a-generation burst of funding from federal and state governments, have created conditions perfect for a rise in the adoption of smart water technologies.

What Is Smart Water?

The phrase “smart water” is used to describe a number of initiatives that utilize a data-driven approach to manage water and wastewater systems. These tools are typically designed to identify inefficiencies in water or energy use or to sound the alarm when water quality begins to deteriorate. In many cases, it is designed to take the manual work out of utility maintenance, alleviating pressures on staff. The strength of smart water comes from its ability to leverage real-time information directly to operators or consumers.

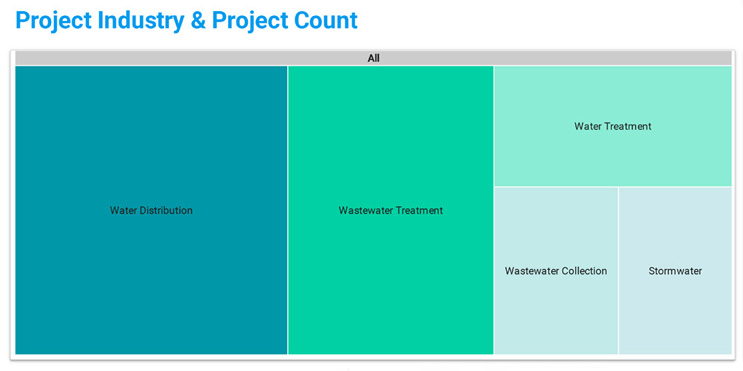

Figure 1: A breakdown of smart water projects by their larger industry. Water distribution is the largest segment, with smart meter and leak detection projects leading the pack.

Anticipated Spending

Just like the utilities themselves, our ability to understand utilities is evolving. We can now peek into the future of smart water initiatives by exploring the capital improvement plans of municipalities, districts, and authorities across North America in a structured format. These data are pulled from over 3,000 capital improvement plans, which house over 300,000 unique projects, representing trillions of dollars of investments. Sophisticated classification tools allow us to drill down on specific initiatives based on project titles, descriptions, start years, and overall budget to define funding plans for communities of all sizes.

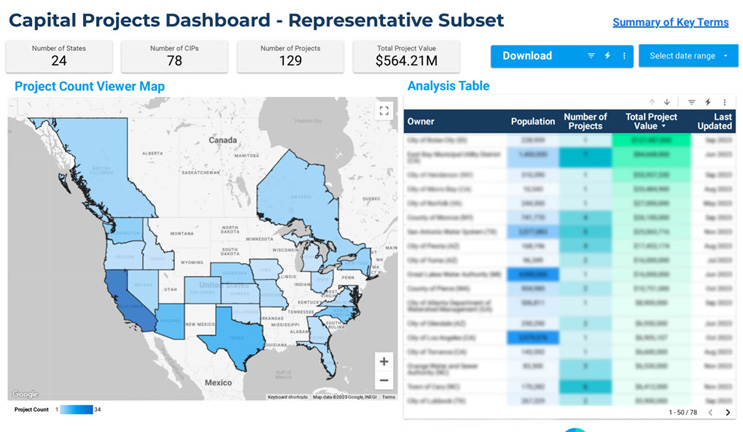

Figure 2: Geographic breakdown of data-driven projects. States with a significant number of projects mentioning “smart water,” “real-time,” or “data-driven” information are highlighted in blue, with darker shades representing more mentions.

Because smart water is broad and continually evolving, there are several ways to define these data, with the full North American market representing nearly $5 billion in spending. For the purposes of this analysis, we focus on infrastructure projects from capital improvement plans with a start date in 2024 mentioning “smart” infrastructure, “real-time,” or “data-driven” solutions. By this definition, we drill down to 119 specific capital projects representing $534 million in spending for this analysis.

Advanced metering infrastructure (AMI) projects tend to be the most expensive and time-consuming. A $55-million AMI project in Nevada is the single most expensive smart water project kicking off in 2024, along with two additional metering projects in the top five. While some communities are brand-new adopters of smart meters, this technology was first introduced decades ago and made accessible to utilities in the early 2000s. In fact, the first generation of smart meters is now reaching the end of their useful life and requires replacement, further increasing the number of smart metering projects kicking off in 2024.

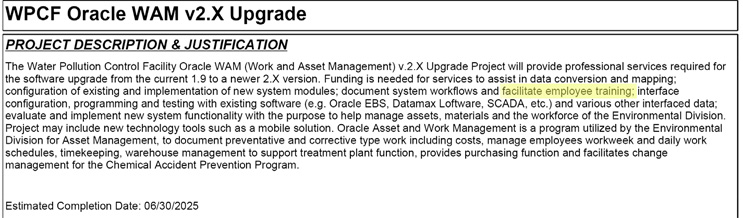

Figure 3: A snippet of text from a Nevada capital improvement plan (CIP) outlining software spending at their Water Pollution Control Facility, which will include an element of employee training.

Regional Variations

The top three states by volume of smart water projects send a clear message: drier regions (where water loss consequences are most severe) are more invested in smart water solutions. California, Texas, and Arizona together represent 46%, nearly half of all projects calling for data-driven and real-time information. California has the most projects calling for smart water solutions, representing over 28% of all projects. A combination of high populations and drought-prone regions, along with a large amount of funding availability, have made California communities early and enthusiastic adopters of innovative solutions.

Interestingly, Ontario and British Columbia are the only Canadian provinces with any significant number of smart water projects planned for 2024. The dominance of opportunities in U.S. communities is likely in part due to the larger pool of funding made available through programs like the Infrastructure Investment and Jobs Act (IIJA) and the American Rescue Plan Act (ARPA), many of which specifically encourage spending on innovative technologies.

What Else Can We Expect From The Smart Water Surge?

The rise in smart water will also lead to new requirements for operators, as maintenance and understanding of these systems are critical. While many smart water innovations are designed to make the roles of operators more streamlined, requirements for employees to understand and continually adapt to new technologies will likely become a growing part of their positions. Employee training will need to be baked into these upgrades, as you can see in the example from a Nevada utility in Figure 3.

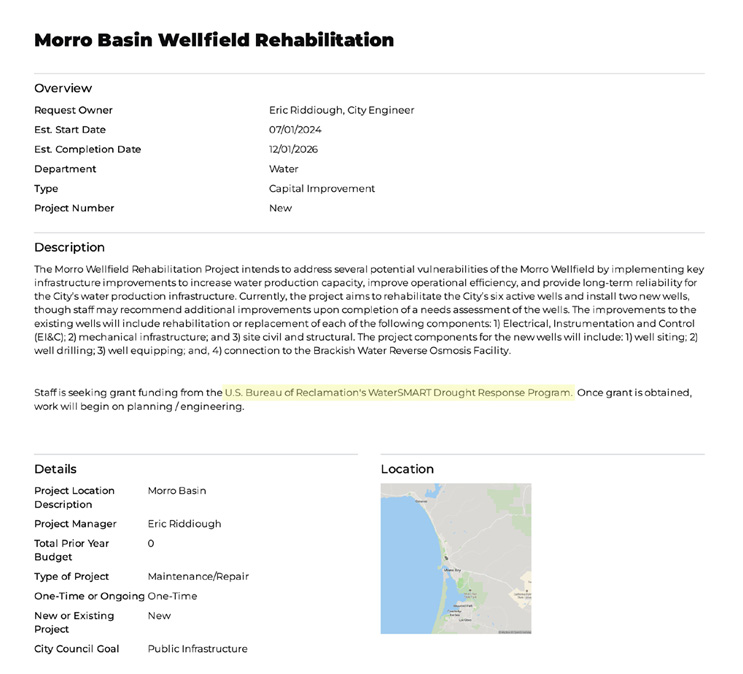

Communities are also rising to the challenge of spending available federal and state funds on smart solutions. In the example above, a California city is seeking WaterSMART funding for improved operational efficiency at a wellfield.

Figure 4: A snippet of text from a California CIP seeking funding through the WaterSMART Drought Response Program to bring a wellfield rehabilitation project to fruition.

The availability of funds will provide unprecedented access to some of the most innovative technologies on the market. As technologies get more advanced, available data become richer, creating a flywheel effect and further enriching utility operations. This technology renaissance makes the upcoming year an exceptional time to be in the water industry.

About The Author

Allie Parks is a senior solutions consultant at Citylitics, Inc., specializing in connecting infrastructure industry leaders to key municipal opportunities in North America. Citylitics delivers predictive intelligence on local utility and public infrastructure markets. The company’s data engine transforms over a billion documents buried in 31,000+ cities and utility data sources into high-value intelligence for targeted business development.