Europe's Industrial Water Market To Surpass €100B By 2030, Propelled By High-Tech, Scarcity, And Sustainability Drivers

Europe’s industrial sector is poised for a major transformation in water-related investments, with the total market size forecasted to exceed €101.08B by 2030. This shift is being accelerated by several factors—particularly the growth of semiconductor manufacturing, the expansion of data centers, and increasingly stringent regulations. As a result, the demand for more resilient and efficient water solutions is rising across the continent. Capital and operating expenditures across 15 different industry verticals are projected to grow at a compound annual growth rate of 5.15%. Key segments, such as food production, power generation, and high-tech industries, are advancing at an even faster pace.

According to the Europe Industrial Water Market Outlook: Trends, Drivers, and Forecasts, 2025–2030, a newly released report from Bluefield Research, a leading provider of global water market data and insights, the renewed emphasis on industrial water management is reshaping the market landscape for solutions providers throughout the European Union (EU).

“Industrial sectors are increasingly viewing water not as a cost center, but as a critical operational asset,” says Zineb Moumen, an analyst at Bluefield Research. This shift is reshaping investments in water sourcing, treatment, and reuse, driven by tightening EU regulations, rising energy prices, and the urgent need for more resilient and sustainable water management strategies.

High-Tech and Food Sectors Lead Demand

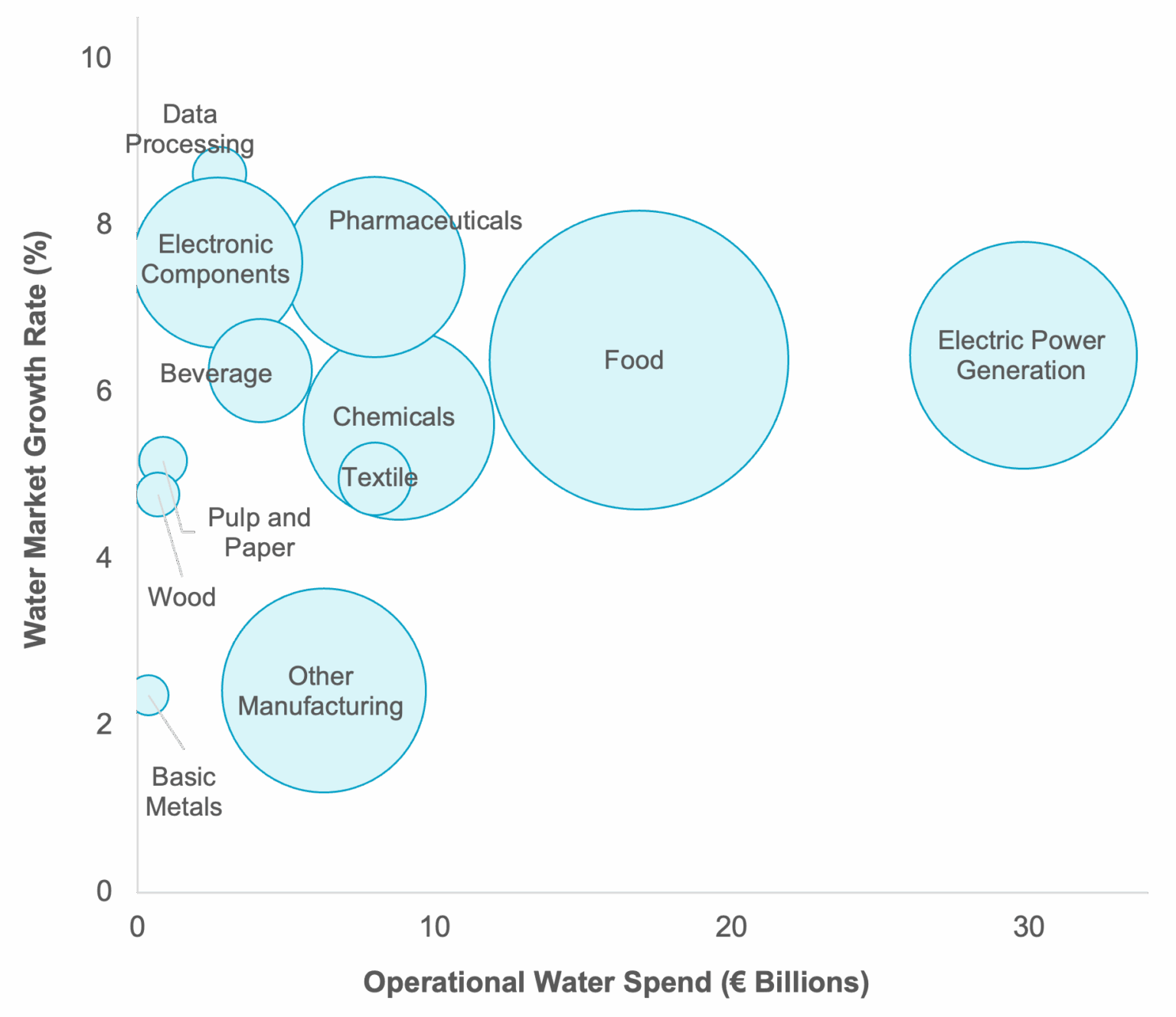

At the forefront of industrial water management spending is food manufacturing, which accounts for 27% of the forecasted total, followed by electric power, chemicals, and pharmaceuticals. However, the high-tech sectors—particularly data centers and semiconductor manufacturing—are emerging as the industry’s fastest-growing segments, with a combined investment expected to reach €10.42B by 2030. Their rapid growth, fueled by advancements in artificial intelligence (AI) and a shift toward hyperscale infrastructure, is increasing the demand for water in electric power generation. Consequently, the electric power sector is projected to continue to require substantial water resources.

Exhibit: Vertical Growth Rate vs. Operational Water

Note: The manufacturing of coke and refined petroleum products, as well as mining, was omitted from the figure due to low market value and growth rate; circle size corresponds to the European 2025 market size value (Source: Bluefield Research)

Regional Dynamics Drive Divergent Growth Patterns

Western and Southern Europe together account for 64% of the total market value, but they are evolving in different ways:

- Southern Europe (particularly Spain and Italy) is experiencing faster growth, driven by acute water scarcity, sector diversification, and rising demand from data centers and the automotive manufacturing industry. In Spain, approximately 70% of its territory is facing water stress.

- Western Europe, with its mature industrial base, offers significant opportunities for retrofitting as firms adapt to new regulations concerning per- and polyfluoroalkyl substances (PFAS) and nutrient discharge.

- Northern and Eastern Europe benefit from EU cohesion funding and the expansion of manufacturing in countries like Poland and the Czech Republic.

“The biggest opportunities will go to companies that can navigate Europe’s diverse industrial landscape—where effective water management increasingly hinges on region-specific challenges and priorities,” Moumen points out. “Spain’s droughts, Germany’s stricter discharge rules, and Poland’s battery factories each require distinct water management approaches. No two markets move at the same pace.”

Competitive Landscape Evolves Amid Market Growth

Europe’s industrial water market is rapidly evolving, shaped by a mix of global multinationals, specialized technology providers, and digital innovators responding to intensifying environmental, social, and governance (ESG) and regulatory pressures. Market leaders like Veolia, Suez, and Xylem offer comprehensive services ranging from treatment plant design to long-term operations. Veolia and Suez benefit from their deep roots in heavily regulated Western Europe, while Xylem is expanding through strategic digital acquisitions. These companies are capturing the growing demand for scalable, compliance-ready solutions in water-intensive sectors such as food, chemicals, and power.

Meanwhile, specialized companies and those focusing on digital innovation are targeting specific market points. Kurita and Kemira lead in PFAS removal and chemical optimization—capabilities that are becoming increasingly essential as EU water regulations tighten. Grundfos is advancing pump systems with real-time monitoring technology to reduce costs and energy consumption. AI-driven platforms from firms like WatEner and Aquasuite are transforming industrial operations and collaborating with utilities across Spain, the Netherlands, and Italy.

Regulatory and Sustainability Pressures Drive Investment

Recent regulatory revisions—including updates to the Urban Wastewater Treatment Directive, the Industrial Emissions Directive, and upcoming restrictions on PFAS—are prompting companies to enhance their infrastructure and adopt compliant technologies. The European Green Deal aims to cut water usage by 13% by 2030, which will accelerate the adoption of reuse, desalination, and smart water systems. At the corporate level, ESG goals are driving a shift toward circularity, with more than half of tracked initiatives now incorporating reuse strategies, efficiency upgrades, or digital water management tools.

“Regulatory pressures—combined with volatile chemical prices and tighter discharge thresholds—are turning sustainability from a reputational goal into a business imperative, fundamentally reshaping how companies prioritize water management investments,” says Moumen. “Success in this €101B market will go to those offering technically sound, locally tailored, and compliance-ready solutions.”

About Bluefield Research

Bluefield Research supports strategic decision-makers with actionable water market intelligence and data in the global industrial and municipal sectors. With expertise spanning infrastructure, policy, and technology, Bluefield helps companies understand where the market is going—and why.

The Insight Report titled Europe Industrial Water Market Outlook: Trends, Drivers & Forecasts, 2025–2030 presents a data-driven analysis of the evolving landscape of industrial water investment across 31 countries and 15 industry verticals. The full report is available for purchase and can be downloaded immediately from Bluefield’s website.

Source: Bluefield Research