Zero Liquid Discharge Opens Up Opportunity For Forward Osmosis To Make Its Mark

By Abhirabh Basu, research associate, Lux Research

While many companies and investors have struggled to make sense of an entry point into the massive water industry, seeds are consistently being sown for those that know how to monitor and enter intelligently. One such emerging solution offering nuanced opportunity is forward osmosis (FO) in difficult-to-treat and high-value industrial markets. FO uses semi-permeable membranes and a concentrated draw solution to separate freshwater from a high salinity feed. Unlike other membrane-based processes, such as reverse osmosis (RO), which pushes water through a membrane with pressure, FO does not rely on external pressure to move water through the membrane.

So, what are the opportunities and challenges? While FO has been a heavily researched topic in academia, the technology has been slow to adopt in industry largely due to its energy guzzling regeneration step to recover freshwater. Many early stage companies in the space initially targeted the municipal seawater desalination industry but the two step FO process has yet to successfully compete with the incumbent technology in the space. However, FO startups are starting to exploit the technology’s low fouling potential and high salinity feed tolerance in applications, such as milk dewatering and zero liquid discharge, where most membrane-based processes foul easily due to high pressure requirements.

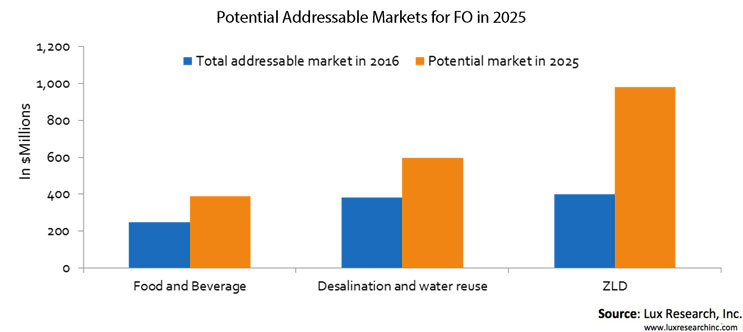

As a result, the largest and the fastest growing market for FO is in brine concentration and zero liquid discharge (ZLD). ZLD is an advanced water treatment process that eliminates large volumes of contaminated wastewater leaving a facility. ZLD systems generally include thermal equipment like evaporators and crystallizers, but can also use a variety of pre-treatment and pre-concentration steps to improve the overall water recovery of a process. We estimate the market for ZLD to be currently $400 million per year based on the number of systems that come online each year. More efficient processes could increase market share, creating a projected $1 billion market by 2025. FO wins in this space as it can pre-concentrate salts more completely, reducing overall energy needs by roughly half against incumbent technologies sold by giants like GE and Veolia. In contrast, FO does not win significant share in seawater desalination or food & beverage markets, the other two typically pursued applications by the current developers.

Not surprisingly, the last three years have seen an increase in investments in the FO space. A large share of this interest has emerged from Chinese technology companies who are keen on new technologies that offer a competitive edge in the industrial sector, and couple water and energy challenges faced by the industry in China. In addition, startups like Oasys Water and Porifera have gained momentum, finding more applications in difficult-to-treat industrial wastewater and ZLD than in markets that compete directly with RO, such as municipal desalination. However, companies such as Trevi System and Modern Water continue to compete against incumbent technologies in the seawater desalination market with little success. In the membrane space, incumbents have been monitoring both the academic and startup space to scout for new innovation, with Toray Chemical Korea taking an equity investment in Porifera for membrane development, and Danish startup Aquaporin recently struck a strategic partnership with two large Chinese water companies, in addition to an earlier link-up between Trevi Systems with Asahi Kasei

We expect FO technology to continue to advance in both value proposition and adoption. Forward-thinking water systems integrators will find paths to engage, while we also expect at least one large membrane company to acquire a promising startup to dominate the FO market in the near future, akin to LG Chem’s acquisition of NanoH2O in the ROmarket.