Mexico Primed For US$32B Water Infrastructure Investment

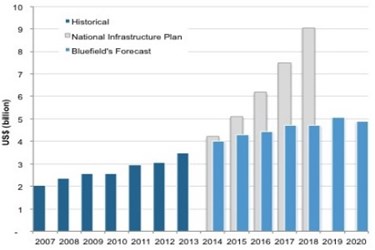

Mexico’s water sector is scaling with system providers and investors positioning to capitalize on the federal government’s recently announced National Infrastructure Plan (2014-2018). Bluefield Research forecasts that government targets will not be fully met by 2018. Rather, Bluefield expects US$32 B of investments to be reached in 2020, still representing a significant investment towards bridging an estimated 24 billion cubic meter water supply-demand gap by 2030.

A new report from Bluefield Research analyzes market trends and how government water treatment and infrastructure targets are creating greenfield opportunities for companies across the water value chain. Currently, the rate of wastewater treated nationally is 50.3 percent, with a target to increase the rate of wastewater treatment to 63 percent by 2018.

Furthermore, 52 percent of Mexico’s 2,200 wastewater plants utilize conventional technology; 594 wastewater plants are cumulatively 85,000 cubic meters per day over capacity, representing a significant opportunity to expand existing assets and retrofit less efficient systems such as septic systems and wetland treatment.

Companies like Abengoa, Degrémont, Hyflux, and Mitsui have already advanced M&A and partnership strategies to compete in this market long dominated by domestic players. Many of these foreign entrants are aligning with local EPC firms and investors to gain an early foothold.

“Now is the time to compete in Mexico,” said Erin Bonney Casey, water analyst at Bluefield Research. “66 percent of the forecasted US$32 B investment has yet to be allocated, and companies that develop strategies today will be the ones best positioned to receive the lion’s share of future investment.” For more information, visit www.bluefieldresearch.com/mexico-water-2014.

Source: Bluefield Research