Mining Water Treatment Market To Hit US$17B Annually By 2019 As Global Competition Ramps Up

Mining has emerged as a key industrial market for global water solutions providers. Bluefield Research forecasts the annual water treatment market for hard-rock mining (i.e., iron, copper, gold, nickel) to grow 85 percent over the next five years, from roughly US$9 billion in 2014 to US$17 billion by 2019.

The projected growth is driving increased competition across the sector’s highly-fragmented competitive landscape. Demand has sparked activity amongst a host of leading water management and treatment solutions providers– including GE Water, Suez, Veolia Water, and Pentair– as they jockey for market share through M&A, partnerships, and value chain repositioning.

In addition, Bluefield Research notes that stricter regulations on water usage globally are expanding opportunities for new market entrants– such as Aqualia, Doosan, Acciona, and Valoriza– to supply mines with desalinated water. Highlighting this opportunity, more thanUS$15billion of large-scale desalination plants and supply pipelines dedicated to mining are in development.

“There are three trends driving growth in water for mining,” says Erin Bonney Casey, an analyst at Bluefield Research specializing in water treatment markets. “Nearly 50 percent, or US$223 billion, of planned hard-rock investment globally is slated for regions with medium-to-high water stress. Furthermore, regulations on water supply, wastewater treatment, and acid mine drainage in key markets are forcing miners to adopt solutions. And finally, advanced technology is helping to drive down the water demand per ton of mined ore.”

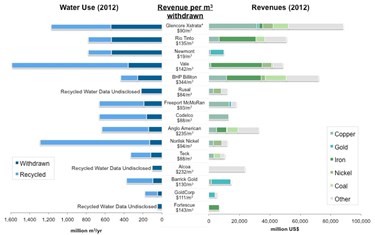

According to Bluefield Research, as of 2012 the 15 leading mining companies worldwide used more than 25 million cubic meters per day of water, of which 62 percent was treated and recycled. In addition, revenue per cubic meter withdrawn varied greatly by company, ranging from a best-in-class US$344 per cubic meter for BHP Billiton down to US$19 per cubic meter for Newmont.

Bluefield Research’s latest analysis on water for mining also examines the pivotal role of EPC and design firms in determining water treatment strategies. Leading construction firms in terms of mining-related revenue, as of 2012, were Hochtief AG, Grupo ACS, Bechtel, Kiewit, and China Metallurgical, while leading design firms included Bechtel, Sinclair Knight & Merz, Hatch, WorleyParsons, and Louis Berger.

“We’re seeing more water solutions companies seeking to develop strong partnerships with EPC and design firms,” says Casey. “As competition ramps up on the supply side, creating relationships with these leading firms, who often are the arbiters when it comes to water technology, will be crucial for suppliers looking to gain greater share in this growing market.”

Water Solutions for Global Mining: Competition, Costs & Demand Outlook, 2014–2019, a Market Insight provided to clients of Bluefield Research’s Advanced Water Treatment & Desalination Insight Service, is now available for purchase. The Market Insight provides analysis of regulatory trends, review of mining sector water demand, water solutions provider value chain analysis and company profiles, and capital investment forecasts for water solutions, including a detailed presentation of forecast methodology.

For more information, visit www.bluefieldresearch.com/water-treatment-for-global-mining-competition-costs-demand-outlook-2014-2019.

Source: Bluefield Research