Investing In Water Stewardship

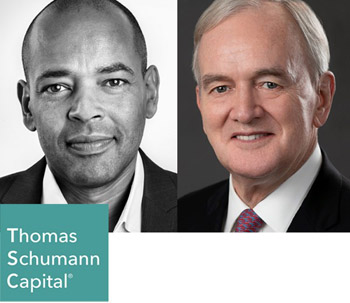

By Thomas Schumann and Willem Buiter

Scarcity of fresh, clean water will be a defining issue for the 21st century. It will be a major challenge — for many, an existential one — even if climate change is addressed effectively. Further global warming will exacerbate freshwater shortages in much of the world, although increasing evaporation and higher average precipitation will benefit some regions. Reduced snowfall, rising sea levels, and increased likelihood and severity of extreme weather events will adversely affect the availability and quality of freshwater in many regions. Freshwater scarcity is one of the key dimensions of water risk confronting businesses in every sector of the economy, as captured in the TSC Water Security Index.

Freshwater is a unique resource. It is essential to life, prosperity, and environmental sustainability. Many see it as a gift from God. It is also a limited, scarce resource. Given enough time, it is renewable through nature’s hydrologic cycle; or, more expeditiously, through the expenditure of real resources on recycling through treatment and purification. At any given point in time, demand outstrips supply and water must be rationed. Every community faces the challenge of designing a rationing mechanism that is efficient, environmentally sustainable, and just. Markets for physical water and water rights must play a key role in ensuring efficient and environmentally sustainable water use. The government must ensure an equitable and sustainable allocation of water.

Water is also a private good that can be allocated efficiently using the market mechanism. First, it is “rival in use” (you can’t drink what I am drinking). Second, it is in many cases quite easily “excludable”: the cost of preventing “free” water consumption is often low. Excludability requires that water consumption is observable and that property rights in water can be enforced. There are issues with the definition and enforcement of surface water rights that can become acute when a river is shared by two or more nations. Groundwater rights can encounter common access problems. All these issues are surmountable. Water can be priced.

FINTECH TV The Impact: In this episode, Thomas Schumann, a sustainability pioneer and the only expert for Water Security investment and financial products, discusses why the climate crisis is a water crisis, lack of water risk assessment, the global effect of the water crisis and much more.

It will not be possible to achieve a fair, efficient, and sustainable allocation of freshwater unless water is priced in all its uses to reflect its opportunity cost and scarcity value, including any negative environmental externalities.

Making sure that the true social marginal cost of delivering fresh, clean water is charged for agricultural water use is key. Globally, agriculture irrigation accounts for 70% of all freshwater withdrawals. The figure is over 40% in many OECD countries, including the U.S.

Agricultural water is frequently provided for free or at heavily subsidized prices. Making farmers pay the full social marginal cost of water will raise the cost of agricultural products, including food and other essentials. This will disproportionately impact low-income households. The government should address these equity issues through income support using fiscal instruments, like a universal basic income.

Household water consumption, likewise, is often priced well below its social marginal cost. Raising household water prices inflicts hardship on low-income households. Again, fiscal support for low-income households must be forthcoming to address this fairness issue. A second-best solution would be to use a “block tariff”, making the social minimum volume of water available at a low price (or free of charge) but charging the full social marginal cost for water use above the social minimum volume.

The physical integration of water markets is far from complete. In California, agricultural water district rates in June 2021 ranged from $200 to $500 per acre-foot in the southern end of the Central Valley to less than $1.00 per acre-foot in some districts in the northern part of the state. Cross-border freshwater scarcity differences can be even more dramatic — compare the water-abundant UK or the Netherlands to the water-deprived nations in the Middle East and North Africa (MENA).

Transformative projects are underway to deepen integration of physical water markets and reduce inter-regional price differences in an environmentally sustainable manner. Two examples are sponsored by Thomas Schumann Capital. One is SkyH2O’s Atmospheric Water Generation (AWG), based on a proprietary technology which extracts clean freshwater from the atmosphere. Productive capacity can be located close to the ultimate customers. Two key drivers of financial viability are atmospheric humidity and the cost of energy. The second path-breaking initiative is Project Greenland, which aims to bring the abundant high-quality freshwater contained in the polar icecaps to markets in the MENA region. Its Iceberg Management and Water Extraction Program identifies appropriate free-floating North Atlantic icebergs that are towed to an operational location in the west of Scotland where the ice and water are processed for further transportation to the ultimate MENA consumers.

The higher water prices that are necessary and unavoidable will serve environmental sustainability by discouraging wasteful water usage; they will also boost the financial viability of innovative private sector projects like the two sponsored by Thomas Schumann.

As the integration of the physical water markets progresses, deeper and more competitive spot markets for water rights have developed. Notable examples can be found in California and in Australia. The trading of long-term leases and forward contracts has prompted the creation of a water rights futures market in California. Other water rights derivatives markets are imminent. Properly regulated and supervised these markets for water rights as an asset can improve the inter-temporal allocation of water. The water century is here now.

Thomas Schumann is the founder of Thomas Schumann Capital. He is a sustainability pioneer and expert for Water Security investment and financial products. His birthplace, Frankfurt am Main, Germany’s financial capital, and the 2015 world’s most sustainable city according to the Sustainable Cities Index inspired his path. Thomas’ MTP (Massive Transformative Purpose) is Agenda 2030, “Transforming our World”, specifically United Nations Sustainable Development Goal 6 “Water Security” and 13 “Climate Action”.

Thomas Schumann is the founder of Thomas Schumann Capital. He is a sustainability pioneer and expert for Water Security investment and financial products. His birthplace, Frankfurt am Main, Germany’s financial capital, and the 2015 world’s most sustainable city according to the Sustainable Cities Index inspired his path. Thomas’ MTP (Massive Transformative Purpose) is Agenda 2030, “Transforming our World”, specifically United Nations Sustainable Development Goal 6 “Water Security” and 13 “Climate Action”.

Willem Buiter is an independent economic advisor and speaker. He is currently an Adjunct Professor of International and Public Affairs at Columbia University and an Adjunct Senior Fellow at the Council on Foreign Relations. He was Global Chief Economist at Citigroup from 2010 to 2018 and a Special Economic Advisor at Citigroup from 2018 to 2019. Previously, he was Chief Economist and Special Counselor to the President of the European Bank for Reconstruction and Development and an original member of the Monetary Policy Committee of the Bank of England. He was the Juan T. Trippe Professor of International Economics at Yale University and has also held professorships at the London School of Economics and Cambridge University. He is the author of 78 refereed articles in professional journals and seven books.” He is an advisor/consultant to Thomas Schumann Capital.