U.S. Water Reuse Pipeline To Drive US$47.1B In Infrastructure Spending Through 2035

Water reuse—the process of recycling treated wastewater for beneficial uses—represents a viable cornerstone of resilient water supply planning for utilities, municipalities, and industries, unlocking a potential surge in infrastructure investment across the U.S.

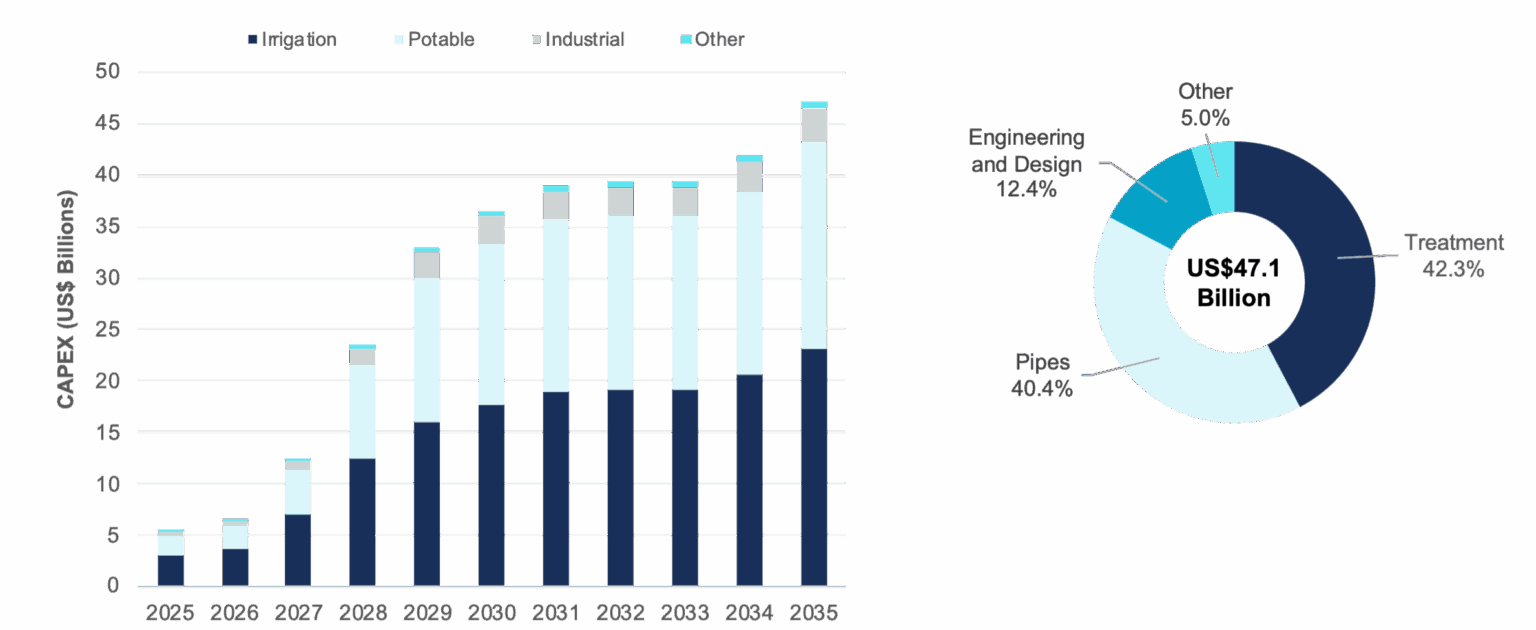

According to a new Insight Report, U.S. Municipal Water Reuse: Market Trends and Forecasts, 2025–2035, from Bluefield Research, a leading provider of global water market data and insights, capital expenditure (CAPEX) for municipal reuse infrastructure and treatment systems are forecasted to average US$47.1B from 2025 through 2035.

The largest share of spending will be directed toward advanced treatment technology and facilities, which account for 42.3% of the ten-year outlook. Conveyance pipe networks (i.e., purple pipes) and engineering and design account for 40.4% and 12.4% of spending, respectively. Underlying this positive outlook are more than 600 projects in the planning and execution phases of development, advancements in state-level policies, and changing urban, agricultural, and industrial water needs.

Exhibit: U.S. Cumulative Capacity Additions Project Spend by Offtake Application, 2025–2035

Potable Reuse Moves Toward Mainstream

While demonstrated at scale in other countries, the increasingly widespread deployment of potable reuse systems makes the U.S. market unique. By 2035, potable reuse projects are expected to account for 37.0% of all new reuse capacity additions, signaling a strategic shift toward higher-value, supply-resilient applications for some communities. Associated capital expenditures are forecasted to surpass US$19.9B .

Behind this shift are necessary changes in state-level policies, which are the primary enablers of reuse development. Over the past five years, direct potable reuse (DPR), which requires the highest levels of treatment and monitoring, has gained added momentum. Colorado, California, Florida, and Arizona have established regulations, and four additional states—New Mexico, Utah, Kansas, and Nevada—are actively exploring DPR pilot programs and new project guidelines.

Reuse investment for irrigation applications—ranging from crop watering and urban landscaping to municipal green spaces—is still projected to account for nearly half (49%) of capital expenditure over the next decade. “While irrigation applications make up the foundational application for water reuse, large potable reuse projects such as the Groundwater Replenishment System in Orange County, California, and the [Sustainable Water Initiative for Tomorrow] SWIFT project in Virginia’s Hampton Roads Sanitation District are showcasing a change in receptiveness among municipal decision makers,” says Megan Bondar, an analyst at Bluefield Research.

The Geography of Reuse Is Changing

Catalyzed by the 2012–2017 drought, including mandated water usage cuts, California’s project pipeline has expanded. The state is projected to surpass Florida in terms of reuse capacity buildout over the next 10 years, accounting for 41% of new reuse capacity additions. Colorado, Texas, and Florida are also poised for significant growth, collectively accounting for 45% of projected new capacity—linked to rising populations and overdrawing from aquifers.

Looking forward, Western U.S. states remain at the epicenter of municipal reuse buildout, with nearly 390 announced projects in various stages of planning. However, the Southeast is gaining ground, with almost one-third of projects already under construction.

“We’re now seeing a pronounced eastward momentum within the Midwest and several East Coast states—including Virginia, New York, and New Jersey,” explains Bondar. “Unlike projects in the Western U.S., which are primarily driven by drought resilience, these initiatives tend to focus more on improving water quality and slowing the advance of saltwater intrusion into critical aquifers.”

Industry Partnerships Incrementally Redefine Reuse Economics

Industrial demand is rapidly emerging as a key driver of municipal water reuse. As water stress intensifies—particularly in the Western states of New Mexico, Arizona, and Nevada, which rank highest for economic water stress across nine industrial sectors—utilities and private facility operators are forming partnerships to secure supply and sustain growth.

Data center developers have moved to the forefront of this shift, particularly since 97% of water used by major operators is sourced and treated by municipal utilities. In Virginia, Loudoun Water—serving one of the world’s most concentrated data center markets—delivers more than 800 million gallons of reclaimed water annually through a dedicated 20-mile purple pipe network.

“On paper, it makes strategic sense for industrial facilities to source treated water directly from wastewater utilities—treated water that would otherwise be discharged into rivers or other surface waters,” states Bondar. “That said, execution is often complex, with multi-stakeholder coordination creating hurdles to project completion.”

Looking ahead, water reuse is set to play a defining role in how the U.S. addresses its growing water challenges. The alignment of policy momentum, technological innovation, and industrial demand will be critical to this transformation. As utilities, communities, and private partners rethink how water is sourced, managed, and valued, reuse will move further from the margins to the mainstream.

About Bluefield Research

Bluefield Research supports strategic decision makers with actionable water market intelligence and data in the global industrial and municipal sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report, U.S. Municipal Water Reuse: Market Trends and Forecasts, 2025–2035, presents a data-driven perspective on how market trends, policy developments, and strategic pivots are reshaping the investment landscape for municipal reuse infrastructure, leveraging a dataset of more than 1,000 tracked reuse projects across 22 U.S. states. The full report is available for purchase and immediate download from Bluefield’s website.

Source: Bluefield Research