China's Huge Biosolids Opportunity: Sludge Solutions Wanted

By Paul O’Callaghan and Stefan Urioc

As wastewater treatment plants proliferate in China, the need for innovative biosolids treatment technologies (and help from abroad) arises.

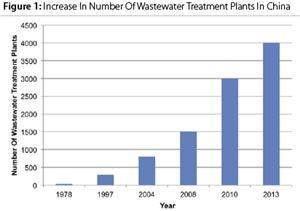

China’s heavy investment in wastewater treatment in the past two decades has seen the number of wastewater treatment plants (WWTPs) increase dramatically (figure 1). At the end of March 2009, there were 1,590 completed and another 1,885 under construction. By 2010, there were approximately 3,000 — a number expected to double during China’s 12th Five-Year Plan from 2011 to 2015. In 2013, the estimated number of WWTPs reached 4,000. On average, the country is building 300 to 500 each year.

Figure 1 illustrates the number of wastewater treatment plants, as opposed to the total installed wastewater treatment capacity.

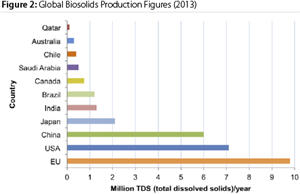

Figure 2 shows that China is now the third-largest producer of biosolids in the world, yet it has the largest infrastructure gap in sludge management infrastructure and solutions.

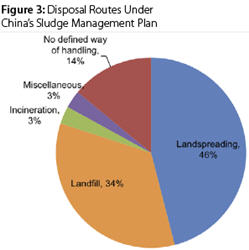

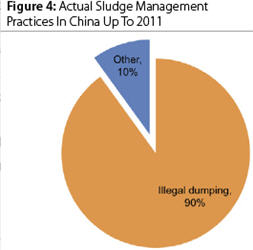

Throughout this process of investment in new WWTPs, sludge management has been very much an afterthought. While a national sludge management plan (figure 3) was drawn up, the prevailing sludge disposal method up until 2011 was illegal dumping, which accounted for more than 90 percent of volume, as shown in figure 4. This was partly due to regulatory restrictions on landspreading and landfill. In China, the mainstream sludge treatment technology is anaerobic digestion (AD). However, currently only 50 out of approximately 4,000 (<1 percent) WWTPs have installed AD facilities. Due to a chronic lack of operational experience and knowledge, only around 30 of those 50 plants actually operate their AD equipment. Other sludge treatment options available in China include aerobic composting and drying.

Throughout this process of investment in new WWTPs, sludge management has been very much an afterthought. While a national sludge management plan (figure 3) was drawn up, the prevailing sludge disposal method up until 2011 was illegal dumping, which accounted for more than 90 percent of volume, as shown in figure 4. This was partly due to regulatory restrictions on landspreading and landfill. In China, the mainstream sludge treatment technology is anaerobic digestion (AD). However, currently only 50 out of approximately 4,000 (<1 percent) WWTPs have installed AD facilities. Due to a chronic lack of operational experience and knowledge, only around 30 of those 50 plants actually operate their AD equipment. Other sludge treatment options available in China include aerobic composting and drying.

China has a clear need for sludge treatment solutions that are user-friendly with local expertise and have low energy consumption (or are suitable for optimizing energy generation).

The sludge treatment market will grow as China tries to solve its sludge problem. Interestingly, it is likely to rely more on international suppliers to provide sludge management solutions in the next five years than it will be for wastewater solutions. During that same period, it is expected that investment in sludge treatment will be in the region of 10 billion Chinese renminbi or yuan (RNB/CNY), which is equivalent to $1.64 billion USD.

There is no clear onesize- fits-all solution. Incineration will make sense in some of the larger facilities but will be too capitalintensive to be used to treat the majority of the sludge in China. At medium- to large-scale plants, anaerobic digestion makes sense, though air emissions issues around the use of biogas may be a barrier as air regulations get tighter.

Norway’s Cambi recently won a contract to refit its thermal hydrolysis solution at five facilities, including the 1 million m3/d (264 MGD Gaobeidian) WWTP in Beijing for use in sludge pretreatment. However, there are currently only a limited number of digesters in China (50) and an even smaller number that are operational (30), which limits the  addressable market opportunities. The final disposal route will vary widely from region to region. Land application may be possible where metals limits are within the allowed levels. Use as a fertilizer in forestry provides another potential outlet. To be disposed in a landfill, sludge has to be dewatered to 40 percent dry solids, and historically, lime stabilization has been used as one way of achieving this. The biosolids management landscape is therefore a complex and evolving tapestry of local conditions, government regulations, and economics.

addressable market opportunities. The final disposal route will vary widely from region to region. Land application may be possible where metals limits are within the allowed levels. Use as a fertilizer in forestry provides another potential outlet. To be disposed in a landfill, sludge has to be dewatered to 40 percent dry solids, and historically, lime stabilization has been used as one way of achieving this. The biosolids management landscape is therefore a complex and evolving tapestry of local conditions, government regulations, and economics.

Sludge management in China is one of the largest emerging water technology market opportunities in the world — for companies that can navigate the market and identify the best niches for their solutions.

About The Authors

Paul O’Callaghan is the founding CEO of O2 Environmental, a leading consultancy providing expert analysis on global water technology market opportunities. Paul also founded BlueTech Research, a subsidiary of O2 Environmental that provides intelligence services to clients to identify key opportunities and emerging trends in the global water industry.

Stefan Urioc is a water technology market analyst and data scientist at BlueTech Research and leads the smart water practice area. Stefan holds a master of science in environmental water management from Cranfield University and a master’s degree in environmental engineering from the Agronomic University of Bucharest.