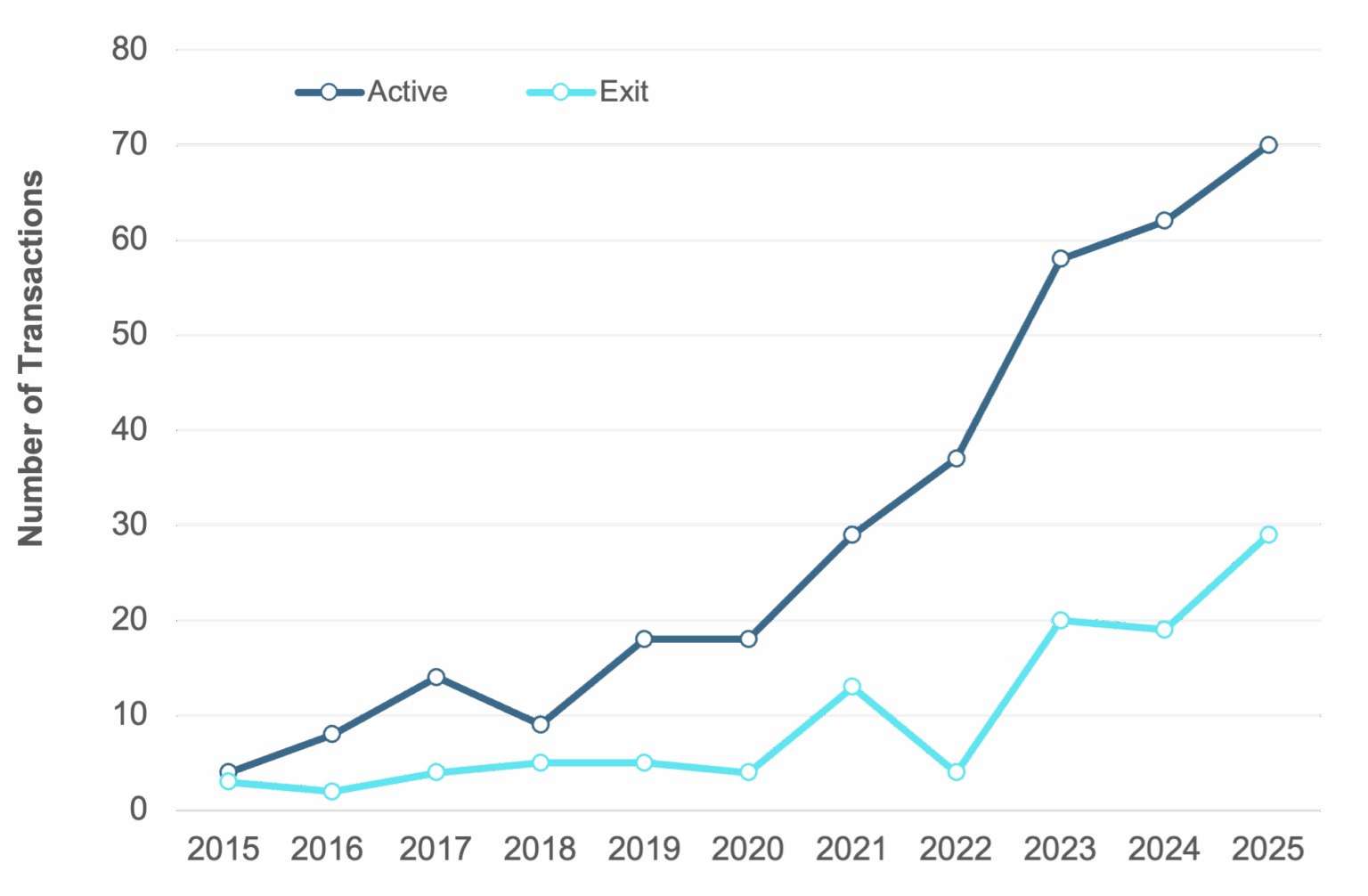

Private Equity Executes 435 Water Deals Since 2015, Doubles Holdings As Exit Wave Nears

Private equity (PE) is playing an increasingly influential role in reshaping the global water sector, with active holdings more than doubling since 2019 to over 327 positions worldwide. Driven by aging infrastructure, growing water scarcity, and rising demand for advanced treatment solutions, investment activity is accelerating across both municipal and industrial water sectors.

A new Bluefield Insight Report, Private Equity in Water: Acquisitions, Exits, and Investment Trends, finds that private equity firms have executed 435 transactions across 25 countries since 2015. The U.S. accounts for 73% of active holdings, underscoring its position as the epicenter of PE-led consolidation in water.

“Private equity’s role in water has expanded rapidly—from launching platform investments to completing 36 bolt-on deals this year alone,” says Reese Tisdale, president & CEO at Bluefield Research. “While the sector remains fragmented, a number of leading firms have built out sizable portfolios that now appear poised for exit.”

Exhibit: Private Equity Acquisitions & Exits, 2015–2025

Key Insights from the Report:

- Acquisitions far outpace exits, with just 87 exits recorded since 2015. The majority have occurred through strategic sales (55%) and secondary buyouts (35%). Initial Public Offerings (IPOs) remain rare, with only six public listings during this period.

- 60% of PE-held water assets are less than three years old, suggesting a potential wave of exits—via strategic sales, secondary transitions to a Private Equity firm, or IPOs—depending on market conditions.

- Treatment and engineering services dominate PE portfolios, representing only 60% of active holdings, as investors target scalable, recurring revenue business models.

- Firms such as New Mountain Capital, Sciens Water, Ridgewood Infrastructure, and EQT have distinguished themselves among the leading consolidators—scaling water platforms through targeted acquisitions and substantial capital commitments spanning the utility, technology, and services segments.

The report’s findings are based on Bluefield’s proprietary global M&A transaction database, which tracks acquisitions and exits in the water sector from 2015 through 2025.

About Bluefield Research

Bluefield Research provides data-driven intelligence to support strategic decision makers in the global water sector. Covering industrial and municipal markets, Bluefield’s expertise spans infrastructure, policy, and technology—helping clients understand where the market is going, and why.

Source: Bluefield Research