Growth Opportunities Are On The Horizon In The Water And Wastewater Treatment Equipment Market As Public Concern On PFAS Rises

By Shilpa Tiku

What Are PFAS?

Per- and polyfluoroalkyl substances (PFAS) are a family of ever-expanding, complex man-made compounds that have leached into our soil, air, and water. There are nearly 5,000 different types of PFAS found in various products like nonstick cookware, food packaging, cleaning supplies, paints, waterproof jackets, firefighting foams, carpets, and more.

PFAS molecules are made up of signature elemental carbon and fluorine atoms linked together. Because the carbon-fluorine bond is considered the strongest in organic chemistry, they don’t disintegrate or break down and stay in the human body for many years. PFAS compounds are often referred to as "forever chemicals" because of their persistence and immense longevity in the environment. PFAS have been in the news a lot lately due to their widespread use, pervasiveness, legacy pollution, harmful health impacts, and widespread contamination of drinking water sources across the U.S.

Several studies to date suggest possible links between human exposures to PFAS and adverse health effects. In some studies, higher levels of PFAS in a person’s body were associated with increased cancer risks, increased cholesterol levels, kidney disease, changes to liver function, thyroid conditions, increased risk of high blood pressure or pre-eclampsia in pregnant women, and auto-immune disorders. The most commonly researched PFAS compounds are perfluorooctanoic acid (PFOA), initially used by DuPont to make Teflon, and perfluorooctane sulfonic acid (PFOS), an ingredient used in 3M’s Scotchgard until 2002. Although these two compounds are no longer manufactured in the U.S., chemical manufacturers have replaced them with other PFAS, for instance, GenX.

Regulations Around PFAS:

The Environmental Protection Agency (EPA) has the authority to set enforceable Maximum Contaminant Levels (MCLs) under the Safe Drinking Water Act. At this stage, there are no MCLs enforced by the EPA for PFAS chemicals. The EPA has set a non-enforceable health advisory level of 70 parts per trillion (ppt) for the sum of PFOA and PFOS. The current pace of federal action has led to individual states facing PFAS contamination crises to take regulatory actions individually. Some states have approved or initiated health guidelines or have established inter-agency work groups to address the emerging issue of PFAS in their state. Some of these states include California, Connecticut, Colorado, Maine, Massachusetts, Michigan, Minnesota, New Hampshire, New Jersey, New York, North Carolina, Vermont, and a few others.

Technologies To Remove PFAS

Certain technologies like activated carbon adsorption, ion exchange resins, and high-pressure membranes have been found to remove PFAS from drinking water. Activated carbon is the predominant technology currently being used. In 2019, more than 65 percent of the revenues by technology came from activated carbon. “Activated carbon is going to dominate this market in the near future. The demand for activated carbon will most likely be the largest in the next few years simply because that is the most widely used treatment media. It's well understood, it's pretty easy to come by, and it's relatively inexpensive. However, it becomes less feasible at sites where the contamination is really high, or where PFAS concentrations are really high. There may likely be a shift over the next few years where end users will consider ion exchange resins or high-pressure membranes more,” notes Shilpa Tiku, Chief Research Officer at Verify Markets.

Drivers: The key drivers in this market include public outrage as communities are calling for stronger federal action on PFAS compounds and increasing awareness regarding the prevalence of PFAS contamination in drinking water.

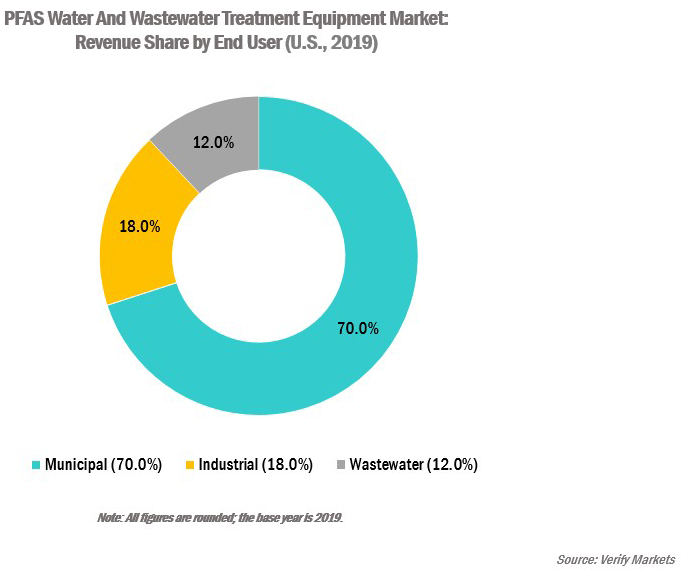

Market size: The PFAS water and wastewater treatment equipment market is valued under $100 million in 2019. The municipal segment represented an estimated 70.0 percent of the market by revenues.

In the near future, regulations will likely get stronger. “We will see state agencies and local municipalities addressing the PFAS issue. Sometime within the next two to five years, there will likely be a very strong environmental protection agency regulation that will require municipalities, or at least on a state-level, to test for PFAS contamination in water sources for both wastewater and drinking water. When that happens, we will probably see a massive influx and spending on infrastructure, testing components, and treatment equipment,” notes Tiku.

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com.

Shilpa Tiku is the Chief Research Officer at Verify Markets. Shilpa has experience in research and consulting for over 17 years. She focuses on monitoring and analyzing emerging trends, technologies and market dynamics in several global markets. To reach her for comments, interviews, or market consulting, call +1 210.595.9687 or email her at shilpa.tiku@verifymarkets.com.