Global Private Water Utilities Trade Places In Quest For Long Term Growth

The private sector’s role in water utilities continues to be debated– in developing countries the promise of closing water infrastructure gaps, while in some mature markets, governments are buying-back water systems. At the same time, access to water supplies is increasingly threatened by climate change and inadequate public investment in infrastructure. These factors contribute to a challenging competitive environment, with the result being a significant shake-up in global private water utility rankings according to a new study from Boston-based Bluefield Research.

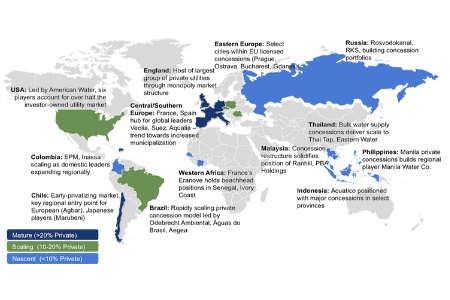

According to Bluefield’s just released report, the world’s 50 largest private water utilities served over 280 million people in 24 countries and generated over $53B in annual revenue on a net equity basis in 2014. France, the UK, USA, and Brazil host the largest private water utilities, but an increasing number of new players appear in Bluefield’s rankings of population served and water produced from regions where private participation in the water sector is on the rise including Southeast Asia, Latin America, and Africa. Private participants are placing an increased emphasis on a diverse set of countries, with the US, Brazil, Chile, Italy, and Spain topping Bluefield’s 2015 market attractiveness ranking for private participation.

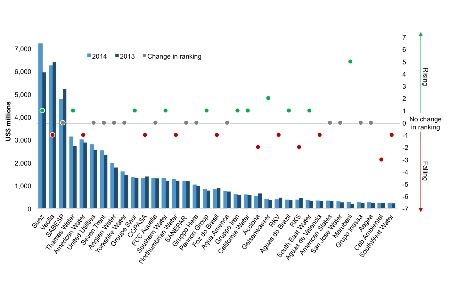

Between 2013 and 2014, eleven companies moved up in the global top 35 consolidated rankings by revenues, reflecting changes in company strategies, M&A activity, and macroeconomic conditions. Key ranking moves among the top five largest groups globally, on a revenue basis, were Suez surpassing Veolia for the top ranking and Thames Water overtaking American Water in the 4th position. Brazil’s SABESP retained its 3rd place ranking and remains the top ranked private national water utility based on population served and volume of water produced annually. Drivers for growth include a combination of M&A, rate increases, and concession awards that reflect a unique time in which players seek incremental growth abroad while defending their positions in more mature home markets.

These and other findings can be found in Bluefield Research report, Private Water Utilities: Global Rankings & Company Strategies, which highlights key drivers and trends among global private utility leaders.

Global Private Water Utility Consolidated Rankings, 2013-2014

Beyond providing in-depth analysis of player positioning based on key metrics, Bluefield’s report captures key strategy trends that are guiding portfolio investors seeking new opportunities. Choppy macroeconomic growth, shifting risk profiles in countries such as Brazil, along with improving track records of markets such as the Philippines, present a complex environment for new project selection in a hyper-local industry.

“Portfolio investors’ success in finding assets, such as Japanese trading houses, will challenge international leaders like Veolia and Suez going forward as they adjust their business models,” said Keith Hays, director of Bluefield’s Private Water Insight Service, “Now is a unique time to take a second look at markets with lowering competitive barriers and more pressing needs for private investments”.

Private Water Utilities: Global Rankings & Company Strategies is based on Bluefield Research’s ongoing tracking of over 100 private water utilities and offers a complete view of the sector including top-down regional trends combined with bottom up company profiles accompanied by a rich set of data indicators.

Private Water Utility Model – Global Footprint Overview

Source: Bluefield Research