Global Water Utilities Forecasted To Spend US$387.5B On Digital Solutions This Decade

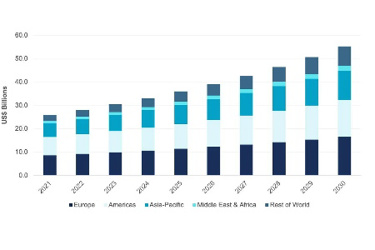

Globally, water and wastewater utility sector expenditure on digital solutions is forecasted to grow 8.8% annually, from US$25.9B in 2021 to US$55.2B in 2030. According to a new report from Bluefield Research, The Digital Water Revolution: Global Digital Water Forecasts, 2022-2030, utilities will spend a combined US$387.5B on associated technology and services over the course of this decade.

“Globally, the water sector is being transformed by a wave of new technologies for connectivity, mobility, automation, and analytics. In every region of the world, digital technologies are enabling water and wastewater utilities to monitor and manage assets and operations as never before, maximizing service quality, efficiency, and sustainability,” says Eric Bindler, Director of Research for Bluefield. “This growth will be seen across hardware, software, professional services, and connectivity solutions targeting the water industry.”

Across the 45 countries analyzed by Bluefield, the outlook for digital water solutions varies significantly by market and region. While the epicenter of global growth is the more established U.S. market, which makes up more than 25.0% of the total spend, emerging markets like India, Vietnam, and Turkey are expected to see the fastest growth due to rapid urbanization, infrastructure buildout, and the potential for technology leapfrogging. Meanwhile, highly progressive utilities in countries such as Sweden, Australia, and the Netherlands account for the highest digital water spend per capita, driven by a combination of stringent regulations, climate and environmental pressures, and a strong local culture of utility innovation.

Utility size is one of the most important factors shaping digital adoption around the world. With utilities ranging from national water authorities serving millions of people to small rural providers serving a few dozen people, the demand, budget, and staff capacity for digital technology vary significantly from utility to utility. Larger, more mature providers are beginning to invest in cutting-edge technologies such as artificial intelligence (AI), robotics, and the Internet of Things (IoT) to optimize their assets, operations, and data, with double-digit growth expected in areas like data integration and strategic asset management.

Meanwhile, most small and mid-sized utilities are in the early stages of their digital journeys, investing in low-cost monitoring hardware and basic software platforms in order to move away from less efficient manual or paper-based systems. The advent of cloud computing and new business models, such as Software-as-a-Service, is expected to greatly expand access to digital technology for small, resource-constrained providers, with utility spend on cloud software expected to surpass more traditional on-premise software spend by the end of the decade.

“While supply chain disruptions and financial volatility are certainly causing headaches for both companies and utilities in the short term, we see significant growth opportunities in the global digital water market moving forward,” says Bindler. “In fact, we expect digital water spend to scale more than three times as quickly as municipal water expenditures as a whole, elevated by mounting regulatory and climate pressures, ongoing advances in technology and business models, a raft of new infrastructure stimulus funding programs, and growing awareness of the water sector’s critical cybersecurity needs.”

About Bluefield

Bluefield Research provides data, analysis, and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield works with key decision makers at municipal utilities, engineering, procurement and construction firms, technology and equipment suppliers, and investment firms. For more information, visit www.bluefieldresearch.com.

Source: Bluefield Research