In 2022, Water Quality Gets The Attention It's Due

By Kevin Westerling,

@KevinOnWater

With the funding brought forth by the bipartisan infrastructure bill passed late last year, as well as aggressive policies and regulation to rid water supplies of per- and polyfluoroalkyl substances (PFAS) and lead, 2022 shapes up as the year we finally address our industry’s most troubling and challenging contamination issues in a meaningful way, with the help of innovative companies such as Sanexen (and others featured throughout these pages).

Sanexen’s ALTRA Proven Water Solutions address the aforementioned contaminants, among others, and their technology has been awarded the 2021 Clean50 Top Projects Award, the 2020 Water’s Next Award in the Projects and Technology: Drinking Water category, and the coveted “Efficient Solution” label by Solar Impulse. This was under the guidance of Martin Bureau, the company’s vice president, innovation, who below addresses a range of questions posed about PFAS, lead, funding for treatment and infrastructure renewal, and more.

Bureau began his career in engineering in 1992 with a bachelor of engineering in metallurgy, followed by a master’s degree in physical metallurgy and a doctorate in materials science. He worked in applied research at the National Research Council of Canada (NRC) and has authored more than 200 scientific journal articles and international conference reviews, in addition to coauthoring more than 30 patents.

Prior to his current role, Bureau led the research and development/ engineering team, during which time Sanexen was awarded grants totaling $3.1M — from Sustainable Development Technologies Canada (SDTC), Transition Énergétique Québec (TEC), RecycQuébec, and Québec’s Ministry of Economy and Innovation — for the technological demonstration of their technologies.

Though based in Québec, Canada, his company serves all of North America, and Bureau is well-versed in U.S. water issues, as evidenced in the following exchange.

How will the focus on PFAS, and new state and federal maximum contaminant limits, affect operations for water utilities?

The new focus of the EPA, whether it’s at the state or the federal level, is now putting tremendous pressure on water utilities for their wastewater and potable water treatment plant and, in turn, they are channeling that pressure to the sources of PFAS upstream in their networks. Industrial plants that release PFAS in their wastewater stream as well as landfill sites and other sources of underground water contamination from PFAS, such as legacy sites (firefighting training areas, orphan/abandoned industrial sites), are expecting to have their state EPA (or the like) on their back for, at this point, reporting on the level of contamination that they release to the wastewater streams or underground water, and eventually putting in place treatments for addressing these contaminants. Potable water treatment plants will have to install water treatment systems to address PFAS. Depending on their size, the water utilities will have millions to tens of millions of dollars in CAPEX to invest in those new treatment systems. Wastewater treatment plants may be able to just transfer the responsibility of treating PFAS to the upstream sources if they are identified by the surveys of the EPA.

What factors will determine how the utility proceeds with treatment?

The factors that will determine whether they need to invest now are the enforceable criteria to meet depending on the case, whether it’s geography or type of water. If the source of contamination upstream is identified, the utility may be able to avoid or postpone the investments by putting pressure to invest in a treatment at the identified source.

Is the funding issue settled with the infrastructure package that was passed? What financial hurdles still need to be cleared?

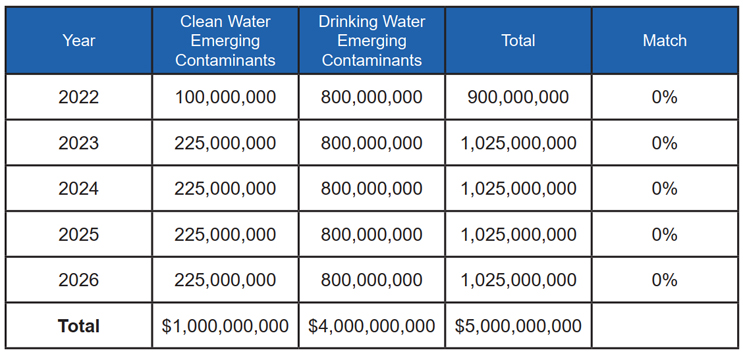

The Infrastructure Investment and Jobs Act contains a total of $5 billion for five years for drinking water and wastewater systems to address emerging contaminants like PFAS, $1 billion targeted to wastewater utilities to mitigate PFAS in wastewater discharges, and $4 billion to help drinking water utilities remove PFAS from drinking water supplies or connect well owners to local water systems. The federal funding begins in fiscal year 2022 (October 1, 2021). The $4 billion going to drinking water utilities will be disbursed through the Drinking Water State Revolving Fund (DWSRF, $800 million each FY 2022-26) as grants that would be available to water systems of all sizes. (See chart.)]

Lead is the other predominant drinking water threat, also addressed in the funding package with earmarked dollars. What are the next steps on the path to ‘lead-free’?

The Infrastructure Investment & Jobs Act has a total of $15 billion, $3 billion per year, directed to lead service lines. Congress also included a total of $11.7 billion for the Drinking Water State Revolving Fund (SRF) and Clean Water State Revolving Fund. These are loan funds and require some matching dollars from the municipality/water utility. The Drinking Water State Revolving Fund has provided loan funds that directly support lead pipe replacement projects.

This is the largest investment in clean water and drinking water infrastructure in history. The next steps are for states to apply for funding to the EPA, which will transfer the money for FY 2022 as soon as possible. Once the states receive the money, they will begin bidding projects.

What other treatment needs and trends do you see on the horizon?

1,4-dioxane has attracted attention recently, and we see growing concerns for other types of contaminants related to industrial chemicals like flame retardants based on brominated organic compounds used for textiles, for example; chlorinated solvents still massively employed everywhere; pesticides (e.g., organophosphates); phthalates and other plasticizers for plastic-based products; and, of course, microplastics, which we find as microparticles in every aquatic living organism. Finally, a massive need right now for treatment is to address PFAS content in biosolids and sludges that are sprayed into agricultural fields for fertilization purposes. We have seen recently commercially available composts made from those biosolids with very concerning concentrations of PFAS (100 ppb).

Where do you see innovation fitting in? Are utilities, engineers, and industry embracing new technologies at a suitable rate to surmount current and future challenges?

The processes to get rid of these contaminants are known. As innovators, our challenge is to adapt them in such a way that they can fit into existing water treatment infrastructures. Water utilities struggle to find budgets just to maintain their water systems. Investing massively to address new contamination that was not even suspected a few years ago is simply not thinkable. The recent infrastructure bill will help water utilities cope with some of the challenges, but not all. Far from it.

And what challenges do you think are the most difficult to solve? What will keep water managers up at night in 2022 and beyond?

Meeting the parts-per-trillion criteria for PFAS put in place in some states for water sources that currently have hundreds of parts per trillion, if not more, within the timeframe proposed.

What do you hope to see in terms of industry action toward ensuring water security and sustainable operations for the long term?

Instead of trying to address PFAS concentration at the publicly owned water treatment system, where PFAS levels are low since they are highly diluted, with sometimes millions of gallons per day of water flow rates, I hope that we’re going to see responsible industries making the right decision to address their PFAS emissions right at the source, which would be, collectively, outstandingly cheaper.