U.S. Drought Reshapes Thinking On Water Solutions

By Bluefield Research

California’s drought, increasing water consumption, and improving technology costs are sparking deployment of more advanced municipal and industrial solutions to address water stress across the U.S. The epicenter of change is across the U.S. Sunbelt, where wastewater reuse and desalination have been thrust into the spotlight as key solutions.

Wastewater Reuse: A Key Driver Of Change

To put things in perspective, the U.S. is the largest market for reuse by volume, globally. However, this only equals 3 percent of total supplies and places the U.S. well behind leading markets Israel and Singapore’s reclaimed water rates of 20 percent and 30 percent, respectively.

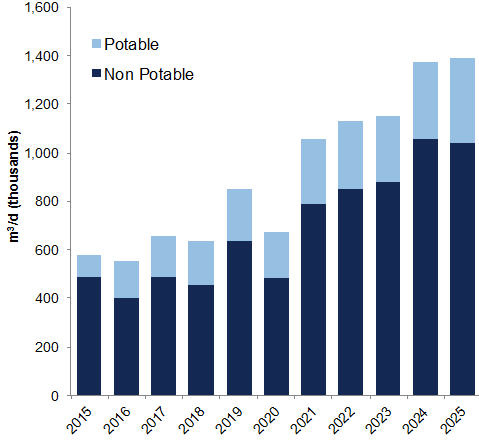

According to a new report from Bluefield Research, U.S. Municipal Wastewater & Reuse: Market Trends, Opportunities, & Forecasts, 2015-2025, wastewater reuse for municipal utilities will increase 61 percent by 2025, requiring US$11.0 billion of capital expenditures.

Top 5 Takeaways: U.S. Municipal Wastewater & Reuse

Source: Bluefield Research

Amidst a growing call for improved water efficiency, potable reuse — treating wastewater to drinking water quality — is gaining traction. In the U.S., potable reuse, almost exclusively driven by indirect applications (i.e., reservoirs, injection), makes up 15 percent of the total capacity and is expected to increase to 19 percent of total water reuse by 2025. The expected jump stems largely from heightening pressure on policymakers and utilities to stay ahead of scaling urban populations, anticipated future droughts, and already limited water supply alternatives.

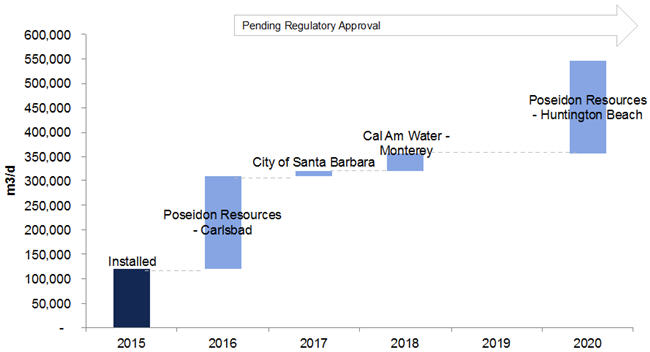

To date, the only operating direct potable reuse plants in the U.S. are Wichita Falls, TX, and Big Spring, TX. Another plant in Cloudcroft, NM, is in final stages of development. An opaque and fragmented regulatory environment, coupled with public reservations about reclaimed water, has throttled development nationwide. Concerns about reusing wastewater for drinking water, however, are changing rapidly in states like California, where more than US$1.9 billion of reuse applications have been submitted to state agencies for approval.

Forecasted Potable Reuse Capacity Additions

Source: Bluefield Research

Desal Still Limited To Select Projects

Acceptance of seawater desalination as part of the U.S. water supply portfolio has been slow to take hold, as demonstrated by 17 seawater desalination projects in California that have languished, and beleaguered by environmental opposition, high costs, and permitting challenges. However, the combination of new desalination capacity and continued drought pressure on coastal urban centers could help swing momentum in desalination’s favor to become part of the long-term solution rather than a costly emergency stopgap.

Poseidon’s 190,000 m3/d Carlsbad reverse osmosis (RO) plant, which is at the cusp of start-up after more than a decade of development, is hoped to be a tipping point for U.S. desalination. Santa Barbara’s once mothballed plant has now been approved for retrofit, and Guadalupe Blanco River Authority in Texas received US$8 million in low interest loans for an independent water and power plant (see SWIFT Action in Texas: State Water Implementation Fund for Texas, 2015 Awards). While the path to widespread desalination is not clear of hurdles, incremental adoption is beginning in communities facing water stress.

Planned Reuse Projects In California By Development Stage And Year

Source: Bluefield Research

The best solution to water stress is rain, but policymakers and utilities are coming to terms with long-term water supply volatility and the economic impact on communities, industries, and agriculture. As demonstrated in Florida and Texas, the manufactured solutions will require a portfolio of water technologies and management tools to stay ahead of long-term water risks.

To read more insights and analysis on the global water market trends and opportunities by the Bluefield Research, please visit www.bluefieldresearch.com.