Water Quality Trading: A Necessary Tool In The Compliance Toolkit

New pollutants and water quality parameters are changing perspectives on watershed solutions.

By David Primozich, senior director of ecosystem services, The Freshwater Trust

Water quality trading is becoming an increasingly important compliance option for utilities subject to new regulations on phosphorus, nitrogen, and temperature. Unlike traditional discharge permits, these new water quality parameters are influenced heavily by agriculture and urban runoff, setting the stage for holistic watershed solutions that were not previously possible.

Since the Clean Water Act became law in the early 1970s, state and federal water quality agencies have focused most of their attention on industrial and municipal wastewater — to good effect. Significant public and private investments aimed at cleaning up polluted discharge spawned new industries and technologies, creating a remarkable improvement in many of the country’s rivers, lakes, and streams. These days, the raw sewage, chemicals, heavy metals, and other pollutants that catalyzed the Clean Water Act are largely contained. But new pollutants of concern, generally nontoxic pollutants influenced significantly by nonpoint source activities, are forcing the industry and agencies to look at practical watershed-based approaches for compliance.

What Is Water Quality Trading?

Point-source-to-non-point-source water quality trading occurs when a regulated point source, like a wastewater utility, pays for conservation actions in its watershed that would not have occurred otherwise — actions such as installation of new riparian buffers, pressurized sprinkler systems, drainage water management systems and bioreactors, or improved tillage and fertilizer management practices. The water quality improvements that result from these actions (aggregated thermal or nutrient load reductions) are documented, and reduction values are established using standards and agreed upon calculation methods, which are growing in their sophistication and acceptance by regulators. The point source can then use the quantified reductions (called credits) as part of its compliance portfolio.

Water quality trading has been around in concept for decades, but recently it is getting a lot of attention for several reasons. First, the cost of removing pollutants from waste streams is high and only getting higher on a per-unit basis. Second, regulatory agencies are responding to pressure for more options by working with stakeholders — utility managers, consulting engineers, and a network of third parties — to create the science, systems, and guidance to ensure water quality trading programs are credible and transparent. Third and perhaps most importantly, when applied well, trading is becoming one of the few compliance tools that could save communities and utilities money while creating significantly more and long-lasting ecological benefits than would be possible with end-of-pipe controls alone.

Example: Medford, OR, Chooses Trading

In 2010, managers at the Medford Regional Water Reclamation Facility faced a challenge. The facility serves 170,000 customers in southern Oregon’s Rogue River Valley, and a recent total maximum daily load in the basin imposed a new thermal load limit for the city. Plant engineers analyzed several options, including mechanical refrigeration and storage of wastewater in an expanded pit (which, as the cheapest technological option, would have cost about $16 million). Looking at the same 20-year lifecycle as the engineered options, the city also considered a water quality trading alternative that would cost about $6.5 million to restore 10 to 15 miles of streamside vegetation.

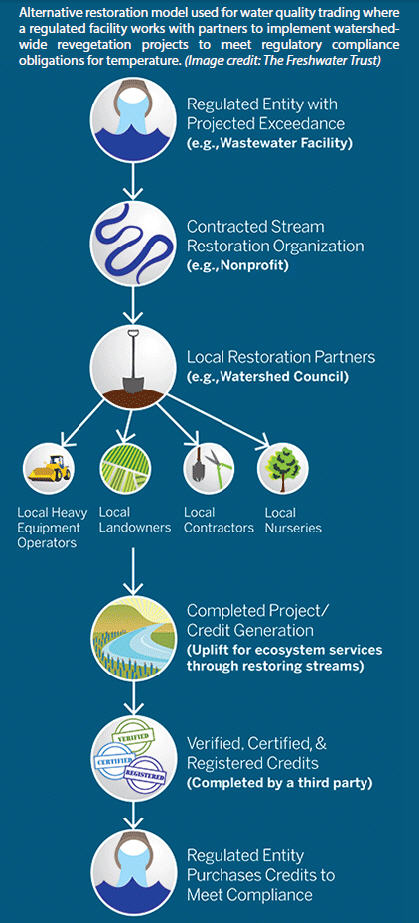

Medford selected the trading option, and in 2011 received its National Pollutant Discharge Elimination System (NPDES) permit, which was Oregon’s first to include water quality trading with enforceable milestones and credits delivered by a third party using a new set of comprehensive procedures and protocols. In 2012, The Freshwater Trust (contracted as the trading program manager for Medford) began implementing streamside revegetation projects. Through 2014, four restoration projects have been implemented, independently verified, and registered on the Markit Environmental Registry, generating enough temperature credits to address nearly one third of Medford’s compliance obligation. (Another three project sites are also under construction at this time.) Within the next 6 to 8 years, The Freshwater Trust will have implemented enough revegetation sites to meet Medford’s entire projected 20-year credit obligation.

This trading program is saving the city and its ratepayers almost $10 million compared to the next best end-of-pipe solution. In addition to the cost savings, the Medford program injects money spent on restoration into the local economy by employing local restoration contractors and providing conservation payments to landowners. Beyond generating credits, the conservation community is supportive because the riparian revegetation work improves habitat for fish and wildlife where they need it and reduces erosion and silting from surface runoff.

Regulatory Framework Supporting Water Quality Trading

In addition to the scientifically grounded restoration and watershed models being used for trading, the regulatory frameworks supporting trading are also becoming increasingly robust. Last year, the U.S. EPA and the U.S. Department of Agriculture (USDA) reiterated their substantial support of water quality trading, bolstering earlier commitments made in EPA’s 2003 trading policy, the 2006 USDA-EPA agreement to offer market-based incentives for trading, and the 2007 EPA water quality trading toolkit for permit writers.

At the state level, many states have developed trading guidance that informs how trading should be incorporated into NPDES permits. In 2014, Idaho, Oregon, and Washington, along with EPA Region 10, defined a comprehensive set of regional recommendations for improving and accelerating the implementation of trading programs throughout the region. The joint regional recommendations lay out a set of guiding principles and practical steps that should be considered when designing a trading program. In the Midwest, the Electric Power Resources Institute laid the groundwork for a multistate trading program in the Ohio River Basin, transacting the first pilot set of voluntary credits in 2014. And after more than a decade, Chesapeake Bay states and agency partners are increasing efforts to coordinate nutrient trading programs to expedite watershedwide reduction goals.

Additionally, groups such as the Willamette Partnership have worked to develop crediting protocols and standards that bring a new level of rigor, oversight, and specificity to trading programs. And last year the National Network on Water Quality Trading and the National Water Quality Trading Alliance both formed to improve dialogue and support policies and guidelines that make water quality trading a viable compliance alternative.

Water quality trading is often intertwined with larger questions about nonpoint source pollution, inequities in the regulatory structure, and assignment of allocations in emerging TMDLs. Because of its proximity to these hotbutton issues, trading sometimes is subject to a high level of scrutiny and skepticism. Opposition to trading has come primarily from environmental advocacy groups that are seeking more enforceable controls on agricultural land management practices. Some groups believe water quality trading reduces the responsibility of agriculture by offering payment for land management actions that advocates believe should be required anyway. Others believe regulated entities should not be allowed to “buy” the ability to discharge pollutants while others are concerned about water quality impacts at the point of discharge.

Regulatory agencies and stakeholders throughout the country are wrestling with this next stage of the Clean Water Act implementation. By mid-2014, at least 13 of the 50 states had authorized legislation, policy, guidance, or draft guidance on water quality trading. Looking ahead, this trend is expected to continue as more agencies and utilities look to trading as a secure and sensible tool for compliance.

Assessing The Feasibility Of A Trading Program

For wastewater utilities facing new load limits for pollutants that are largely coming from nonpoint sources in their watershed, a feasibility analysis of a water quality trading program should be standard practice. While standardized mechanisms for trading did not exist even five years ago, regulators, regulated entities, and conservation groups have worked in recent years to clarify protocols for measurement and procedures for quality control as well as develop tracking and reporting systems for transparency. These innovations now make evaluation of a trading alternative more practical for managers and consulting engineers.

Things to consider when assessing the feasibility of a trading program for a particular source in a particular watershed:

- Does the discharge create localized impacts that need to be addressed prior to trading?

If continued discharge of a particular pollutant exacerbates a local water quality impairment, steps need to be taken to minimize localized effects prior to trading. - How much reduction will be needed to meet new load limits?

Utilities need to determine the potential projected exceedance under “worst-case scenario” conditions. This means evaluating trading within the context of potential factors like increased population growth, higher ambient temperatures, lower flows, etc. - Is there sufficient reduction potential from other sources in the watershed?

Once the projected exceedance for a facility is understood, a careful evaluation of potential reductions that can be realistically achieved is needed. In some cases there may not be sufficient improvement potential for nonpoint sources in a watershed — a discovery needed early in the process. - How do costs of a trading program compare with other compliance solutions?

In much the same way that managers and engineers evaluate the full lifecycle costs of facility improvements, evaluation of a trading solution requires an understanding of the full cost of implementation, maintenance, monitoring, and reporting for the entire credit life. With new guidance, it is now possible to compare trading alternatives with treatment solutions. - Is it possible within the existing regulatory framework?

States have varying levels of guidance and experience with trading, but substantial new resources are available. Stakeholders have been working together over the last several years to share procedures that will make adoption of water quality trading simpler and the quality standards and systems for transparency more uniform across states. - Is trading understood and supported by regulators, environmental stakeholders, and permit writers?

Local knowledge and social acceptance of trading are important considerations. Early outreach to stakeholders and regulators is warranted during the feasibility stage of a water quality trading program. - Is there capacity in the supply chain to accomplish the work needed to secure reductions?

A credible trading program needs to be implemented on a realistic schedule. In some cases, local capacity to do the work to the required quality standards may exist. In other places, it will need to be cultivated through outreach and training programs.

Who Does What, And How Is Risk Managed?

Wastewater utilities can develop and implement trading programs on their own. This option is often attractive to large utilities that have the internal capacity and budget flexibility to manage a complex, long-term program. Small and midsized utilities are now seeing trading as a feasible alternative because, with regulatory support and standards in place in many parts of the country, it is now possible for third parties to offer turnkey options that compare well with traditional end-of-pipe technology options. A turnkey approach managed by a third party removes risk and uncertainty for a utility, making the purchase of water quality credits a viable compliance alternative for addressing new limits.

As regulators set more stringent limits for wastewater utilities, permittees need practical solutions to meet these requirements. Water quality trading, a sensible extension of the goals first articulated in the Clean Water Act, has finally arrived as an important tool in a utility’s compliance toolkit. Trading program components — validated watershed models, transparent regulatory structures, and established implementation processes — have all come together. Early programs demonstrated that economics and ecology do not always lead to different outcomes and continue to pave the way for trading to be a comparatively straightforward and cost-effective compliance solution with a huge environmental upside for watersheds.

About The Author

David Primozich is a leading expert on water quality trading and environmental accounting in the U.S. As senior director of ecosystem services at The Freshwater Trust, David leads efforts to quantify environmental improvements that result from land and water management actions and helps utilities design programs to meet regulatory compliance obligations.