U.S. Municipal Utilities Face US$4.8B Biosolids Management Bill As Disposal Costs And Capacity Pressures Mount

U.S. municipal wastewater utilities face a looming US$36.4B bill for biosolids management over the next decade—nearly double today’s costs. Shutdowns of aging incinerators, landfill capacity constraints, and per- and polyfluoroalkyl substances (PFAS) contamination concerns are squeezing out traditional low-cost disposal options.

According to a new Insight Report, U.S. Municipal Biosolids Management: Drivers, Trends, and Forecasts, 2025–2035, total U.S. municipal biosolids management spending will surge, growing from US$2.5B in 2025 to more than US$4.8B annually by 2035. This represents a 6.2% compound annual growth rate in management costs that will ultimately need to be paid by cities, towns, and their respective wastewater utilities.

Traditional Disposal Pathways Under Pressure

Behind the scenes of municipal wastewater management, more than 23,900 treatment plants across the country process wastewater effluent for approximately 267 million people. In doing so, they generate about 6.3 million dry metric tons of biosolids each year—a nutrient-rich byproduct that has long been applied to farmland, converted into fertilizers, incinerated, or sent to landfills.

Today, however, these traditional outlets are under increasing strain. Stricter federal air quality standards are forcing some incinerators to close, while permitting obstacles and community opposition have stalled landfill expansions. At the same time, growing concern over PFAS in biosolids is leading to more stringent testing and tighter limits on land application—leaving some utilities with few, if any, viable disposal options.

“Many municipal wastewater utilities, particularly in urban areas, are finding that their preferred low-cost disposal methods are increasingly becoming less available or just simply more expensive,” says Pat Byrne, an analyst at Bluefield Research. “As a result, utilities are investing in more affordable methods and technologies like drying and dewatering, while also giving greater consideration of advanced destruction systems.”

Regional Disparities Drive High Variability in Biosolids Management Costs

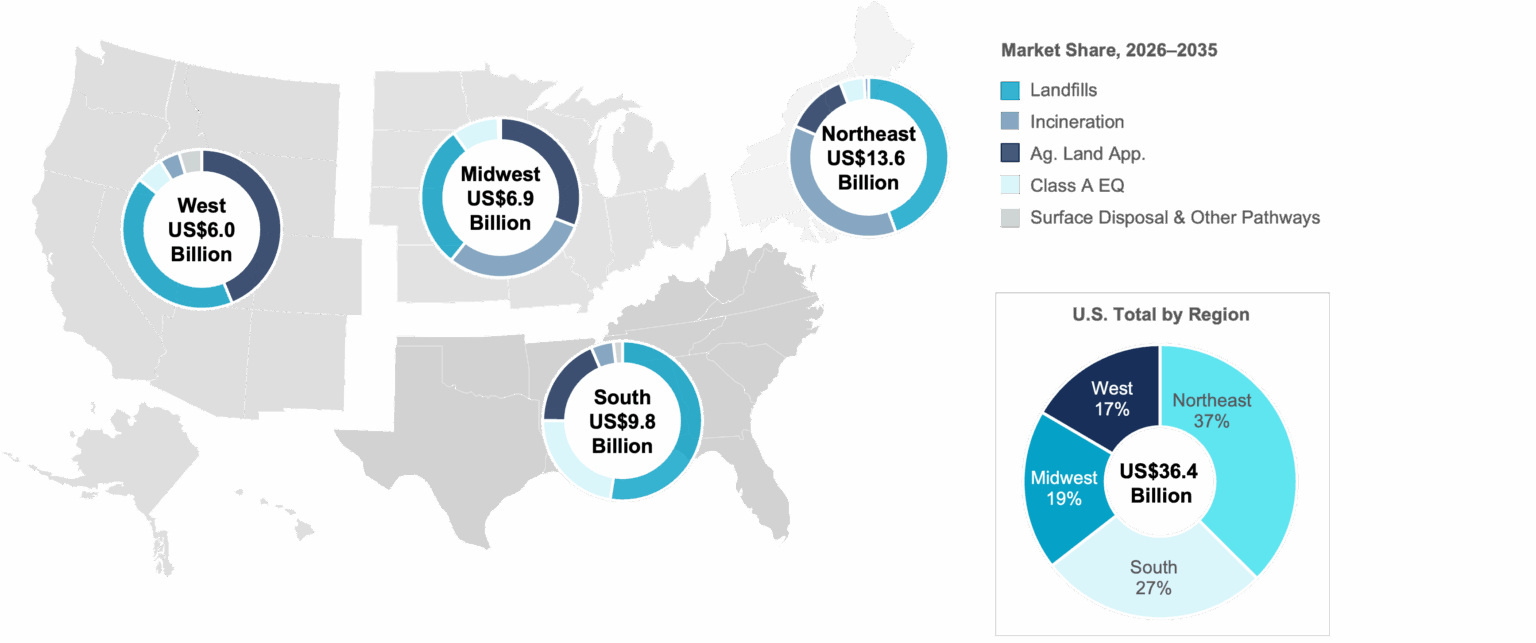

As biosolids management options tighten nationwide, regional disparities in disposal capacity and regulation are reshaping municipal spending patterns across the U.S. Bluefield forecasts that the Northeast will account for US$13.6B—more than one-third of total U.S. municipal biosolids spending through 2035—as competition for limited landfill and incinerator space intensifies. In the Southeast, rising landfill tipping fees and continued population growth will drive spending to US$9.8B, or 27% of the national total. Across the Midwest and West, land application remains more accessible but faces mounting logistical challenges and growing local opposition.

“There’s no one-size-fits-all approach,” Byrne notes. “Utilities are making decisions based on local capacity, alternative costs, and community sentiment—all key factors in driving regional differences in how biosolids are managed across the country.”

Exhibit: Municipal Biosolids Management Spend Outlook by Region, 2026–2035

Uneven PFAS Rules Leave Utilities Exposed

With limited federal action on PFAS, states are charting their own paths in managing wastewater and biosolids. Some have enacted outright bans on land application, such as Maine’s 2022 prohibition, while others are implementing new monitoring rules and contaminant thresholds that raise management costs. Even in states without formal PFAS restrictions, growing public opposition is prompting utilities to scale back land application programs as farmers and communities grow increasingly wary of potential contamination risks.

At the federal level, the U.S. Environmental Protection Agency’s recent designation of perfluorooctanoic acid (PFOA) and perfluorooctane sulfonate (PFOS) as hazardous substances introduces new legal and financial liabilities for utilities managing biosolids, further heightening the uncertainty surrounding disposal practices.

Innovation Accelerates in Biosolids Management

Rising biosolids hauling costs and limited local disposal capacity are pushing utilities to invest in dewatering and drying technologies aimed at reducing biosolids volume and moisture before disposal. This shift is creating opportunities across the value chain ranging from specialized equipment providers such as Fournier Industries and Prime Solution, to full-service water treatment firms like Toro Equipment and Veolia, as well as diversified industrial technology companies including Alfa Laval and Mitsubishi Heavy Industries.

At the same time, leading service providers such as Synagro and Denali Water Solutions are expanding their geographic footprints and strengthening expertise in biosolids handling and facility operations. Emerging innovators like 374Water are also introducing advanced destruction and thermal processing systems that could reshape long-term biosolids management strategies.

“There’s a growing opportunity for companies that can help utilities adapt to these shifting market dynamics,” Byrne explains. “Whether through advanced destruction technologies or improved operational models, utilities are looking for partners that can deliver sustainable, cost-effective solutions for biosolids management.”

About Bluefield Research

Bluefield Research supports strategic decision-makers with actionable water market intelligence and data in the global municipal and industrial sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

The Insight Report titled U.S. Municipal Biosolids Management: Drivers, Trends, and Forecasts, 2025–2035 presents an in-depth analysis of the U.S. municipal biosolids management market, including a comprehensive view of market trends, forecasts, competitive dynamics, and profiles of leading companies. The full report is available for purchase and can be downloaded immediately from Bluefield’s website.

Source: Bluefield Research