U.S. Water-Related Expenditures For Data Centers To Exceed US$4.1B Through 2030

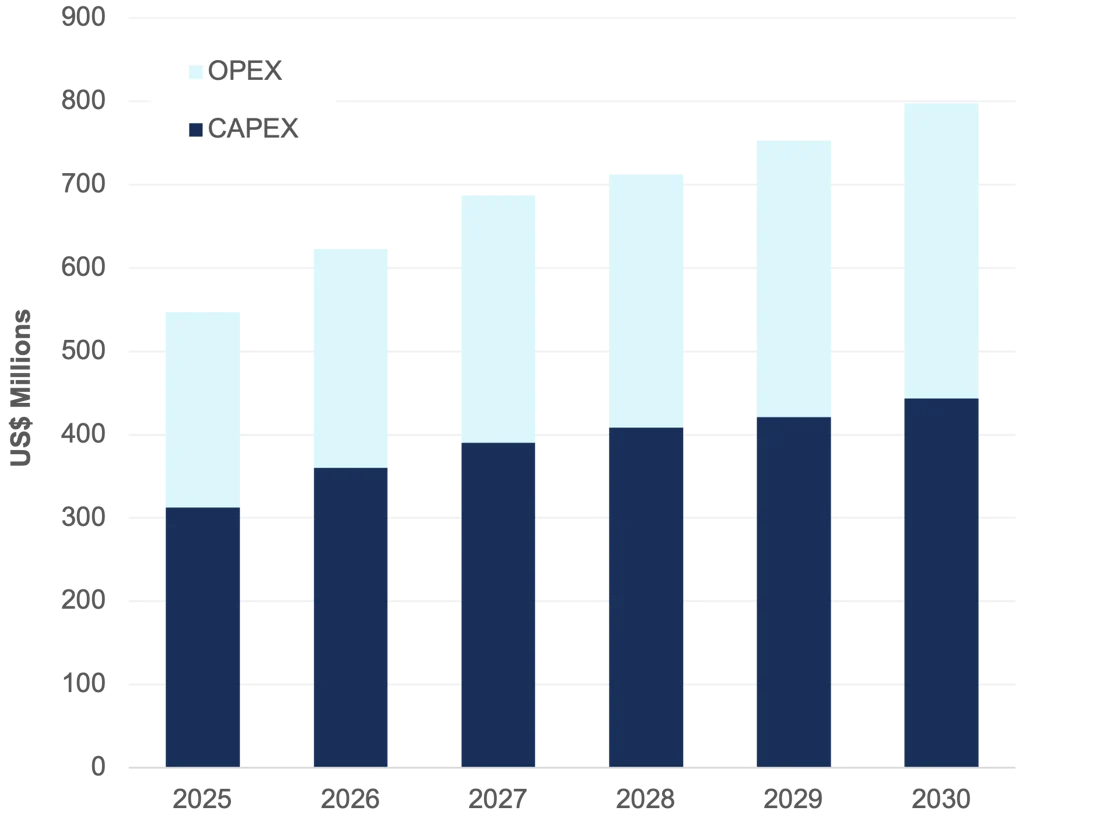

The role of water in the high-growth data center market is fast becoming a critical factor in site selection, design, and operations. By 2030, annual water-related capital and operational expenditures are forecasted to reach US$797.1M, representing a 31.4% increase from today.

According to a new report from Bluefield Research, U.S. Water for Data Centers: Market Trends, Opportunities, and Forecasts, 2025–2030, this surge in activity is accelerating—driven by artificial intelligence (AI)-fueled growth, mounting local concerns over water availability, and the tech sector’s urgent push to safeguard operational resilience amid growing environmental scrutiny.

Hyperscale data centers, which currently represent 51.4% of total market demand, are forecasted to withdraw 150.4 billion gallons of water between 2025 and 2030. This volume is equivalent to the annual water withdrawals of 4.6 million U.S. households.

“Data centers are no longer just digital infrastructure—they’re increasingly part of the water infrastructure equation,” says Amber Walsh, a senior analyst at Bluefield Research. “The scale of this demand is incredible, and the primary reason for solution providers rushing into the market with offerings to capitalize on the growing utilization of reuse and advanced treatment.

Exhibit: U.S. Water for Data Centers Expenditure, 2025–2030

”Hyperscale Data Centers Reshape the Water Infrastructure Landscape

With more than US$100.0B in announced data center development from leading operators, the sector’s growing water footprint (estimated at US$4.1B in capital and operational expenditures by 2030) is reshaping how and where communities invest in water-related infrastructure. These facilities, sometimes spanning over 1 million square feet and housing up to 300+ megawatts of IT load, are not only driving unprecedented energy demand but also placing new pressure on municipal water systems as AI-fueled growth accelerates.

“Hyperscalers, once viewed primarily as power-intensive operations, are now helping redefine a new water infrastructure paradigm,” says Walsh. “As water-stressed and underfunded municipalities confront drought, permitting delays, and resource constraints, tech companies are playing an increasingly influential role in shaping local decisions.”

While much of the spotlight remains on Big Tech hyperscalers (i.e., Amazon Web Services [AWS], Google, and Meta), a growing cohort of third-party data center developers and operators is reshaping the landscape. Firms such as QTS Realty Trust, Vantage Data Centers, Aligned Data Centers, Digital Realty, Stack Infrastructure, and Compass Datacenters are playing a larger, more critical role in shaping new water demand.

To date, water-intensive traditional cooling systems have been the dominant solution for addressing temperature management in these server farms. However, given the increasing size of data centers and heat loads, innovative liquid cooling systems are gaining traction. Liquid cooling deployments are expected to reach nearly half of new builds by 2030, up from 33.2% today, transforming the industry’s water use outlook.

More than 97% of the water used by major data center operators is purchased from municipal drinking water systems—many of which are already under strain. In The Dalles, Oregon, for example, Google’s water withdrawals accounted for over a quarter of the city’s supply in 2023. The company’s water withdrawals increased by 52% from 2020 to 2023, highlighting the growing tension between digital infrastructure development and local water resilience.

Alternative Approaches to Water Management

As water stress and regulatory scrutiny intensify, leading data center operators are evolving from passive consumption to active resource management. The utilization of reclaimed water (i.e., water reuse), especially in high-demand areas, is prompting this shift.

A key example is Loudoun County, Virginia—home to one of the world’s densest data center clusters—where Loudoun Water delivers over 800 million gallons of reclaimed water annually via its expanded purple pipe (water reuse) network. Operators like AWS and Equinix are leveraging this infrastructure; Equinix has invested US$1.4M to expand its connections and has reported annual water and wastewater charges of over US$590,000.

“Utilities benefit from infrastructure improvements, while hyperscale companies can quantify ‘avoided water loss’ as part of their sustainability metrics,” says Walsh. “These win-win collaborations offer scalable paths to align community water needs with corporate growth strategies.”

Capital investment is accelerating across three key fronts, supporting these shifts. Municipal utilities are being upgraded to handle larger water loads, on-site treatment systems are being developed to support reuse and compliance, and companies are investing in advanced technologies, such as pumps, sensors, filtration, and pretreatment units, that enhance operational efficiency and resilience.

A Market in Transition

The data center market segment is undergoing a structural shift across the board, from legacy evaporative air cooling and ad hoc water use to more sophisticated, digitally monitored, and locally integrated solutions. “As the market matures, leading companies will be those that treat water as a core asset—not just a utility bill,” notes Walsh. “Whether it’s through reclaimed water, closed-loop systems, or remote sensors, the winners will be those aligning technical innovation with operational sustainability.”

About Bluefield Research

Bluefield Research supports strategic decision makers with actionable water market intelligence and data across the global industrial and municipal sectors. With expertise across water infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report, U.S. Water for Data Centers: Market Trends, Opportunities, and Forecasts, 2025–2030, draws on primary research from the water, energy, power, mining, agriculture, and financial sectors and their respective supply chains. The full report is available for purchase and immediate download from Bluefield’s website.

Source: Bluefield Research