Private Water Players Vie For Larger Global Stakes

By Bluefield Research

Access to water supplies globally is increasingly threatened by climate change and inadequate public investment in infrastructure. As a result, governments, municipal utilities, and key stakeholders have been forced to address the intensely debated role of private sector participation as a longer-term solution to local water stresses. Recent analysis by Bluefield Research indicates a dynamic landscape undergoing significant change.

Private participation is well established and expected to grow under current market conditions. The world’s 50 largest private water utilities served over 280 million people in 24 countries and generated over $53 billion in annual revenue on a net equity basis in 2014. France, the UK, USA, and Brazil host the largest private water utilities and in most cases will remain key markets for incremental growth and mergers and acquisitions (M&A) activity going forward.

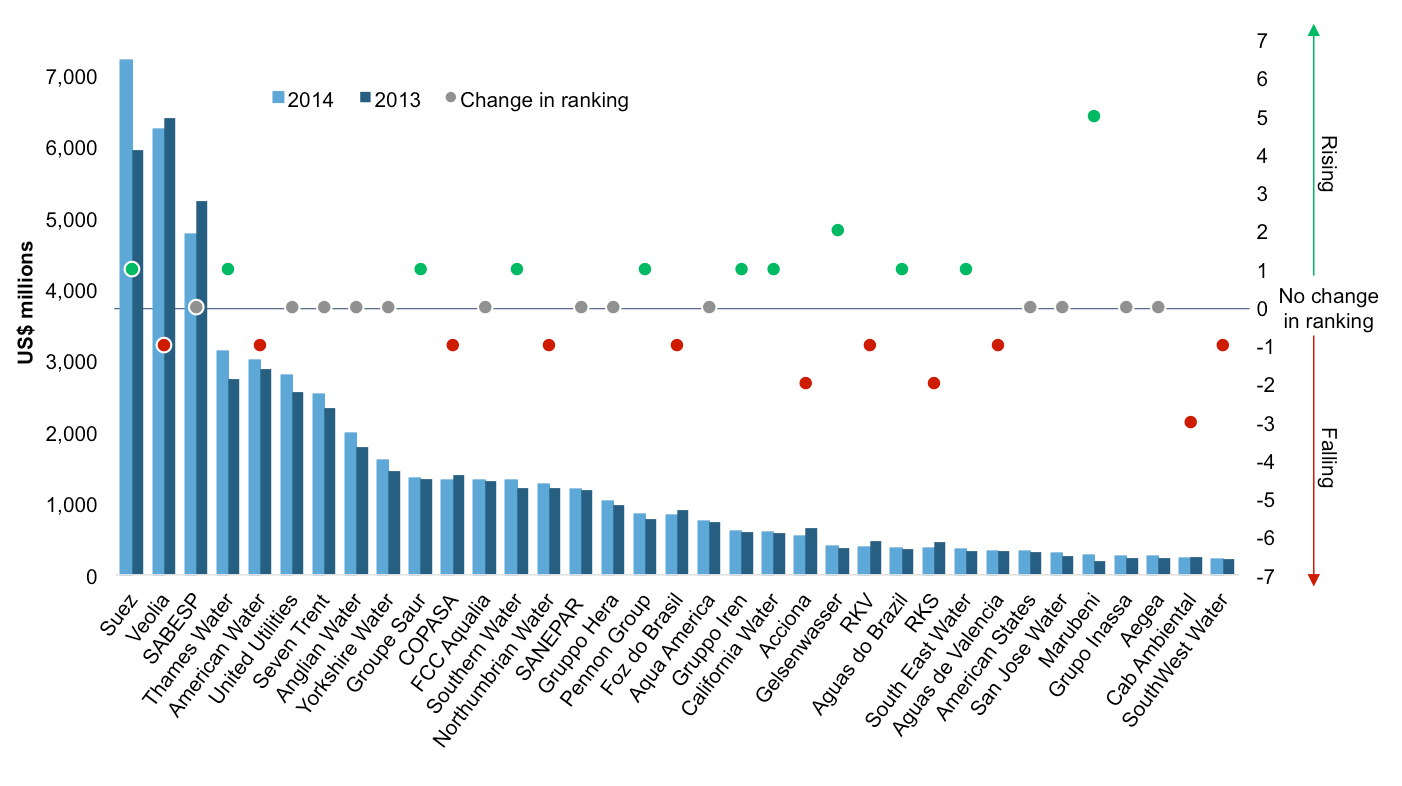

Between 2013 and 2014, 11 companies moved up in Bluefield Research’s global top 35 consolidated rankings by revenues. While this this shakeup reflects changes in company strategies, M&A activity, and macroeconomic conditions, the impact of developing country assets in company portfolios is also taking on greater significance.

It is a unique time for companies to take a second look at markets with lowering competitive barriers and more pressing needs for private investments. The global water landscape is transitioning, demonstrated by the analysis of more than 86 M&A transactions and 72 concessions since 2013. While entrenched players hold onto key national positions, the emerging global presence of Japanese and Brazilian players indicates changes in the rankings going forward.

The promise of closing water infrastructure gaps looms large in developing markets and an increasing number of new players appear in Bluefield Research’s annual utility rankings as a result of this trend. Key regions where private participation in the water sector is on the rise include Southeast Asia, Latin America, and Africa. Shifting risk profiles in countries such as Brazil, along with improving track records of markets such as the Philippines, present a complex, but viable, environment for new project selection. Because of this shift, portfolio investors in the bottom half of the global utility rankings are expected to undergo major changes from year-to-year.

At the same time, global leaders Veolia and Suez are adjusting their own business models and impacting the top of global utility rankings. Changes among the top five largest groups, on a revenue basis, were Suez surpassing Veolia for the top ranking and Thames Water overtaking American Water in the 4th position. Brazil’s SABESP retained its 3rd place ranking and remains the top ranked private national water utility based on population served and volume of water produced annually.

Global Private Water Utility Consolidated Rankings, 2013 - 2014

These and other findings can be found in Bluefield Research report, Private Water Utilities: Global Rankings & Company Strategies, which highlights key drivers and trends among global private utility leaders. Bluefield Research tracks over 100 global private water utilities and offers a complete view of the sector — top-down regional trends combined with bottom up company profiles accompanied by a rich set of data indicators.

Visit www.bluefieldresearch.com for more information on Bluefield’s coverage of global water markets and strategies.