Global Smart Water Metering Market Hits US$6.8B As Digital Transformation Accelerates

Smart water metering has grown into a US$6.8B global market, emerging as a cornerstone of utility digital transformation, according to a new report from Bluefield Research, a leading provider of global water market data and insights. This shift is opening the door to innovation and competition, attracting nontraditional players, such as telecom and software providers, into a historically hardware-centric industry.

Metering systems, accounting for over 20% of utilities’ digital spend in 2024, play a central role in this transformation. Advanced equipment, including automatic meter reading and advanced metering infrastructure (AMI), enables utilities to optimize shrinking workforces, recover lost revenue, enhance customer engagement, and better manage underground assets. “These advanced meters have evolved into powerful tools that provide real-time visibility into water networks,” according to Christine Ow, an analyst at Bluefield Research. “For utilities, they’re not just data points—they’re primary interfaces with residential, commercial, and industrial customers.”

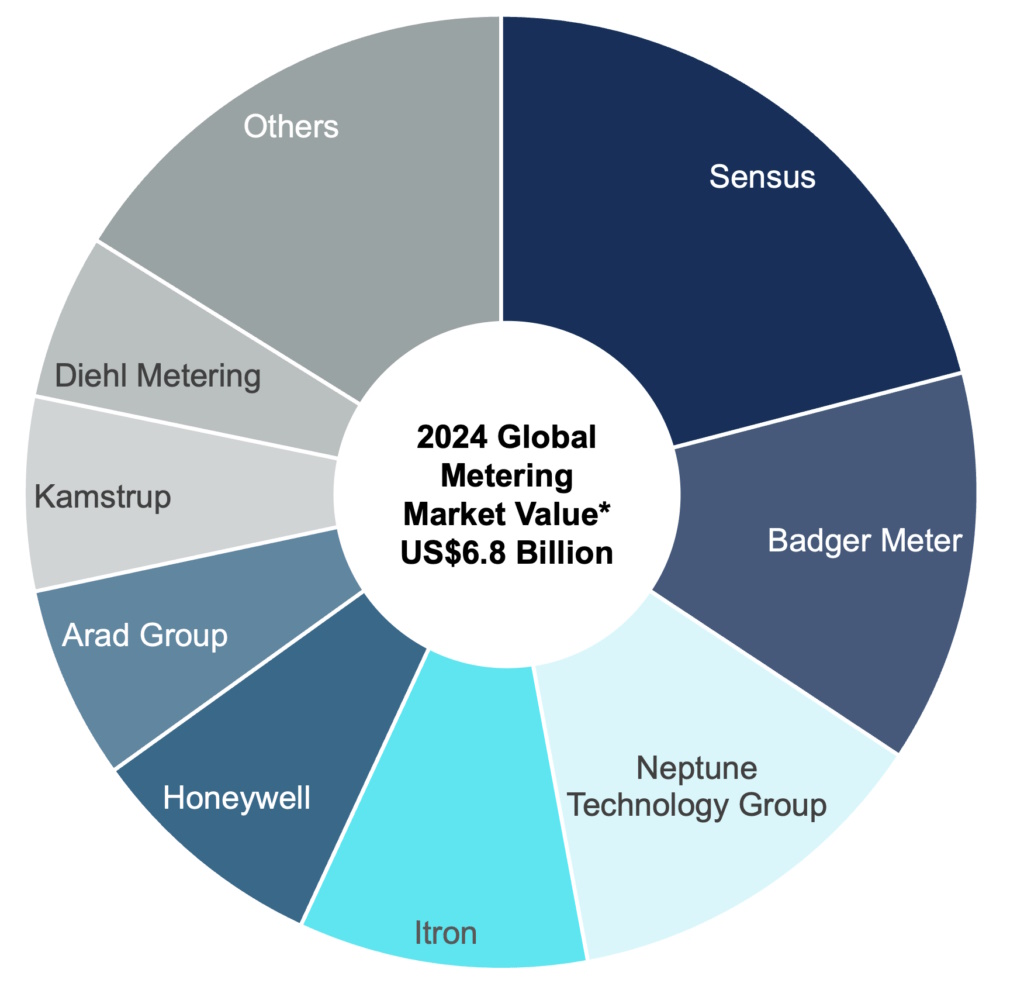

The top 20 water metering vendors now account for 76% of the global market for hardware and software. Headlined by leading companies Sensus (a Xylem company), Badger Meter, and Neptune Technology Group, they are developing more robust portfolios spanning equipment, analytics, and services. Diversified players like Honeywell and Mueller Water Products are joining the market, though water metering comprises a smaller share of their overall business.

Exhibit: Global Market Share for 20 Leading Water Metering Firms (2024)

Software, Artificial Intelligence (AI), and the Rise of Digital Platforms

As vendors look beyond core hardware, advanced analytics and software platforms are emerging as key differentiators. These advanced digital systems enable utilities to detect leaks and monitor and forecast asset performance. In addition to higher margins and greater scalability, the solutions position vendors for long-term roles as technology partners rather than solely product suppliers.

While still in its early stages, companies are utilizing AI to streamline installations, analyze water usage patterns, and predict network and equipment failures. These innovations are accelerating the shift from static infrastructure to intelligent, adaptive systems, enabling utilities to transition from reactive to proactive operations.

New Business Models Broaden Market Access

At the same time, new service-based models are making smart metering more accessible, particularly for smaller or budget-constrained utilities. Options like network-as-a-service (NaaS) and metering-as-a-service (MaaS) reduce up-front capital investments by providing subscription-based access to communications infrastructure and ongoing operations support.

A growing array of retrofit technologies—such as meter interface units—is also helping utilities extend digital capabilities to legacy meters. These devices can connect to IoT networks, such as Amazon Sidewalk, thereby expanding the reach of smart metering to rural and hard-to-reach service areas.

Policy as Catalyst—and Constraint

Globally, policy remains a double-edged sword in the deployment of smart meters. In Europe, supportive programs like Spain’s €3B PERTE initiative and the U.K.’s AMP8 mandate to install 10 million smart meters by 2030 are driving large-scale rollouts.

In contrast, the U.S. presents a more mixed environment. Federal infrastructure funding is providing market momentum, but tariffs and Build America, Buy America (BABA) rules are adding pressure to manufacturing and supply chains. A temporary BABA waiver for AMI meters remains in place through 2027; however, longer-term compliance will require a considerable investment in domestic sourcing of electronic components.

“Smart meters are no longer just tools for data collection—they’re platforms that deliver deeper insights and system-wide visibility,” Ow adds. “As utilities move further into digitalization, they’re looking for future-ready systems that can grow with their needs.”

Bluefield Research supports strategic decision makers with actionable water market intelligence and data across the global industrial and municipal sectors. With expertise across water infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

This Insight Report, Global Water Metering Outlook: Evolving Technology Trends, Business Models, Competitive Landscape, and Leading Companies, draws on more than a decade of proprietary research, interviews with industry professionals, utility case studies, and financial analysis. The full report is available for purchase and immediate download from Bluefield’s website (or included with a Digital Water Landscape Corporate Subscription).

Source: Bluefield Research