Measuring Innovation: Water Quality Analytics Startups To Watch

By Abhirabh Basu, research associate, Lux Research

In an industry with more than its share of startup tech companies, Lux Research identifies innovators in water quality analytics that are poised to make a splash.

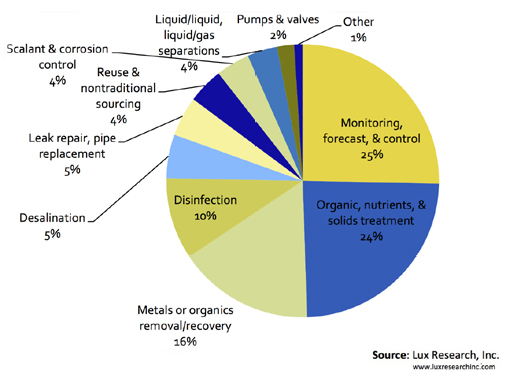

The water industry is flooded with technology companies competing to remain afloat. Every year, Lux Research, a strategic advisory company, interviews executives of more than 120 startups in the water space. According to Lux’s analysis (Figure 1), a striking concentration of startups focuses on analytics technologies, with many using advanced sensors to measure water quality. These companies represent a full quarter of the startup activity in the industry. Such a large crop of analytics companies indicates a long overdue change in process control.

A Work In Process

In contrast to other sectors, the water industry lags behind in process control by decades. For instance, while factory production has long been closely monitored and automated by computers, the same cannot be said for most water systems. The chemical complexity of these systems, as well as the geographic scale in the case of municipalities, have proven to be significant barriers to process control. Traditional lab testing and spot sampling continue to create delays in operators’ ability to detect crucial process and water quality issues.

Figure 1: Startup Activity In The Water Industry

Today, the water analytics market is valued at $2 billion and is growing at five percent per year. Established companies such as Hach, Mettler Toledo, Agilent, and Veolia dominate the space and provide robust techniques to measure a range of traditional parameters. However, new and innovative startups are challenging the status quo, creating technologies that offer better real-time data acquisition and more analyte-specific and sensitive analytics.

Mapping Innovation

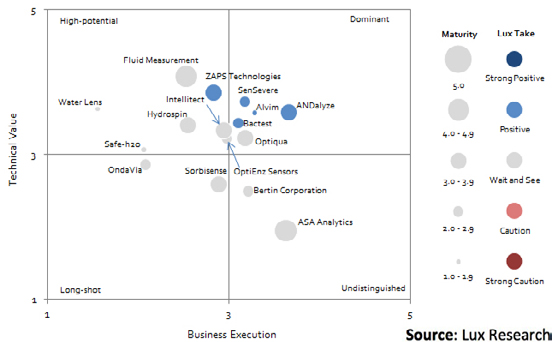

In order to compare emerging startups, the Lux Innovation Grid (Figure 2) maps innovation in a particular market segment or technology area, ranking companies on both their general business execution and their technological value.

Figure 2: The Lux Innovation Grid On Water Quality Analytics Companies

Companies in the upper right corner of the Lux Innovation Grid, so-called “dominant” startups, have relatively strong business execution and technical value and make great partners or investment targets. These companies are often first to the market with revolutionary or disruptive technologies and face little competition.

SenSevere has introduced real-time bromide and hydrogen sensors that function in highly corrosive and challenging environments. Bromide in water treatment plants and distribution systems can interact with organic matter during regular chlorine disinfection to form trihalomethanes (THMs), which are carcinogenic in humans. Currently, water treatment plants infrequently test bromide levels by sending water samples to laboratories. SenSevere’s chemical sensors detect bromide at levels as low as 10 ppb, allowing operators to immediately address contamination in their system.

Italian startup Alvim provides sensors to directly monitor biofouling. Compared to traditional methods of measuring biocide loss and general fouling, Alvim’s sensors offer valuable process control for applications in cooling water systems, industrial water treatment, desalination, food processing, and paper mills. In one example, Alvim deployed five sensor units in a pulp and paper process line to monitor biofilm buildup, allowing operators to adjust their processes to use fewer chemicals or alter chemical use to address key problems. The company is currently developing an explosion-proof version of its sensor for oil and gas applications. Alvim has several established customers including GDF Suez (now known as ENGIE) and Danone.

Illinois-based ANDalyze, which is currently seeking a buyer, provides a sensitive DNA-based fluorescence test for free metals that can expand to detecting trace levels of organics and bacteria. Its handheld device currently measures trace metals in the low ppb range and can display results in less than 30 seconds. The tests are robust, easy to use, and exceed the sensitivity of other handheld devices. The company has secured more than 20 distributors worldwide, including the analytics giant Hach. ANDalyze is currently developing an online instrument with the U.S. Army’s Construction Engineering Research Laboratory (CERL) to monitor metals and possibly other compounds in a continuous process.

On The Horizon

“High-potential” companies, which appear in the upper left quadrant of the grid, represent those that have attractive technologies but struggle to gain market share. However, these companies make good licensing targets or investment targets for those who can tolerate a higher degree of risk. Water analytics companies that have previously appeared in the high-potential quadrant include Neosens and Capilix, which were both promptly acquired by Aqualabo Group and Metrohm, respectively.

Among current high-potential companies, Zaps Technology has improved its standing since Lux’s previous interview with the company. The company’s real-time monitoring system uses three optical techniques simultaneously — absorbance, reflectance, and fluorescence. This allows it to rapidly detect more than 100 water quality parameters, from simple chemicals, like chlorine and ammonia, to complex analytes such as organic compounds, E. coli, chlorophyll, and algae, with a high degree of sensitivity. Zaps is attempting to go head-to-head against traditional biochemical oxygen demand (BOD) testing with its alternative BOD measurement that provides results in seconds, compared to the painstaking standard five-day tests. The company is currently awaiting method approval from the U.S. Environmental Protection Agency (EPA), but if approved, its technology can potentially revolutionize wastewater monitoring by allowing plant operators to prevent surface discharge of contaminated waters in real time.

Lux recently spoke with OptiEnz Sensors, which is fieldtesting its fluorescence technology with new sensor probes for real-time and continuous monitoring of organic compounds in water. In addition to its benzene, toluene, ethylbenzene, and xylene (BTEX) sensors, OptiEnz has developed carbohydrate sensors for the food and dairy industry. Its tricholoroethylene (TCE) sensor can instantaneously detect TCE in the single-digit ppb range, an application useful for groundwater monitoring near industrial facilities. OptiEnz’s value proposition lies in providing robust sensor probes to compete against tedious laboratory testing procedures. It has started generating revenue through tests with Fortune 100 companies in the food and beverage, pharmaceutical, biofuels, and frack water treatment industries.

Tightening discharge restrictions from regulators worldwide has increased the need to closely monitor waste streams, allowing next-generation sensor technologies to break out of the lab. Water quality analytics have moved away from time-consuming laboratory tests to continuous and real-time monitoring and rapid analysis techniques, such as lab-on-chip analysis, that require minimal operator expertise. The water industry is long overdue for automation in process control, but new technology is finally achieving this goal. Industry leaders who are scouting for innovative technologies to improve their processes should engage the leading startups in the space.

About The Author

Abhirabh Basu is a research associate at Lux Research (www.luxresearchinc.com) on the Water Intelligence team, where he conducts research focused on water treatment technologies. Basu has a B.S. in Chemical Engineering from Panjab University in India and an M.S. in Environmental Engineering from New York University Polytechnic School of Engineering.