U.S. Power Profile Shift Sparks Water Opportunity

By Erin Bonney Casey

The power sector looks to zero liquid discharge and taps municipal reclaimed water as a water reuse strategy.

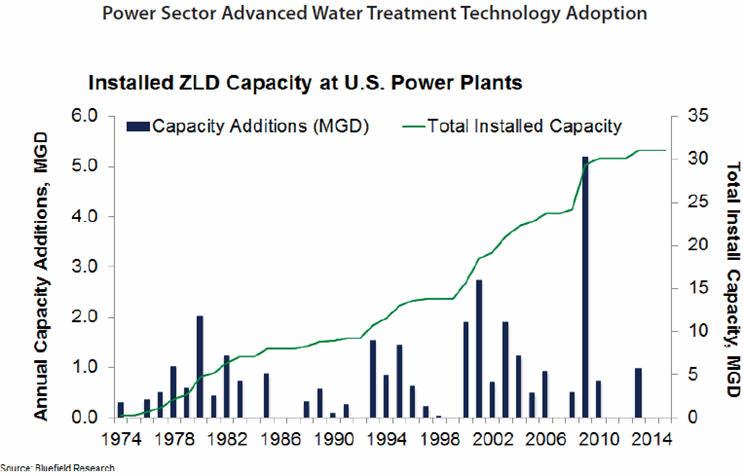

From an installed base of 72 zero liquid discharge (ZLD) systems and 67 power plants utilizing reclaimed water across the U.S., Bluefield Research is seeing an increasing trend toward reuse in the U.S. power sector as companies look for new water management strategies. ZLD, a water treatment process in which all wastewater is purified and recycled, helps conserve water supplies and manage wastewater flows. The power sector is increasingly looking to ZLD systems to meet regulatory challenges and reduce water use in water-stressed areas. On the other hand, reuse of municipal reclaimed water can provide a drought-proof and cost-effective water supply source for water-hungry power plants.

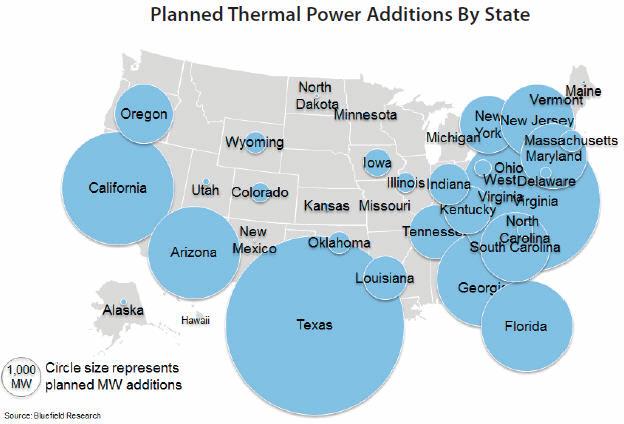

Use of ZLD systems, installed to expand on-site water reuse and eliminate concerns about wastewater discharge, is expanding, although they are still somewhat of a niche play. Currently, the 72 U.S. power plants employing ZLD systems have a total combined capacity of 22,000 GPM (119,000 m3/day). New thermal power plant additions from 2016 through 2025 are expected to total 38 gigawatts (GW), mostly through the addition of natural gas-fired plants. The U.S. power sector is evolving toward greater adoption of combined-cycle gas plants — a substitute for decommissioned coal plants — and sparking growth opportunities for water solution providers. The Mid-Atlantic and Midwest, regions that historically have relied on coal, are shifting to gas-fired plants, with large-scale capacity additions planned to compensate for the scheduled retirement of coal plants.

Most power capacity additions are planned for the Mid-Atlantic and Midwest states, reflecting the ongoing shift from coal to natural gas.

New gas-fired plants are also increasingly looking at ZLD technology for reuse as a means of reducing their water footprint and complying with regulatory shifts. In Texas, California, and Arizona, which are water scarce, planned thermal power capacity additions total 16 GW, 42 percent of the total. Companies will be looking at new water management strategies for new thermal plants to secure the necessary cooling water and boiler feed supplies for plant operation. For example, the largest ZLD installation at a power plant in the U.S. is at the Duke Energy natural gas-fired combined-cycle (NGCC) plant in Arlington Valley, AZ. Installed in 2009, the system has a flow rate of 3,600 GPM (19,620 m3/day). The ZLD system allows the plant to reuse water in this extremely water-stressed region.

Additionally, the new Steam Electric Power Generating Effluent Guidelines passed by the U.S. EPA in 2015 will force wastewater treatment retrofits at coal-fired plants not slated for retirement. This follows a series of regulations aimed at reducing air pollution and prompting the installation of flue-gas desulphurization (FGD) units, which moved some of the removed toxins into the wastewater stream. ZLD systems can provide a solution for operators looking to clean effluent from FGD units.

The power sector is increasingly looking to ZLD systems to meet regulatory challenges and reduce water use in water-stressed areas.

Greenfield Power Plants Drive Municipal Wastewater Reuse

In addition to on-site reuse utilizing ZLD treatment solutions, power plants are increasingly turning to reclaimed municipal water for a drought-proof water supply and associated cost savings. New plants, whose cost structures allow innovative water solutions more than retrofits, are expected to tap into municipal wastewater for drought-resistant water supplies.

Currently, 26 percent of the new capacity is proposed in four water-stressed states — Texas, California, Arizona, and Florida — where utilities and independent power producers are already under pressure to more heavily weight water supply risks to operations. Currently, 67 U.S. power plants utilize reclaimed wastewater from municipal wastewater sources, which is expected to rise. For example, Covanta recently installed GE’s water reuse technology at the 90-MW Delaware Valley waste-to- energy facility. Elsewhere, the Turkey Point nuclear power plant in Florida has signed an agreement with Miami-Dade to utilize up to 340,000 m3/day of reclaimed water for cooling tower use at the expanded facility. The agreement will provide cost savings to plant owner Florida Power and Light (FPL) in the form of lower water rates and will help Miami-Dade preserve its stressed potable water supplies.

Panda’s Water Strategy Highlights Range Of U.S. Drivers

Panda Power Funds’ recent progress toward the second of two new gas-fired power plants in the Chesapeake Bay basin highlights the focus on reuse strategies, including ZLD. Panda’s proposed Mattawoman Power Project in Brandywine, MD is an 859-MW combined-cycle generating station planned for commissioning in 2017. While Mattawoman awaits public comment, the 778-MW Stonewall project in Virginia is under construction and planned for 2017.

Both of Panda’s plants will employ innovative water management strategies for water supply and wastewater management. They will use municipal reclaimed water for supplies and install ZLD systems to treat produced wastewater and recycle it on site. The Stonewall plant will use reclaimed wastewater from Leesburg, VA for cooling water, while the Mattawoman plant will draw reclaimed water from the Piscataway Wastewater Treatment Plant (WWTP) in Accokeek, MD.

The growing influence of regulations surrounding the Chesapeake Bay region is also impacting power development in seven Mid-Atlantic states. Signed in June 2014, the Chesapeake Bay Watershed Agreement has compelled Delaware, Maryland, New York, Pennsylvania, Virginia, West Virginia, and the District of Columbia to address water quality, including industry impacts on the basin. Not exclusive to power, industrial development in the region going forward will be forced to meet tighter nutrient (nitrogen and phosphorus) limits.

Competitive Landscape For ZLD Solutions Dominated By Three Key Players

While GE, Veolia, and Aquatech have deployed the large majority (99 percent) of U.S. systems, new capacity additions, particularly in water-stressed regions (e.g., Western U.S. states), is driving greater competition. Companies deploying membrane treatment technologies — ultrafiltration (UF), reverse osmosis (RO), and evaporators to concentrate plant brines — are best positioned to move into this market. An increasing number of ZLD solutions providers, both domestic and foreign, are looking to break into this market as power plants increasingly embrace innovative water management strategies.

About The Author

Erin Bonney Casey is a senior analyst in Bluefield’s Advanced Water Treatment and Desalination practice. Erin is on the Water Environment and Reuse Foundation’s Project Advisory Committee on Current Use and Trends of Reuse in the Hydraulic Fracturing Industry. Prior to joining Bluefield, Erin worked at Brown Brothers Harriman as a business analyst. She also has international experience with Grameen Research, focusing on Latin American economies and tax laws. Erin has a BA from Bates College and a Masters from Oxford University in Water Science Policy and Management. Erin is based in Bluefield’s Boston office.

Erin Bonney Casey is a senior analyst in Bluefield’s Advanced Water Treatment and Desalination practice. Erin is on the Water Environment and Reuse Foundation’s Project Advisory Committee on Current Use and Trends of Reuse in the Hydraulic Fracturing Industry. Prior to joining Bluefield, Erin worked at Brown Brothers Harriman as a business analyst. She also has international experience with Grameen Research, focusing on Latin American economies and tax laws. Erin has a BA from Bates College and a Masters from Oxford University in Water Science Policy and Management. Erin is based in Bluefield’s Boston office.