U.S. Water And Wastewater Treatment Infrastructure CAPEX To Surpass US$515B By 2035, Shaped By Aging Assets And Regulatory Pressures

U.S. municipal capital expenditure (CAPEX) for water and wastewater treatment infrastructure is projected to total US$515.4B through 2035, according to a new report by Bluefield Research. With a compound annual growth rate of 4.4%, growing from US$37.2B to US$57.3B annually, the next decade signals a critical turning point for modernizing water systems in response to intensifying regulatory, climate, and demographic pressures.

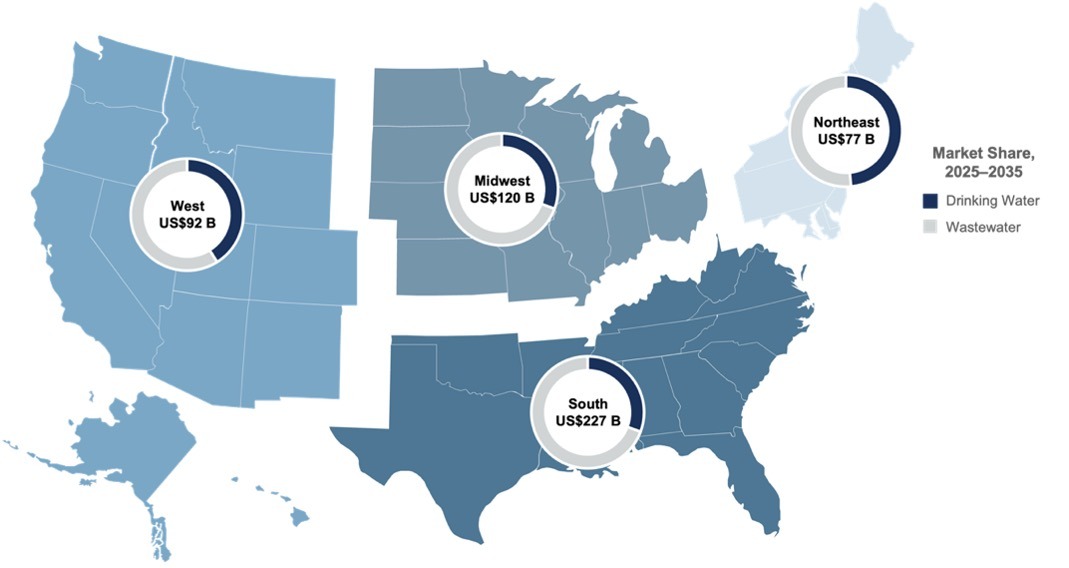

Across the two primary forecasted segments—drinking water and wastewater—the latter represents 58% of the total forecast, totaling US$310.4B. Investment in wastewater treatment infrastructure is attributable to expansion of centralized sewer systems, adoption of advanced treatment technologies, and efforts to mitigate sewer overflows. On the drinking water side, which is growing at a slightly faster clip than wastewater (4.72% / 4.18%), utilities must navigate anticipated PFAS compliance costs, storage mandates, and shifting population patterns—all of which are driving a major wave of system upgrades. Drinking water CAPEX is expected to total US$214.0B over the next ten years.

“Nearly 80% of forecasted spend—US$406.4B—is slated for upgrades and rehabilitation of existing treatment systems and assets, highlighting the condition of U.S. drinking water and wastewater infrastructure,” says Charlie Suse, Senior Analyst at Bluefield Research. “Given the mounting challenges, utilities need to identify ways to transition from reactive fixes to more advanced long-term asset strategies that improve resilience and contain costs.”

Geography remains a key driver of investment patterns. The southern U.S. is expected to account for 44% of total spend, led by Texas and Florida, where rapid suburban expansion is fueling demand for new wastewater treatment facilities and system buildouts. As the region grapples with increased water stress and heightened climate risks, urgency around long-term investment planning is growing. Meanwhile, the fastest growth is projected in smaller states like Connecticut, Washington, and Maine, where aging infrastructure, shifting demographics, and tightening regulations are converging to drive significant reinvestment.

Exhibit: Cumulative Water & Wastewater Facility CAPEX Outlook by Region, 2025–2035

Beyond geography, utility size also plays a critical role in shaping capital expenditure strategies. Mid-sized systems—those serving between 25,000 and 100,000 people—are in the strongest position to adopt modular and scalable treatment technologies. Larger utilities often have in-house treatment capabilities, while many smaller utilities lack the capital. “Mid-sized utilities are the sweet spot—representing a core investment opportunity for solution providers,” says Suse. Digital transformation, including remote monitoring, energy optimization, and automation, is also emerging as a critical investment theme as utilities seek to reduce long-term labor and reliability risks.

Delays in federal funding, policy uncertainty, and newly announced tariffs are creating headwinds across the industry, impacting technology vendors to utility procurement teams. As of April 2025, only 14.0% of the US$43.6B appropriated for State Revolving Fund programs through the Infrastructure Investment and Jobs Act had reached project deployment, with half of all project awards concentrated in just seven states.

“Water and wastewater services are fundamentally inelastic—people and businesses need them regardless of economic cycles,” says Suse. “This essential nature of water reinforces why deferring investment is not a viable option and why the outlook remains strong.”

About Bluefield Research

Bluefield Research supports strategic decision makers with actionable water market intelligence and data across the global industrial and municipal sectors. With expertise across water infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report is based on a decade of market intelligence, utility capital budgets, policy tracking, and cost data from all 50 states. The full report is available for purchase and immediate download from Bluefield’s website (or included with a U.S. & Canada Municipal Water Market Corporate Subscription).

Source: Bluefield Research